Join our Larry McDonald on CNBC’s Trading Nation, Wednesday at 3:05pm ET

Pick up our latest report here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Central Banks have Lit Emerging Markets a Fire

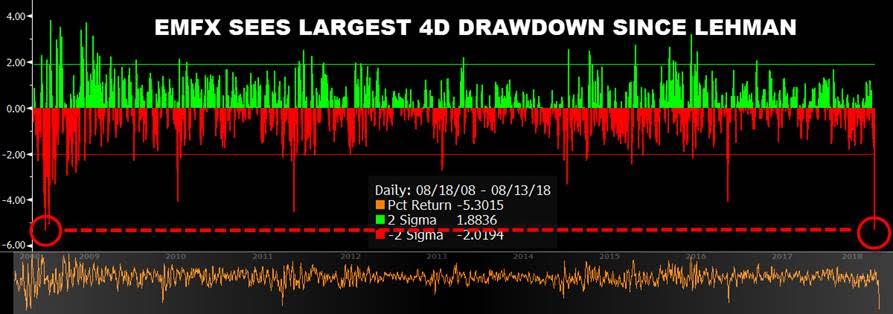

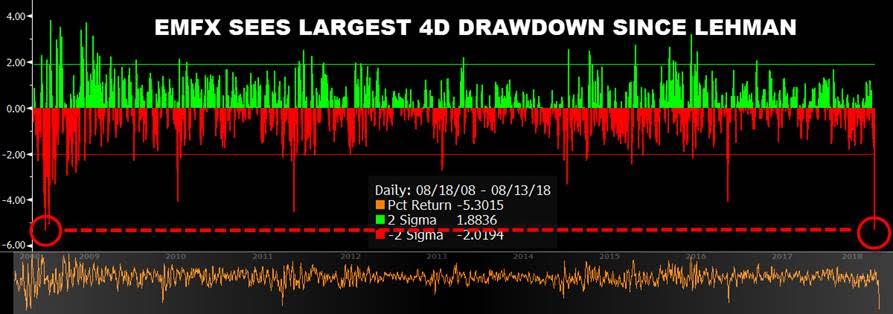

The emerging market foreign exchange basket just witnessed its largest 4D drawdown since Lehman. That’s a -5.3% shift for a 5.2 standard deviation move over a ten year period. This is an exceptionally powerful move which has NOT come to us without follow-on implications.

The emerging market foreign exchange basket just witnessed its largest 4D drawdown since Lehman. That’s a -5.3% shift for a 5.2 standard deviation move over a ten year period. This is an exceptionally powerful move which has NOT come to us without follow-on implications.

Blinders On

Over the last hundred years inside financial markets, we’ve found in each crisis there’s a metamorphosis, a transformation into another serpent, a far different beast. In the 1970’s it was runaway commodity prices, a real energy crisis. In the 1980’s, it was Savings and Loans. The 1990’s brought us sovereign credit defaults (Russia / Long Term Capital) and the dot-com blow up. By 2008, a full-blown sub-prime mortgage crisis was upon us. The sad fact remains, central bankers along with regulators are often caught looking in the rearview mirror. They’re literally oblivious to risk – we call them academics with blinders on. Lost in the woods, this crowd has done a great job at taking leverage down inside large banks. Yet, all they’ve really accomplished is a transfer of the leverage onto both sovereign (country) and corporate balance sheets. Over long periods of time, when you prevent the cleansing process of the business cycle from functioning, capital oozes around the world into all the wrong places. Bottom line, nice work central bankers (FOMC, ECB, BOJ, BOE, PBOC), you lit the fuse and now it’s about to explode.

Cost of Credit Default Protection on Turkey

Turkish Credit Default Swaps – a key instrument investors use to insure against financial turbulence – surged to their highest since the 2008 global financial crisis as the lira took another sharp dive in world currency markets. Five-year Turkish CDS jumped 78 basis points to 529 basis points, data from IHS Markit showed.

Turkish Credit Default Swaps – a key instrument investors use to insure against financial turbulence – surged to their highest since the 2008 global financial crisis as the lira took another sharp dive in world currency markets. Five-year Turkish CDS jumped 78 basis points to 529 basis points, data from IHS Markit showed.

