Join our Larry McDonald on CNBC’s Trading Nation, Wednesday at 3:05pm ET

What’s Our List of Systemic Risk Indicators Saying now? Pick up our latest note here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Blog Updated May 20, 2017 at 4:10pm

Nominal Residential Property Prices

2007-2017

China: +155%

Canada: +82%

Australia: +74%

Norway: +72%

Sweden: +70%

USA: -4%

BIS Data, NY Fed

China’s impact on global property prices is colossal. Massive – debt build funded infrastructure spending pumped up commodity prices globally. Shadow banking leverage in China helped pump up commodity prices 2010-17. This had a substantial follow-on impact on Canada, Norway and Australia real estate prices (these countries are oil and materials rich). Likewise, $1T of currency outflows from China had to go somewhere, likely into real estate markets globally, hello Vancouver. Since 2007, U.S. real state prices are down slightly while property markets in some other G10 economies experienced no such downturn. The side effects of easy money central bank policies are visible here. Even with the global recession: prices, building activity, and mortgage credit continued to rise in fierce fashion. In several instances, the run-up has gone far enough that it has raised concerns about the broader consequences for economic and financial stability if real estate markets were to sour. While prices are extremely overvalued in several markets, there are also important differences across countries, and some important idiosyncratic factors to take into account. Bottom line; leverage, China and commodity prices have had a heavy hand in this disconnect.

A Look Back and a Look Forward

“Subprime is contained”

Federal Reserve’s Ben Bernanke, Spring of 2007

“Subprime is contained”

Bank of Canada’s Stephen Poloz, Spring of 2017

Almost ten years to the day, history is repeating itself – right in front of our very eyes. It was the spring of 2007, New Century had just gone bust. The subprime mortgage lender was the biggest story on Wall St., and when reporters finally got ahold of Federal Reserve Chairman Ben Bernanke, he did what all central bankers do on the eve of a credit crisis – try and keep investors calm.

“At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained. In particular, mortgages to prime borrowers and fixed-rate mortgages to all classes of borrowers continue to perform well, with low rates of delinquency.”

Ben Bernanke, March 28, 2007

Ten years later, almost to the day – Central Bankers in Canada are singing Bernanke’s song. After Home Capital Group’s stunning collapse last month, investors have been told Mortgage lender’s problems won’t spread to other financial institutions. The Bank of Canada Governor Stephen Poloz told Globe & Mail in an interview this weekend. “Home Capital crisis is contained and doesn’t threaten broader market.”

In 2007, our Larry McDonald led a team at banking over $150m in profits betting against New Century and other subprime lenders. He has an entirely different perspective.

“The truth is very elusive as you’re heading toward that giant iceberg, the Captain wants those fannies in the seats. Believe half of what you see and none of what you hear.” McDonald said.

We believe the credit cycle has turned in North America, whether you’re looking at Mall Reits, credit card receivables, auto or student loans – defaults are spiking at an alarming rate. Fasten your seatbelts ladies and gentlemen.

“Risk is most dangerous when it is least apparent, and least dangerous when it is most apparent.”

Jim Grant

Canada’s Subprime Lending King

Moody’s downgrade of Canada’s biggest banks beat down assets in a market already rattled by woes of mortgage lender Home Capital Group Inc. Yet, very similar to 2007 – most analysts say this isn’t evidence of an impending crisis. Investors are concerned that Home Capital’s troubles can lead to broader financial contagion, tipping Canada’s economy into the kind of crisis it averted in 2008.

Moody’s downgrade of Canada’s biggest banks beat down assets in a market already rattled by woes of mortgage lender Home Capital Group Inc. Yet, very similar to 2007 – most analysts say this isn’t evidence of an impending crisis. Investors are concerned that Home Capital’s troubles can lead to broader financial contagion, tipping Canada’s economy into the kind of crisis it averted in 2008.

What’s Our List of Systemic Risk Indicators Saying now? Pick up our latest note here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Still, home prices are at “the top of our list” of issues that could threaten Canada’s financial system, Poloz said. Poloz didn’t rule out the possibility of providing an emergency loan to Home Capital but stressed the need for a private solution to the co.’s issues.

Poloz trusts private system to continue stepping in to support Home Capital.

What’s Our List of Systemic Risk Indicators Saying now? Pick up our latest note here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Here’s Another Classic:

Once up 86% from the January 2016 lows, Russian equities have lost 10% from their recent highs. Down 4% on the year but stull up 14% since the election of Donald Trump – in line with the S&P 500. This descending wedge above speaks to a key technical level Russian equities are dancing on – we’re about to see a significant move…

Once up 86% from the January 2016 lows, Russian equities have lost 10% from their recent highs. Down 4% on the year but stull up 14% since the election of Donald Trump – in line with the S&P 500. This descending wedge above speaks to a key technical level Russian equities are dancing on – we’re about to see a significant move…

Up 132% from the January 2016 bottom, stocks in Brazil have priced in a ton of political goodwill. The EWZ is set to open at the $34.20 – $34.50 level, below the two year trend line above in red.

