Institutional investors can join our live chat on Bloomberg, a groundbreaking venue since 2010 – now with clients in 20+ countries, just email tatiana@thebeartrapsreport.com – Thank you.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click hereBanks in a lot of Pain

One Year Performance

Nasdaq Bank Index -13%

S&P 500 +25%

*Disclaimer – The banking system is pricing in commercial real estate pain, while the S&P 500 is far more optimistic. Looking back over dozens of one-year performance periods, this is a HIGHLY unusual divergence and has only occurred near recessions and extreme financial stress points. We see more than $1T of losses if the Fed really commits to a – “higher for longer” fantasy.

“US office properties, once a $3 trillion market, has now declined to about $1.8 trillion. In the fourth quarter of last year, the US office market experienced its fifth consecutive quarter of negative net absorption of office space. With 5 million square feet of new supply, the overall office vacancy rate reached a 30-year high of 18.6%.” Bloomberg

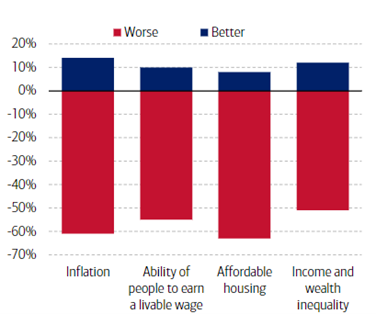

Summary: Wells Fargo (WFC)’s fake account scandal came to the surface in late 2016 and the bank has been living under a punitive consent order from the Fed for six years now. This has prohibited the bank from growing its assets and the stock has done nothing since 2018, while most of its peers went up by 100% to 200%. But last Thursday, the Office of the Controller of the Currency (OCC) surprisingly lifted its consent order. We believe that this is a sign that the Fed is getting close to lifting its punitive asset cap as well. The Fed knows the banks are seriously wounded, and commercial real estate data pain points are more telling by the day – the central bank MUST and will provide relief here, they have NO choice. The timing may be tied to the election. With the order lifted, WFC can grow its assets by as much as $500bl. WFC is still the largest mortgage lender in the country and this action could help give a boost to mortgage lending, so more people can get in a home. Affordable housing is still a top concern among Americans and the Biden administration has made it a top priority for this year.

Trade: If WFC can grow its assets by $500bl when the Fed lifts the consent order it could translate into additional pre-tax profits of $5Bl per year. WFC trades 10x earnings, which suggests the stock has 26% upside in such a scenario. This means the stock going from the current price of $51.9 to $65.50. WFC also has a pristine balance sheet now because it couldn’t grow its loan book for years. Its office-CRE loan book, which is experiencing a lot of stress right now, is only $30bl or 1.6% of assets. Given the quality of its balance sheet and its growth potential, if the Fed lifts the cap, we think WFC could see some multiple expansion as well.

Top Concern for Americans (Source: Bank of America)

