Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

The global reflation rotation, what´s the problem? Millions of investors have a portfolio constructed for 2010-20 (big tech and bonds), not 2020-30 (commodities, value, and global equities). Trillions are on one side of the seesaw and billions are on the other. A colossal rebalancing process is born.

The 30 year treasury index is solidly oversold for the first time since 2018. The prior time before that was 2016. The sell-off has taken it close to its 20 quarter moving average, in other words, to where it should have been in the first place. It is not unusual to be at roughly the same level you have been at for five years. What is unusual, perhaps, is for Treasuries to finally be at normal levels in the time of Covid. But this means one very big fat fact: the Covid trade is over. Mean reversion to normality = mean reversion away from the abnormality. The Covid trade is dead. And the treasury market buried it yesterday. We have thus officially entered the Covid-Is-Dead trade.

Bonds are NOT there to Protect Stocks

Risk-parity asset managers delivered their worst day in nearly 5 months this week, the $1.2 billion RPAR Risk Parity ETF plunged the most since the depths of the Covid rout in March.

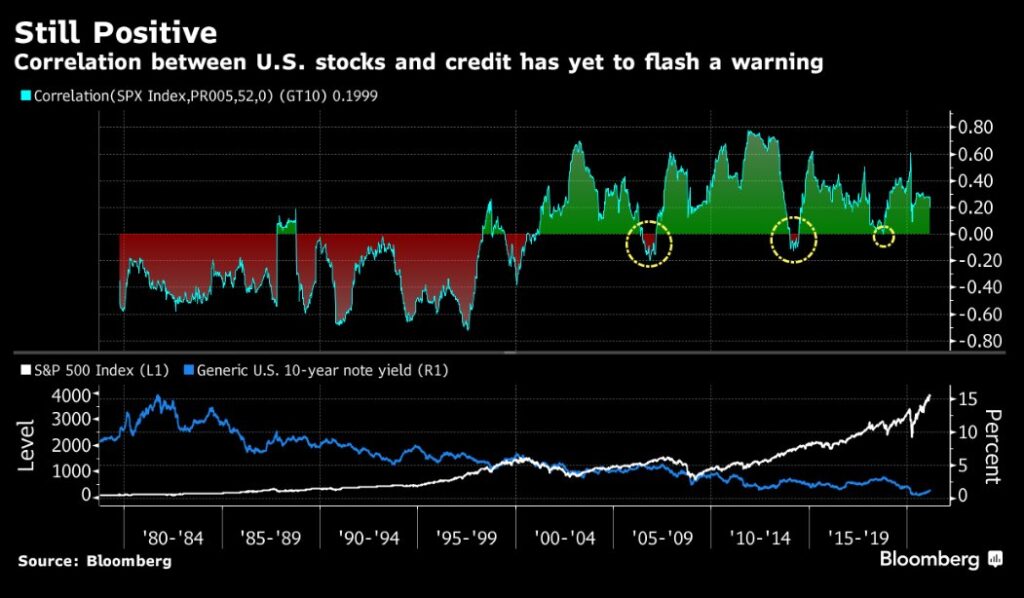

Positive Correlation – Stocks and Bonds

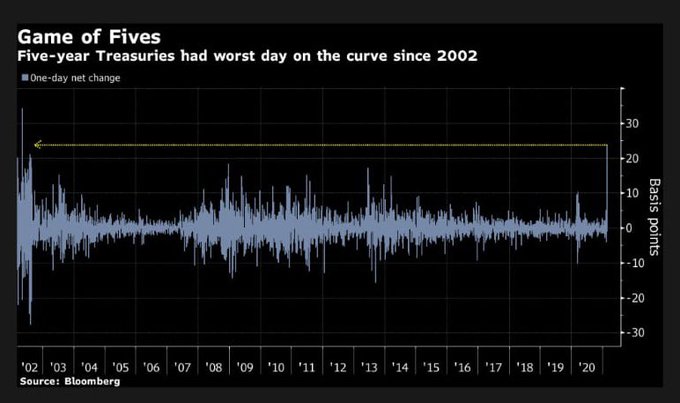

It was the worst single day for 5s (five-year Treasuries) since 2002… What lending instruments are tied to US 5 year bond yields? FCIs are key, financial conditions will determine when the Fed comes in with YCC, yield curve control. Most investors don´t realize that for much of the 80s and 90s, stocks and bonds were positively correlated, moved together (see above in red). As we move back toward that regime, investors must be positioned accordingly. Email tatiana@thebeartrapsreport.com to get our latest Bear Traps Report.

It was the worst single day for 5s (five-year Treasuries) since 2002… What lending instruments are tied to US 5 year bond yields? FCIs are key, financial conditions will determine when the Fed comes in with YCC, yield curve control. Most investors don´t realize that for much of the 80s and 90s, stocks and bonds were positively correlated, moved together (see above in red). As we move back toward that regime, investors must be positioned accordingly. Email tatiana@thebeartrapsreport.com to get our latest Bear Traps Report.

The Year 2021 – So far we have Two 6 standard deviation moves so far.

– hedge fund deleveraging in the GameStop drama, de-grossing…

– relative value rates, sell-off in 5s vs rest of the curve, US treasuries.

*in both cases too much capital was hiding out in crowded venues. Death of the Covid trade.

Credit Leads Equities

When central banks do NOT allow the business cycle to function over longer and longer periods of time – the good news is wealth creation becomes colossal. The bad news is Capital moves into crowded venues, poised for disruption. In rates, as the bond market sold off. Originally, the long end 30s was deemed at risk. Next, capital moved into 10s, 7s (10 and seven-year U.S. Treasuries), a “safe” place. As selling pressure moved into the middle part of the curve, trillions moved into the front-end looking for duration risk shelter. In recent weeks, 5s (5 year U.S. Treasuries) became the colossal hangout, a perceived “safe” place. Then the US treasury brought another* $100B for sale (5-7 year paper) this week. Anemic demand triggered the now historic, 6sd (standard deviation ) blow-up in 5s.

When central banks do NOT allow the business cycle to function over longer and longer periods of time – the good news is wealth creation becomes colossal. The bad news is Capital moves into crowded venues, poised for disruption. In rates, as the bond market sold off. Originally, the long end 30s was deemed at risk. Next, capital moved into 10s, 7s (10 and seven-year U.S. Treasuries), a “safe” place. As selling pressure moved into the middle part of the curve, trillions moved into the front-end looking for duration risk shelter. In recent weeks, 5s (5 year U.S. Treasuries) became the colossal hangout, a perceived “safe” place. Then the US treasury brought another* $100B for sale (5-7 year paper) this week. Anemic demand triggered the now historic, 6sd (standard deviation ) blow-up in 5s.

*total $1.8T U.S. Treasuries for sale in 2021, ABOVE Fed asset purchases.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here