Why a Strong Dollar Matters?

1994 to 2017 Global Debt

$41T to $234T*

*$64T dollar-denominated, nearly all issued over the last 10 years.

BIS, Bloomberg

Turkey, A Large Default is Near, Contagion Upon Us

Late this week, the cost of insuring against a debt default in Turkey overtook that of Greece, which is rated four notches lower by the “brain trusts” at Moody’s. At the same time, investors sliced exposure to emerging markets as Turkey’s currency meltdown fueled contagion concerns and a host of global hot points added to the exit from riskier assets.

A Price to Pay

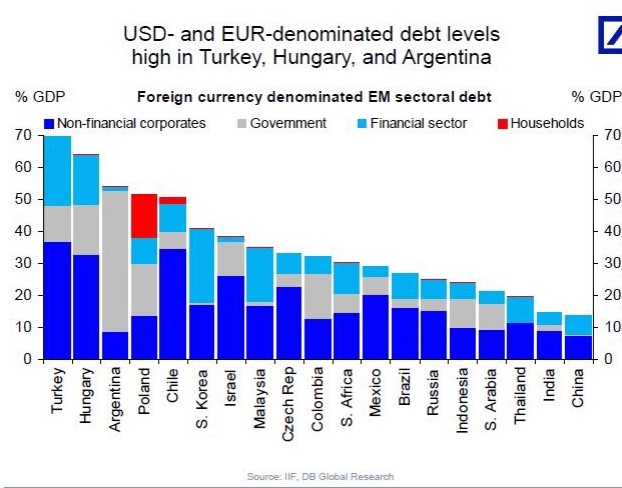

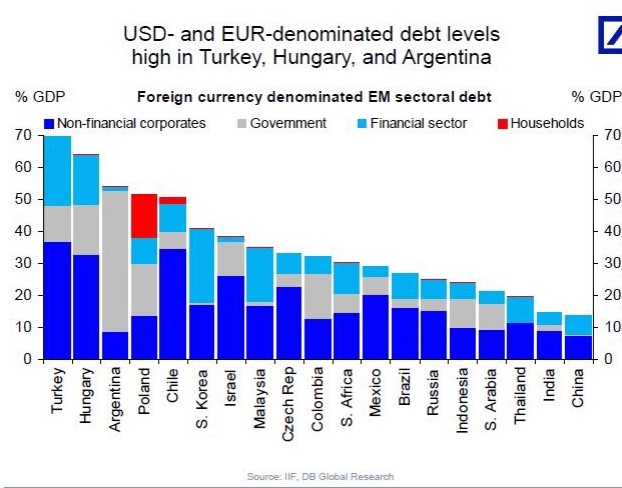

There’s a “Price to Pay” for the easy money Gravy Train which has come out of central banks. Thanks to a Reckless Fed and ECB, Turkey was able to pile up loads of debt – NOT denominated in Lira BUT Dollars and Euros, TURN OUT the Lights. The likeness of 2018’s Turkish credit crisis and the Asian credit crisis of 1997 is very real. If you think of Turkey’s external debt near $450B, that’s nearly 57% of GDP. Next, add on colossal corporate debt layers (see above) – you’re in a HIGHLY unsustainable neighborhood, near 70% of GDP. Back in 1997, Thailand’s external debt was $110B or 64% of GDP, the panic that followed rocked global markets. Over the last month against the US dollar, Turkey’s lira -48% (since July 6th) while one month into the Asian financial crisis the Thai baht was -24% against the US dollar. In rare company – the lira’s recent collapse exceeded daily losses during Russia’s 1998 default and Brazil’s 1999 real crisis.