Up 132% from the January 2016 bottom, stocks in Brazil have priced in a ton of political goodwill. The EWZ is set to open at the $34.20 – $34.50 level, below the two year trend line above in red. In our view, credit risk will surge focused on Brazil’s government bonds if the reforms collapse.

In our view, credit risk will surge focused on Brazil’s government bonds if the reforms collapse.

This image was produced on May 3rd and included in our Bear Traps Report, 95 target highlighted above with the DXY at 99.08 then.

This image was produced on May 3rd and included in our Bear Traps Report, 95 target highlighted above with the DXY at 99.08 then. The dollar closed at 97.14, breaking a key technical level this week.

The dollar closed at 97.14, breaking a key technical level this week. The Nasdaq 100 is up 18% on the year while the Russell 2000 is only 2% higher. Forget about the noisy headlines, the truth is MORE and more stocks are being left behind in this bull market.

The Nasdaq 100 is up 18% on the year while the Russell 2000 is only 2% higher. Forget about the noisy headlines, the truth is MORE and more stocks are being left behind in this bull market.

Moody’s downgrade of Canada’s biggest banks beat down assets in a market already rattled by woes of mortgage lender Home Capital Group Inc. Yet, very similar to 2007 – most analysts say this isn’t evidence of an impending crisis. Investors are concerned that Home Capital’s troubles can lead to broader financial contagion, tipping Canada’s economy into the kind of crisis it averted in 2008.

Moody’s downgrade of Canada’s biggest banks beat down assets in a market already rattled by woes of mortgage lender Home Capital Group Inc. Yet, very similar to 2007 – most analysts say this isn’t evidence of an impending crisis. Investors are concerned that Home Capital’s troubles can lead to broader financial contagion, tipping Canada’s economy into the kind of crisis it averted in 2008.

This is the beginning of a colossal commodity driven credit collapse. Central bank funded moral hazard gone rogue! May 15th, Noble Group Limited Cut To Caa1 From B2 By Moody’s: “Downgrade reflects heightened concern over Noble’s liquidity stemming from its weak operating cash flow and large debt maturities over the next 12 months, Moody’s says. Moody’s also cites significant uncertainties over an operational turnaround and the high likelihood of debt leverage remaining elevated after company reported 1q loss. Outlook remains negative.”

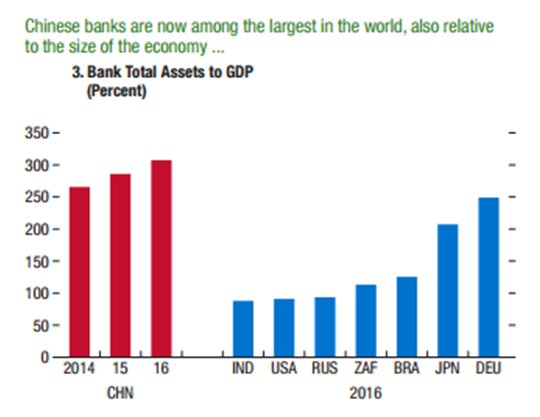

This is the beginning of a colossal commodity driven credit collapse. Central bank funded moral hazard gone rogue! May 15th, Noble Group Limited Cut To Caa1 From B2 By Moody’s: “Downgrade reflects heightened concern over Noble’s liquidity stemming from its weak operating cash flow and large debt maturities over the next 12 months, Moody’s says. Moody’s also cites significant uncertainties over an operational turnaround and the high likelihood of debt leverage remaining elevated after company reported 1q loss. Outlook remains negative.” China’s banking system and underlying economy is far more leveraged than her global peers.

China’s banking system and underlying economy is far more leveraged than her global peers. The insanity of the current global credit profile is on display right here. If you want to buy default protection on the MOST levered economy on the planet earth, its very cheap. This reminds us of Citigroup in 2007, default protection was extremely cheap relative to the underlying credit risk, investors didn’t care. History is repeating itself RIGHT before our very eyes.

The insanity of the current global credit profile is on display right here. If you want to buy default protection on the MOST levered economy on the planet earth, its very cheap. This reminds us of Citigroup in 2007, default protection was extremely cheap relative to the underlying credit risk, investors didn’t care. History is repeating itself RIGHT before our very eyes.