Where are bond yields going with debt on the rise? Click here for our latest report.

*FED OFFICIALS SEE THREE 2017 RATE HIKES VS TWO IN SEPT. DOTS

*FED RAISES RATES BY 25 BPS, REPEATS GRADUAL POLICY PATH PLAN

*FED: POLICY SUPPORTING `SOME FURTHER STRENGTHENING’ ON GOALS

*YELLEN: THERE MAY BE SOME ADDITIONAL SLACK IN LABOR MARKETS

*YELLEN: FISCAL BOOST NOT OBVIOUSLY NEEDED FOR FULL EMPLOYMENT

*EMERGING MARKET CURRENCIES CONTINUE PLUNGE AGAINST THE DOLLAR

Global Credit Explosion, Debt Denominated in US Dollars*

2016: $52T

2010: $31T

2005: $22T

BIS data

“Credit risk on the heels of China’s aggressive currency devaluation will veto the Fed’s desired policy path in 2016. They must pull out the fire hose, kill their planned 2016 (4) rate hikes and talk down the dollar. The winners? Gold, Emerging Markets and Oil.”

The Bear Traps Report, February 2016

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Where are bond yields going with debt on the rise? Click here for our latest report.

Once Again, the Fed is Staring Down the Barrel of a Run Away Dollar

Currency Pain Since US Election

Japan -14.3%

Turkey -11.4%

Mexico -10.8%

Argentina -6.6%

Brazil -6.6%

Europe -6.4%

S Africa -5.8%

Korea -4.1%

Indonesia -2.5%

India -2.0%

China -1.9%*

Russia +3.3%

Bloomberg

*China is the big loser since the election, global populism is NOT China’s friend. Competitive currency devaluations above are stealing billions in trade dollars from China. The U.S. dollar’s surge has ugly side effects.

Easy Money Fed policy has enticed countries and companies around the world to borrow in dollars. We have witnessed a colossal leverage expansion. A substantially stronger dollar makes these debts even larger, much harder to repay. As we witnessed in February, credit risk vetoed the Fed’s desired policy path, their goal of four rate hikes in 2016. This “chicken out” by the Fed was almost entirely dollar driven, or what we call “handcuffs.”

The Dollar trades at elevated levels, something the global economy will struggle with. The effects of Dollar’s double edged sword will be felt in Q1 2017. Bottom Line: markets are underappreciating (have mis-priced) the short term economic risks tied to the dollar’s surge coupled with the backup in rates.

The Dollar trades at elevated levels, something the global economy will struggle with. The effects of Dollar’s double edged sword will be felt in Q1 2017. Bottom Line: markets are underappreciating (have mis-priced) the short term economic risks tied to the dollar’s surge coupled with the backup in rates.

Where are bond yields going with debt on the rise? Click here for our latest report.

Emerging Market Currencies in Pain

Breakouts in the Bloomberg Dollar Index have been associated with surges in U.S. equity market volatility as financial conditions have tightened globally. The above divergence is highly unsustainable.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click hereWhere are bond yields going with debt on the rise? Click here for our latest report.

Concerned or NOT Concerned, Federal Reserve

“The Committee continues to closely monitor inflation indicators and global economic and financial developments.”

December 14, 2016 Fed Statement

“However, global economic and financial developments continue to pose risk.”

March 16, 2016 Fed Statement

S&P 500 and the Fed’s “Concern”

Over the last 18 months we’ve witnessed a humorous disconnect between the Fed’s “concerned” and “NOT concerned” position on global credit and currency risk tied to financial conditions. When the Fed expressed “concern” we were typically near market bottoms, while their position of “not concerned” were always close to near term market highs.

Fed on Global Economic Risks

March 2016: concerned (market bottom)

Dec 2015: not concerned (market high)

Sept 2015: concerned

July 2015: not concerned (market high)

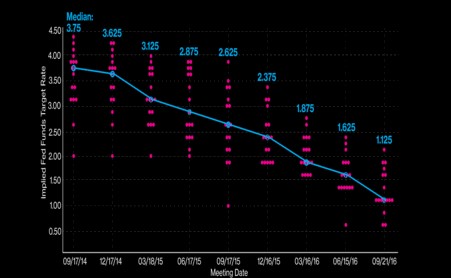

Fed Calling for Nearly 16 Rate Hikes Back in 2014

Year End 2017 FOMC Forecast

Back in 2014 the Fed was calling for nearly 16 rate hikes by the end of next year, but so far we’ve only seen two. As they try and play “catch up” in an effort to save face, the big loser is China. There’s a PRICE to pay for eight years of zero interest rate policy, it is NOT free!