There’s a “Price to Pay” for the easy money Gravy Train which has come out of central banks. Thanks to a Reckless Fed and ECB, Turkey was able to pile up loads of debt – NOT denominated in Lira BUT Dollars and Euros, TURN OUT the Lights. The likeness of 2018’s Turkish credit crisis and the Asian credit crisis of 1997 is very real. If you think of Turkey’s external debt near $450B, that’s nearly 57% of GDP. Next, add on colossal corporate debt layers (see above) – you’re in a HIGHLY unsustainable neighborhood, near 70% of GDP. Back in 1997, Thailand’s external debt was $110B or 64% of GDP, the panic that followed rocked global markets. Over the last month against the US dollar, Turkey’s lira -48% (since July 6th) while one month into the Asian financial crisis the Thai baht was -24% against the US dollar. In rare company – the lira’s recent collapse exceeded daily losses during Russia’s 1998 default and Brazil’s 1999 real crisis.

India’s Rupee, Now through Taper Tantrum Levels

In June, in a rare public tongue-lashing, the Bank of India governor pleaded for the US central bank to relax balance sheet tightening plans, they didn’t listen.

In June, in a rare public tongue-lashing, the Bank of India governor pleaded for the US central bank to relax balance sheet tightening plans, they didn’t listen.

Emerging Market Dollar (Corporate Bonds) Denominated Debt Sales

2017: $495B

2016: $450B

2015: $300B

2013: $360B

2011: $220B

2009: $58B

2007: $124B

WSJ data

Credit Risk Surge – Cost of Default Protection

The Turkish Lira has plunged against the dollar to record lows this week, fueled by concern about the nation’s worsening relationship with the U.S. and authorities’ ability to anchor the nation’s assets. With close to $250B of US Dollar and Euro denominated DEBT, every 1% move lower in the Turkish currency brings a nasty 5 billion Lira interest coverage problem, it’s good night Irene.

The Turkish Lira has plunged against the dollar to record lows this week, fueled by concern about the nation’s worsening relationship with the U.S. and authorities’ ability to anchor the nation’s assets. With close to $250B of US Dollar and Euro denominated DEBT, every 1% move lower in the Turkish currency brings a nasty 5 billion Lira interest coverage problem, it’s good night Irene.

2018 = 1998

In nearly every substantial macro-driven risk-off period, as the crisis kicks off US equities ignore the drama. There’s a beautiful point in every market cycle; macro takes over lazy thinking. It’s a unique, special place in which all participants have to dig deeper into what’s actually going on within the solar plexus of the global economic system. WE ARE THERE RIGHT NOW, peace. Clients are asking if this is 1998 all over again? We say yes. A Lira move near seven (close to a 6 handle now) wipes out most of the equity in Turkey’s banking system, and that’s on a $1T economy. Contagion? EU banks are 7% – 10% lower this month!

In nearly every substantial macro-driven risk-off period, as the crisis kicks off US equities ignore the drama. There’s a beautiful point in every market cycle; macro takes over lazy thinking. It’s a unique, special place in which all participants have to dig deeper into what’s actually going on within the solar plexus of the global economic system. WE ARE THERE RIGHT NOW, peace. Clients are asking if this is 1998 all over again? We say yes. A Lira move near seven (close to a 6 handle now) wipes out most of the equity in Turkey’s banking system, and that’s on a $1T economy. Contagion? EU banks are 7% – 10% lower this month!

“MSCI’s developing-nation currency measure was headed for its biggest drop in almost two months, while an index tracking equities sank the most in a week. The lira collapsed more than 11 percent on Friday and government bond yields jumped to an all-time high as traders waited to see if a speech by Turkish President Recep Tayyip Erdogan would slow the exodus. The currencies of eastern Europe were dragged lower as the euro weakened on a report that the European Central Bank was concerned about possible risks for banks.”

Bloomberg

Turkey’s $250B of US Dollar and Euro Denominated Debt is Coming Home to Roost

Europe is facing BOTH US sanctions and tariffs on their major trading partners (China, Turkey, and Russia). Above all, Europe’s banks are holding the bag – that’s the problem. Here are the bag holders. As of Q1 2018 Spanish bank exposure to Turkey 82.3bn dollars, France 38.4, UK 19.2, US 18, Germany 17.1 Italy 16.9 Japan 14. Switzerland 6.3 Canada 1.2 Austria 1.1. Portugal 0.3. Turkey’s Lira touched a record low of 7.23/USD, the Argentina peso and Brazil’s real reached their weakest point in a month, while the Russian ruble plunged to its lowest level in two years – DEFAULT risk is RISING fast.

