Institutional investors can join our live chat on Bloomberg, a groundbreaking venue since 2010 – now with clients in 20+ countries, just email tatiana@thebeartrapsreport.com – Thank you.

Author Lawrence McDonald is the New York Times Bestselling Author of “A Colossal Failure of Common Sense” – The Lehman Brothers Inside Story – one of the best-selling business books in the world, now published in 12 languages – ranked a top 20 all-time at the CFA Institute.

Long-Term Inflation Trends

Lessons Drawn from the Inflation of the 16th & early 17th Centuries

A. Inflation comes in multiple waves.

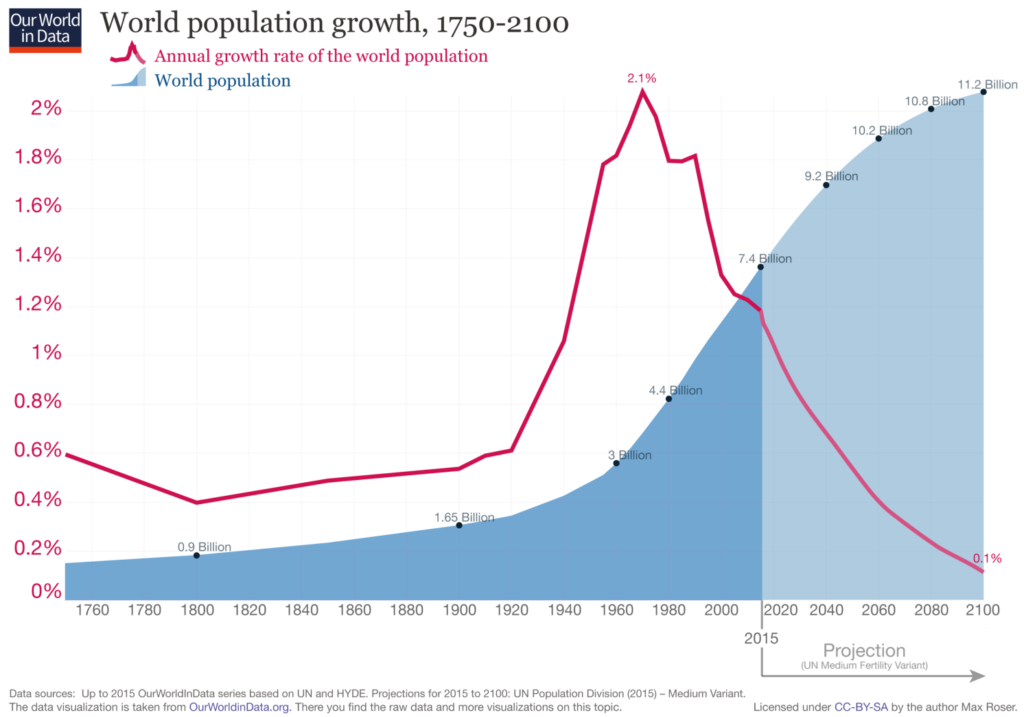

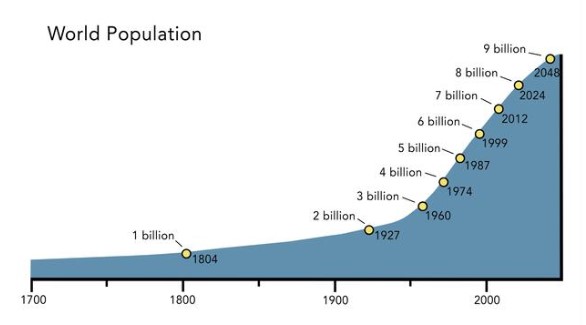

B. Current global population trends (8.0B in 2023 vs. 7.2B in 2013 vs. 6.4B in 2003) vs. the commodity capex deficit trend is VERY inflationary.

C. Perceived demand shocks in the energy sector are a buy.

D. The Fed has far less control over inflation than meets the eye.

E. Inflation fuels real income inequality and that fuels the Power of Labor, and that fuels sustained inflation.

F. Shrikflation is as old as time itself.

G. Hard asset, bull market trends surge in inflation’s second leg higher.

H. Inflation will trigger a colossal political shift, response.

Lessons Learned, is Anyone Listening?

In the last quarter of the 16th century, prices began to increase slowly in Germany and Italy. In Florence, during the 1490s, prices surged. Masses of starving poor crushed themselves trying to get at the granaries. As is usually the case, an epidemic followed the famine. Soon, Venice lost wars in the East to the Turks and in the West to the French. In 1527 Rome was sacked by the French. Such were the events that ended the Renaissance price equilibrium. Inflation didn’t peak until the mid-17th century.

There are priceless lessons behind us, we MUST take note.

While the price of grain started to rise in Florence starting in 1472, there were areas in Europe where grain prices didn’t increase until about 1500. The last significant price increases in Europe ended altogether in 1650, making for the longest sustained inflation period in the history of the continent. Now, here is the key first lesson. We today think it would be a fine and healthy thing to reach a 2% inflation. False. The sustained price inflation from 1470 to 1650 averaged only 1% a year. However, the length of it, and the compounding of it, wreaked havoc for decades. So, while we debate whether inflation has or will be “over” i.e. if it will ever get to 2%, what we are missing is the fact that even 1% inflation, if it lasts long enough, is extremely deleterious to the polity, as you shall see below. The reader may recall our recap of medieval inflation and how destructive that was. Well, it was only about half of one percent a year on average for its duration, and it was a disaster.