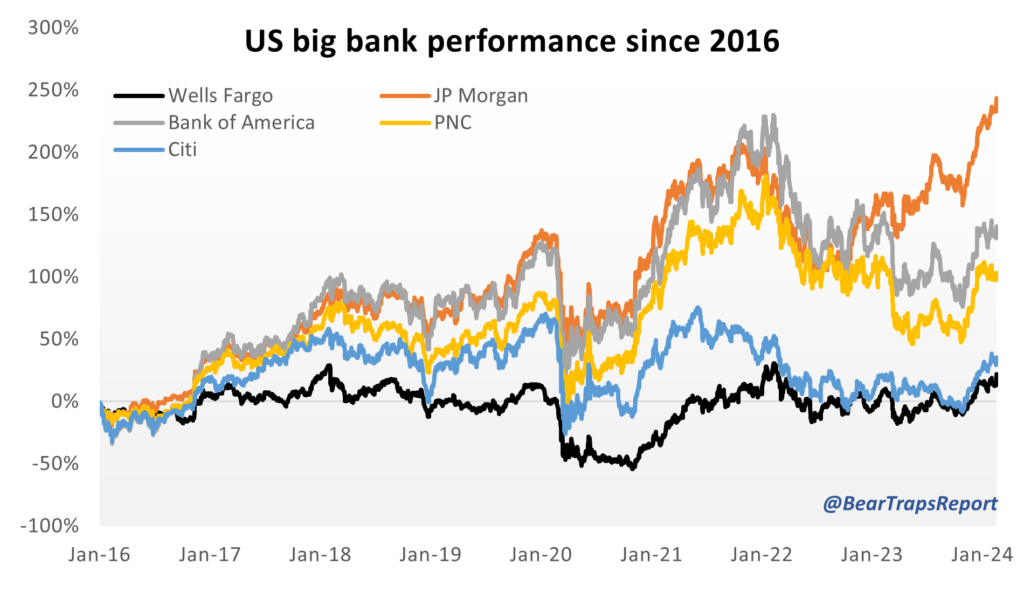

Wells Fargo – Flatlining Since 2016

Wells Fargo has underperformed the other major US banks by over 100% since the fake account scandal started in 2016.

Draconian Punishment

Following WFC’s phony-accounts scandal, the Fed implemented a consent order that prevented WFC from growing its balance sheet above $1.95TR in assets. In addition, two other regulators, the OCC¹ and the CFPB², have also imposed restrictions on the bank and are supervising the bank for its victim compensation and internal controls. WFC also has had some powerful foes on the Senate banking committee, including the committee chair Sherrod Brown (D, OH) and Elizabeth Warren (D, MA) which have been lambasting the bank year after year.

However, last Thursday the OCC surprisingly terminated its consent order regarding sales practices misconduct. That consent order required WFC to revamp how it offers and sells products and services to consumers and protect its customers and employees. We believe the lifting of this OCC consent order paves the way for the Fed to lift its own consent order in the coming months.

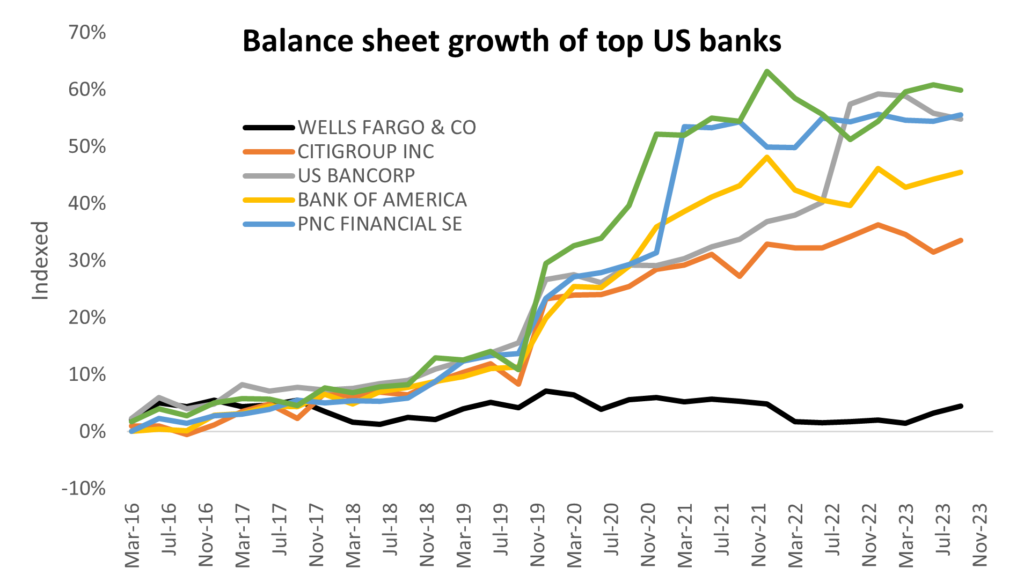

Zero Growth in Wells Fargo Balance Sheet

The big banks in the US have grown their balance sheet by 40% on average since 2018, except Wells Fargo, which was forced to keep its balance sheet flat

Why now?