Europe is facing BOTH US sanctions and tariffs on their major trading partners (China, Turkey, and Russia). Above all, Europe’s banks are holding the bag – that’s the problem. Here are the bag holders. As of Q1 2018 Spanish bank exposure to Turkey 82.3bn dollars, France 38.4, UK 19.2, US 18, Germany 17.1 Italy 16.9 Japan 14. Switzerland 6.3 Canada 1.2 Austria 1.1. Portugal 0.3. Turkey’s Lira touched a record low of 7.23/USD, the Argentina peso and Brazil’s real reached their weakest point in a month, while the Russian ruble plunged to its lowest level in two years – DEFAULT risk is RISING fast.

Turkey / Italy Bond Connection

There’s clearly a flight to quality into German bunds, more disturbing is the price action in Italy’s yields moving higher on the heels of Turkish drama. Yields on two-year securities climbed to the highest levels in more than a week as stocks worldwide declined following a 29 percent tumble in Turkey’s lira this month. Bloomberg noted the Italian 10-year spread over German bunds hit the highest since May. Deputy Prime Minister Luigi Di Maio was reported as saying in an interview Monday that his country won’t be subject to an attack by speculators.

There’s clearly a flight to quality into German bunds, more disturbing is the price action in Italy’s yields moving higher on the heels of Turkish drama. Yields on two-year securities climbed to the highest levels in more than a week as stocks worldwide declined following a 29 percent tumble in Turkey’s lira this month. Bloomberg noted the Italian 10-year spread over German bunds hit the highest since May. Deputy Prime Minister Luigi Di Maio was reported as saying in an interview Monday that his country won’t be subject to an attack by speculators.

Dear Mr. Draghi, Take Notice

Foreign banks in Turkey are exposed to the local government debt for $120 billion: French and English banks are first in line, with $40.4 and $23.9 billion respectively. – BIS Data. At the same time, momentum is building in the US Senate for additional sanctions punishing Russia for election-meddling. The run-up to the U.S. midterms in November is a critical period for U.S.-Russian economic relations. There’s clearly a Euro impact here. Not to mention Germany’s largest trading partner in China facing tariff risk.

Foreign banks in Turkey are exposed to the local government debt for $120 billion: French and English banks are first in line, with $40.4 and $23.9 billion respectively. – BIS Data. At the same time, momentum is building in the US Senate for additional sanctions punishing Russia for election-meddling. The run-up to the U.S. midterms in November is a critical period for U.S.-Russian economic relations. There’s clearly a Euro impact here. Not to mention Germany’s largest trading partner in China facing tariff risk.

Global Equities: The World’s Trading Partners are in Some Pain

Too many investors are hiding out in US equities. Tariffs on China, US sanctions on Turkey and Russia – that’s over $15T of global GDP under substantial stress. It would be nice if the US equity market was on an island, protected from the global economy – but that’s not the case. Turkey’s exports to Russia soared 52.5% last year, up to nearly 6% of GDP. As a result, US sanctions on Russia just add to the Turkish economic dilemma, it brings DOUBLE trouble default risk. US Russia sanctions + Turkey Sanctions = Rising Credit Risk.

Too many investors are hiding out in US equities. Tariffs on China, US sanctions on Turkey and Russia – that’s over $15T of global GDP under substantial stress. It would be nice if the US equity market was on an island, protected from the global economy – but that’s not the case. Turkey’s exports to Russia soared 52.5% last year, up to nearly 6% of GDP. As a result, US sanctions on Russia just add to the Turkish economic dilemma, it brings DOUBLE trouble default risk. US Russia sanctions + Turkey Sanctions = Rising Credit Risk.

Where’s the trade? Pick up our latest report here.

Italy vs. German 10-year bond yield spread is NOW through the Memorial day weekend wides, what a way to end the summer. The VIX Chicago Board Options Exchange Volatility Index touched 17 during the late May drama out of Italy, compared to less than 14 today.