Bloomberg Dollar Index and the VIX

The last time the Bloomberg dollar index was this high the VIX was above 25. Of course China accelerated their currency devaluation in retaliation to the run away dollar from August 2015 – February 2016. Today, we have President elect Trump blasting China and U.S. “One China” diplomacy in Tweets while the dollar is ripping in their face as well. Bottom line: both the Fed and Trump are letting China have it, a financially painful double team. Yellen’s hawkish tone is a slap in the face to China, talking up rate hikes only strengthens the dollar, hurts China’s competitive position in the global economy. How will they respond???

From August to February 2015-16, China was trying to teach the White House and Treasury a lesson:

“Let your currency surge too quickly and we’ll deval our currency too quickly and upset global capital markets in an election year”

China’s Behind the Scenes Message to Washington, January 2016

One Steep VIX Futures Curve

If you model up the spread between the 2 month VIX future and the 8 month relative to currency risk (Bloomberg Dollar Index) BBDXY, vol looks the cheapest going back 18 months. Deep contago in the VIX futures curve makes ZERO sense with EM currencies in flames, thanks Janet.

After China accelerated their currency devaluation Aug – Feb, the S&P plunged 14% in an election year. Next, the Fed pulled out the firehose and started talking down the dollar, killing their planned beloved four rake hikes. It’s Groundhog Day just without a U.S. election in 2017.

We do have election cycles in Italy, Netherlands, France and Germany : ) More to come….

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click hereWhere are bond yields going with debt on the rise? Click here for our latest report.

The Trump administration and Congress of 2017 have a colossal collection of goals for their first 100 days; a) filing and (Congress) approving Cabinet posts, b) a Supreme Court vacancy, c) corporate and individual tax reform, d) replace and repeal of Obamacare and reversing a long list of regulations issued by the outgoing Obama administration in its final months. Adding the need to fund the entire federal government makes all of those objectives even more difficult. As you can see above, the Federal deficit is near unsustainable proportions. The U.S. needs far more than 1.7% GDP growth to support this debt load.

The Trump administration and Congress of 2017 have a colossal collection of goals for their first 100 days; a) filing and (Congress) approving Cabinet posts, b) a Supreme Court vacancy, c) corporate and individual tax reform, d) replace and repeal of Obamacare and reversing a long list of regulations issued by the outgoing Obama administration in its final months. Adding the need to fund the entire federal government makes all of those objectives even more difficult. As you can see above, the Federal deficit is near unsustainable proportions. The U.S. needs far more than 1.7% GDP growth to support this debt load.

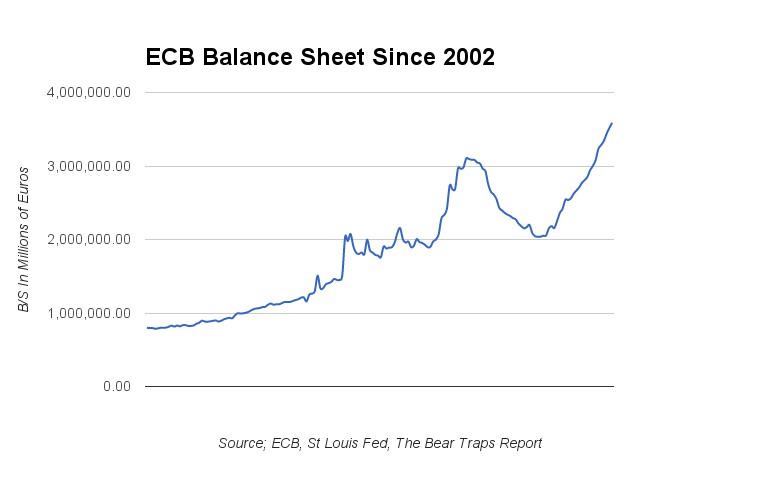

Germany 10 Year Bonds: Highest yield since Jan 27, at 0.43%. However since Mario’s more dovish press conference yields have come lower. The removal of the deposit rate cap, allows the ECB to buy more bunds that trade below this -40 bps threshold.

Germany 10 Year Bonds: Highest yield since Jan 27, at 0.43%. However since Mario’s more dovish press conference yields have come lower. The removal of the deposit rate cap, allows the ECB to buy more bunds that trade below this -40 bps threshold.