Since the start of the coronavirus crisis, banks’ balance sheets have ballooned and the average GSIB³ score has increased by 229 points, the largest increase on record. These balance sheets expanded so much mainly due to demand for deposits and the Fed’s massive asset purchase program (QE). When the Fed buys assets, the Fed credits banks’ accounts with the cash with which it buys the asset. The Fed balance sheet has doubled since early 2020 to $8TR and accordingly, the assets of US banks increased by $4Tr as well. Most banks are now running up against their GSIB surcharge threshold, meaning they get hit with a higher surcharge if they further expand their balance sheet. To stay under these GSIB limits, banks are suppressing loan growth. The chart below shows how mortgage loans have stagnated at the big banks despite the housing boom.

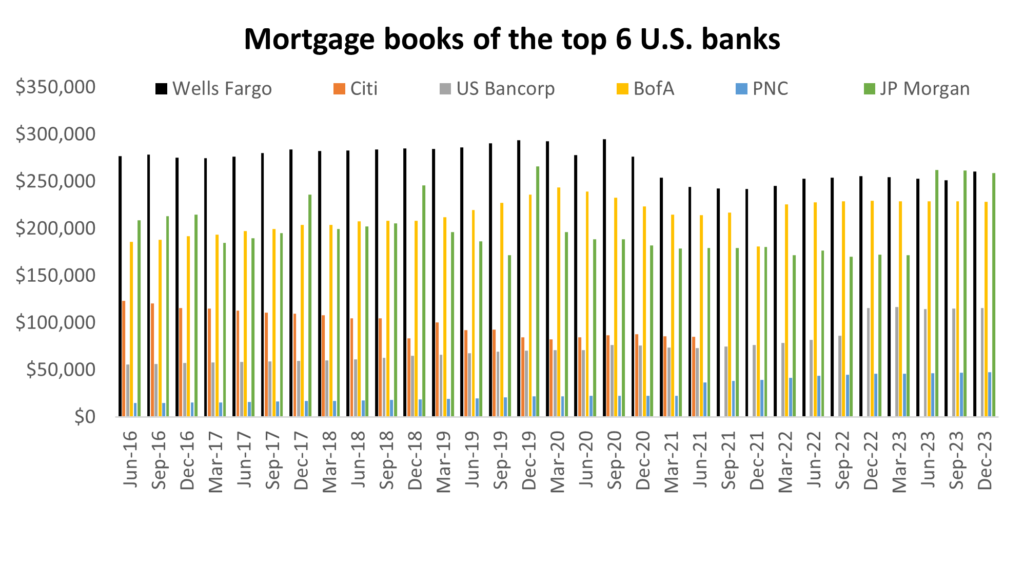

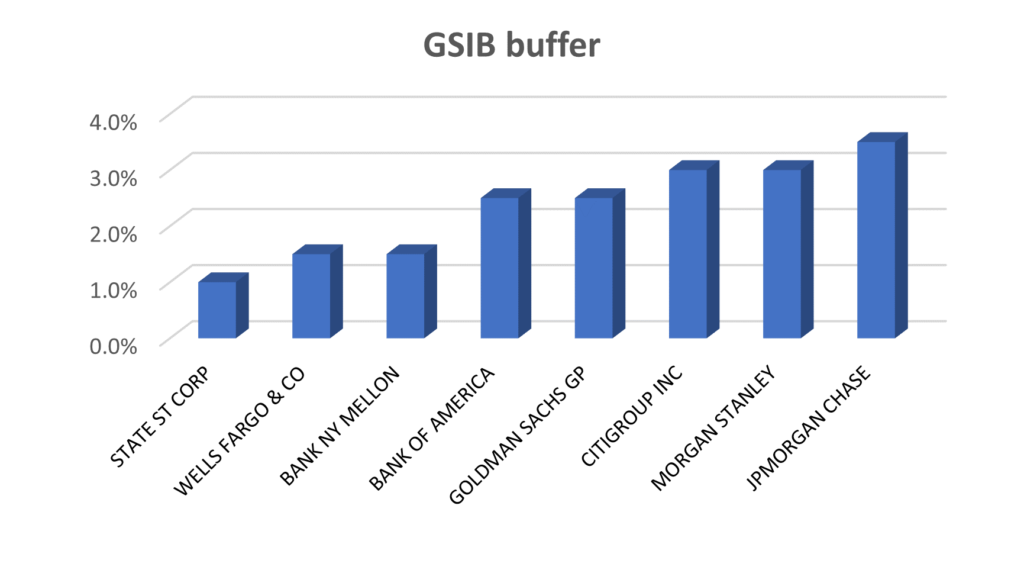

WFC has no such problem because its balance sheet has remained stagnant since 2016. Their GSIB buffer is 1%, compared to 3% for JP Morgan (See below). This is an election year and WFC is still one of the largest mortgage underwriters in the US. By lifting the asset cap, it could help more people to get mortgages and alleviate some of the housing market stress.

Big Banks are Stingy with Mortgage Lending

The big banks have barely grown their mortgage books in the last few years. Mortgage brokers have picked up the slack but the government wants to avoid this because they care little about credit risk as they sell the mortgages to government-owned Fannie and Freddie.

What is Wells Fargo worth if the asset cap is gone?

If Wells Fargo’s balance sheet would have grown in line with their peers since 2016, assets would be between $2.4-$2.9TR instead of $1.9TR. Alternatively, if Wells Fargo maximizes the room it currently has under its GSIB buffer, its assets could be at $2.2TR. Taking the average of these two numbers, we could see $500bl of room for WFC to grow the assets when the Fed lifts the consent order. Given WFC 1% average return on assets, this could translate into $5Bl of additional pre-tax profit per year. To compare, WFC made $21bl in pre-tax profit last year. The stock trades 10x earnings, which suggests it 26% upside in such a scenario. In other words, the stock can go from the current price of $51.9 to $65.50. WFC also has a pristine balance sheet now, because of its inability to grow its loan book. Its office CRE loan book is only $30bl or 1.6% of assets. Given the quality of its balance sheet and its growth potential, if the Fed lifts the cap, WFC could see some multiple expansion as well. We do not take that into account in our valuation, but WFC used to trade at a higher multiple than JPM before 2016. It currently trades at a 20% discount.

What is the asset cap imposed on Wells Fargo?

The Fed’s asset cap order covers operational risk management, compliance risk management, and governance, and the CFPB and OCC’s 2018 orders cover compliance risk management, auto insurance, and mortgage rate lock extensions. This process has dragged on for much longer than both regulators and Wells Fargo initially expected, and Wells Fargo has taken much longer to develop a plan acceptable to the Fed. The bank was initially expected to complete these steps by September 2018. The asset cap is considered by most now to be an unduly draconian punishment for Wells (WFC) past scandals, especially because it has been kept on for so much longer than expected.

The Higher the Score, the Harder it Gets

The big US commercial banks have GSIB scores above 3%, except Wells Fargo. To illustrate, Core Equity Tier 1 ratios for the biggest US banks are now between 11% and 16%. The higher the score, the higher the GSIB surcharge is. This is an incentive for banks to curb their loan growth once they approach a GSIB threshold.

¹ Office of the Controller of the Currency

² Consumer Financial Protection Bureau

³ The GSIB surcharge requirement reflects the Federal Reserve’s unilateral assessment of systemic risk as measured by the weighted sum of a select set of indicators, expressed as a systemic risk score. The higher the score, the higher the applicable GSIB surcharge.