Italy vs. German 10-year bond yield spread is NOW through the Memorial day weekend wides, what a way to end the summer. The VIX Chicago Board Options Exchange Volatility Index touched 17 during the late May drama out of Italy, compared to less than 14 today. As the cost of credit default protection exploded higher on Italian banks in late May, the Five Star Movement’s (M5S) Luigi di Maio and Lega’s Matteo Salvini reached an accord on their coalition’s program. Likewise, the structure of a future cabinet and the candidate for the premiership were on the “Italy First” agenda. Over Memorial Day Weekend, discussions took a sharp turn for the worse as all sides failed to agree on a new finance minister. Some in Lega party leadership insisted on a Euroskeptic head of finance, others want a more centrist figure. Together, the M5S and the League (Lega) have an impressive majority of 37% in the 630-seat Chamber of Deputies, though a slimmer edge in the Senate. Their standing is up over 200% in recent years as the Populists have been able to steal political market share from center-left parties in Italy. See our The Bear Traps Report with Larry McDonald; Tocqueville’s Italy – January 25, 2018_

As the cost of credit default protection exploded higher on Italian banks in late May, the Five Star Movement’s (M5S) Luigi di Maio and Lega’s Matteo Salvini reached an accord on their coalition’s program. Likewise, the structure of a future cabinet and the candidate for the premiership were on the “Italy First” agenda. Over Memorial Day Weekend, discussions took a sharp turn for the worse as all sides failed to agree on a new finance minister. Some in Lega party leadership insisted on a Euroskeptic head of finance, others want a more centrist figure. Together, the M5S and the League (Lega) have an impressive majority of 37% in the 630-seat Chamber of Deputies, though a slimmer edge in the Senate. Their standing is up over 200% in recent years as the Populists have been able to steal political market share from center-left parties in Italy. See our The Bear Traps Report with Larry McDonald; Tocqueville’s Italy – January 25, 2018_

Tesla equity investors obsessed with the stock price are measuring risk-reward with just a piece of the picture. Those you are NOT on top of the entire capital structure are sadly mistaken. In early April, with Tesla junk bonds (5.3% due 2025) near 87 3/8 the equity was trading at $252, today the relationship is 87 3/8 vs. $319, that’s a $70 premium in the equity vs. the credit. After just one-quarter of positive free cash flow since the fourth quarter of 2013, Tesla has $1.3B in debt maturity wall over the next 12 months. After the ferocious burn, cash in the bank is down to $1.3 after backing out $942 million of customer deposits on cars.

Tesla equity investors obsessed with the stock price are measuring risk-reward with just a piece of the picture. Those you are NOT on top of the entire capital structure are sadly mistaken. In early April, with Tesla junk bonds (5.3% due 2025) near 87 3/8 the equity was trading at $252, today the relationship is 87 3/8 vs. $319, that’s a $70 premium in the equity vs. the credit. After just one-quarter of positive free cash flow since the fourth quarter of 2013, Tesla has $1.3B in debt maturity wall over the next 12 months. After the ferocious burn, cash in the bank is down to $1.3 after backing out $942 million of customer deposits on cars. The emerging market foreign exchange basket just witnessed its largest 4D drawdown since Lehman. That’s a -5.3% shift for a 5.2 standard deviation move over a ten year period. This is an exceptionally powerful move which has NOT come to us without follow-on implications.

The emerging market foreign exchange basket just witnessed its largest 4D drawdown since Lehman. That’s a -5.3% shift for a 5.2 standard deviation move over a ten year period. This is an exceptionally powerful move which has NOT come to us without follow-on implications. Turkish Credit Default Swaps – a key instrument investors use to insure against financial turbulence – surged to their highest since the 2008 global financial crisis as the lira took another sharp dive in world currency markets. Five-year Turkish CDS jumped 78 basis points to 529 basis points, data from IHS Markit showed.

Turkish Credit Default Swaps – a key instrument investors use to insure against financial turbulence – surged to their highest since the 2008 global financial crisis as the lira took another sharp dive in world currency markets. Five-year Turkish CDS jumped 78 basis points to 529 basis points, data from IHS Markit showed. There’s a “Price to Pay” for the easy money Gravy Train which has come out of central banks. Thanks to a Reckless Fed and ECB, Turkey was able to pile up loads of debt – NOT denominated in Lira BUT Dollars and Euros, TURN OUT the Lights. The likeness of 2018’s Turkish credit crisis and the Asian credit crisis of 1997 is very real. If you think of Turkey’s external debt near $450B, that’s nearly 57% of GDP. Next, add on colossal corporate debt layers (see above) – you’re in a HIGHLY unsustainable neighborhood, near 70% of GDP. Back in 1997, Thailand’s external debt was $110B or 64% of GDP, the panic that followed rocked global markets. Over the last month against the US dollar, Turkey’s lira -48% (since July 6th) while one month into the Asian financial crisis the Thai baht was -24% against the US dollar. In rare company – the lira’s recent collapse exceeded daily losses during Russia’s 1998 default and Brazil’s 1999 real crisis.

There’s a “Price to Pay” for the easy money Gravy Train which has come out of central banks. Thanks to a Reckless Fed and ECB, Turkey was able to pile up loads of debt – NOT denominated in Lira BUT Dollars and Euros, TURN OUT the Lights. The likeness of 2018’s Turkish credit crisis and the Asian credit crisis of 1997 is very real. If you think of Turkey’s external debt near $450B, that’s nearly 57% of GDP. Next, add on colossal corporate debt layers (see above) – you’re in a HIGHLY unsustainable neighborhood, near 70% of GDP. Back in 1997, Thailand’s external debt was $110B or 64% of GDP, the panic that followed rocked global markets. Over the last month against the US dollar, Turkey’s lira -48% (since July 6th) while one month into the Asian financial crisis the Thai baht was -24% against the US dollar. In rare company – the lira’s recent collapse exceeded daily losses during Russia’s 1998 default and Brazil’s 1999 real crisis. In June, in a rare public tongue-lashing, the Bank of India governor pleaded for the US central bank to relax balance sheet tightening plans, they didn’t listen.

In June, in a rare public tongue-lashing, the Bank of India governor pleaded for the US central bank to relax balance sheet tightening plans, they didn’t listen. The Turkish Lira has plunged against the dollar to record lows this week, fueled by concern about the nation’s worsening relationship with the U.S. and authorities’ ability to anchor the nation’s assets. With close to $250B of US Dollar and Euro denominated DEBT, every 1% move lower in the Turkish currency brings a nasty 5 billion Lira interest coverage problem, it’s good night Irene.

The Turkish Lira has plunged against the dollar to record lows this week, fueled by concern about the nation’s worsening relationship with the U.S. and authorities’ ability to anchor the nation’s assets. With close to $250B of US Dollar and Euro denominated DEBT, every 1% move lower in the Turkish currency brings a nasty 5 billion Lira interest coverage problem, it’s good night Irene. In nearly every substantial macro-driven risk-off period, as the crisis kicks off US equities ignore the drama. There’s a beautiful point in every market cycle; macro takes over lazy thinking. It’s a unique, special place in which all participants have to dig deeper into what’s actually going on within the solar plexus of the global economic system. WE ARE THERE RIGHT NOW, peace. Clients are asking if this is 1998 all over again? We say yes. A Lira move near seven (close to a 6 handle now) wipes out most of the equity in Turkey’s banking system, and that’s on a $1T economy. Contagion? EU banks are 7% – 10% lower this month!

In nearly every substantial macro-driven risk-off period, as the crisis kicks off US equities ignore the drama. There’s a beautiful point in every market cycle; macro takes over lazy thinking. It’s a unique, special place in which all participants have to dig deeper into what’s actually going on within the solar plexus of the global economic system. WE ARE THERE RIGHT NOW, peace. Clients are asking if this is 1998 all over again? We say yes. A Lira move near seven (close to a 6 handle now) wipes out most of the equity in Turkey’s banking system, and that’s on a $1T economy. Contagion? EU banks are 7% – 10% lower this month! Europe is facing BOTH US sanctions and tariffs on their major trading partners (China, Turkey, and Russia). Above all, Europe’s banks are holding the bag – that’s the problem. Here are the bag holders. As of Q1 2018 Spanish bank exposure to Turkey 82.3bn dollars, France 38.4, UK 19.2, US 18, Germany 17.1 Italy 16.9 Japan 14. Switzerland 6.3 Canada 1.2 Austria 1.1. Portugal 0.3. Turkey’s Lira touched a record low of 7.23/USD, the Argentina peso and Brazil’s real reached their weakest point in a month, while the Russian ruble plunged to its lowest level in two years – DEFAULT risk is RISING fast.

Europe is facing BOTH US sanctions and tariffs on their major trading partners (China, Turkey, and Russia). Above all, Europe’s banks are holding the bag – that’s the problem. Here are the bag holders. As of Q1 2018 Spanish bank exposure to Turkey 82.3bn dollars, France 38.4, UK 19.2, US 18, Germany 17.1 Italy 16.9 Japan 14. Switzerland 6.3 Canada 1.2 Austria 1.1. Portugal 0.3. Turkey’s Lira touched a record low of 7.23/USD, the Argentina peso and Brazil’s real reached their weakest point in a month, while the Russian ruble plunged to its lowest level in two years – DEFAULT risk is RISING fast. There’s clearly a flight to quality into German bunds, more disturbing is the price action in Italy’s yields moving higher on the heels of Turkish drama. Yields on two-year securities climbed to the highest levels in more than a week as stocks worldwide declined following a 29 percent tumble in Turkey’s lira this month. Bloomberg noted the Italian 10-year spread over German bunds hit the highest since May. Deputy Prime Minister Luigi Di Maio was reported as saying in an interview Monday that his country won’t be subject to an attack by speculators.

There’s clearly a flight to quality into German bunds, more disturbing is the price action in Italy’s yields moving higher on the heels of Turkish drama. Yields on two-year securities climbed to the highest levels in more than a week as stocks worldwide declined following a 29 percent tumble in Turkey’s lira this month. Bloomberg noted the Italian 10-year spread over German bunds hit the highest since May. Deputy Prime Minister Luigi Di Maio was reported as saying in an interview Monday that his country won’t be subject to an attack by speculators. Foreign banks in Turkey are exposed to the local government debt for $120 billion: French and English banks are first in line, with $40.4 and $23.9 billion respectively. – BIS Data. At the same time, momentum is building in the US Senate for additional sanctions punishing Russia for election-meddling. The run-up to the U.S. midterms in November is a critical period for U.S.-Russian economic relations. There’s clearly a Euro impact here. Not to mention Germany’s largest trading partner in China facing tariff risk.

Foreign banks in Turkey are exposed to the local government debt for $120 billion: French and English banks are first in line, with $40.4 and $23.9 billion respectively. – BIS Data. At the same time, momentum is building in the US Senate for additional sanctions punishing Russia for election-meddling. The run-up to the U.S. midterms in November is a critical period for U.S.-Russian economic relations. There’s clearly a Euro impact here. Not to mention Germany’s largest trading partner in China facing tariff risk. Too many investors are hiding out in US equities. Tariffs on China, US sanctions on Turkey and Russia – that’s over $15T of global GDP under substantial stress. It would be nice if the US equity market was on an island, protected from the global economy – but that’s not the case. Turkey’s exports to Russia soared 52.5% last year, up to nearly 6% of GDP. As a result, US sanctions on Russia just add to the Turkish economic dilemma, it brings DOUBLE trouble default risk. US Russia sanctions + Turkey Sanctions = Rising Credit Risk.

Too many investors are hiding out in US equities. Tariffs on China, US sanctions on Turkey and Russia – that’s over $15T of global GDP under substantial stress. It would be nice if the US equity market was on an island, protected from the global economy – but that’s not the case. Turkey’s exports to Russia soared 52.5% last year, up to nearly 6% of GDP. As a result, US sanctions on Russia just add to the Turkish economic dilemma, it brings DOUBLE trouble default risk. US Russia sanctions + Turkey Sanctions = Rising Credit Risk.