Another lesson, our second, from studying this longest of price rise periods comes from noticing the extreme price variations around the primary trend. There were periods where prices rose well above trend and there were other periods where prices fell well below trend. This is a second lesson from the period we are focusing on in this paper: inflation comes in multiple waves. In other words, the current bout of inflation we have just experienced would be unique in history if it were not followed by yet another. Furthermore, it is a myth that Volcker cured inflation. He greatly reduced it, but he didn’t get rid of it altogether. How so? Well, in the wake of Volcker’s success, the Fed and the rest of the government developed a propagandistic lie: that the only way to avoid the perils of deflation was “modest” inflation. That is a lie because there is a third paradigm: no inflation and no deflation i.e. price stability. The cure against deflation is the same cure as against inflation: zero inflation. 2% inflation is a disease. 1% inflation is a disease. It is utterly false to say our only choice is between high inflation and moderate inflation. If we look at the modern period in toto, we see bouts of inflation followed by bouts of moderation which overall destroy the average person’s standard of living. This is what happened during the period we are considering as well.

What caused the inflation that saw its first sparks in the late 15th century? Population growth. The increase in population strained Europe’s material resources. This is a third lesson that comes from a study of the period. We think about globalization all the time. Yet, for some baffling reason, we think of the present-day inflation as a US phenomenon or a US and EU phenomenon, or as the latter with pushes from OPEC+ and China. Each of these views has something to recommend, but the simple truth is that inflation is a global phenomenon, and if one refuses to look at the total global economy, one will fail to understand the inflationary forces at work in our own day. The fact is, while the US population is growing slightly, because of immigration, the world’s population growth is quite strong. Within a handful of decades, it will crest at over 9 billion souls, more than one billion extra mouths to feed than today. The planet’s basic material resources are not growing at a concomitant rate. Therefore global inflation is inevitable for the next couple of decades at least. And global inflation means the US will suffer inflationary pressures for the next couple of decades at least. Certainly, there will be years when inflation will be less. Just as certainly, there will be years during which inflation will be above trend. The key point is that because the world’s population is growing, long-run inflation is here to stay.

Most countries in Europe showed a catastrophic decline in population in the mid-fourteenth century, which decline continued at a less precipitous rate until the end of the fourteenth century. In the early 15th century, population growth returned, but at a moderate rate. After about 1460 or so, population growth accelerated at a rapid clip. Take England as an example, which, in 1430 to 1470 had a population of around 1 million people. By 1541 the population was 2.8 million. Why did the population stabilize and increase? Well, because real wages had been increasing which increased social optimism which increased family size. Real growth – sustained real growth – is a wonderful tonic if one is planning to have a family. From 1460 to 1510, people married earlier had children earlier, and had more of them.

What were the effects of population growth? The first impact came in the form of increased prices for food. Next came wages and industrial products. “Throughout the first three-quarters of the sixteenth century, agricultural prices rose faster than non-agricultural (in Spain),” writes Earl Hamilton. This was true across Europe. After food prices rose, energy prices rose. In the early years of the period under consideration, energy prices rose slowly. After this initial period of relative quietude, energy prices spiked. Why? Europe was losing its forest and its forest provided fuel: wood. Eventually, around 1530 or so, the prices for wood and charcoal went up faster than the prices for meat and grains. It should be added: not only did energy pricing increase rapidly, but so too did the volatility of those prices.

Energy – the Ultimate Inflation Hedge

Look carefully, oil is very often a CPI leader. An oil reversal higher points to higher – follow on – CPI.

Look carefully, oil is very often a CPI leader. An oil reversal higher points to higher – follow on – CPI.

This is the fourth key lesson to remember as we trade energy today: BUY THE DIPS. Each time energy prices calmed down, another wave of energy price increases followed, for the simple reason that, whatever the peculiar circumstances of a particular season, overall there was simply not enough energy for the populace long-term. So too today: because of a dearth of investment in oil fields there is simply not enough energy for everyone at cheap prices. So, yes, there will be quarters where energy prices are soft, sure enough, but expect new highs down the road.

Intriguingly, industrial prices were slower in their rate rises. During the period, in England, energy prices rose six-fold while prices for industrial goods rose three-fold. This, therefore, is the fifth lesson our study provides: Core inflation is a false measure of inflation. By reducing the number of things that the Fed targets in its war against inflation, it solves its problem by avoiding measuring it. Effectively, the Fed isn’t fighting inflation because it can’t. The Fed has no influence over global population trends. The Fed has no influence over energy investment. Sadly, that means the Fed has no influence over long-term global inflation trends. Everyone is looking for the Fed to cure inflation. It can only have moments of relative success. A true long-term cure for inflation is simply beyond any Central Bank’s grasp. Thus, the market focus on Fed policy is a focus on an illusion.

Around the middle of the 16th century, a new element was added to the inflationary mix: a recognition that inflation existed, that inflation was not transitory, and that inflation was sticky. Once it became widely recognized that inflation existed, the first impulse was to blame someone. However, in essence, everyone was to blame. Inflation caused consumers to spend more money, which exacerbated inflation. People hoarded goods. This in turn caused speculation in goods. This in turn caused panic buying of goods. This in turn caused the degradation of goods: shrinkflation. Just like today as soda cans are smaller and Dorito bags have less chips in them, bakers in the 16th century started selling smaller loaves of bread at higher prices. Hence our sixth lesson: shrinkflation is an inflationary reaction to an already existing inflationary environment. Shrinkflation is symptomatic of a conscious awareness that inflation is not going away.

A consequence of inflation and of its conscious awareness in the population was that some members of society were able to adapt to the changed circumstances better than others. Of course, there were social imbalances before inflation had set in, but these social imbalances were greatly enhanced because of inflation. While wages at one point increased along with food and energy, eventually they lagged significantly. By 1570 the average wage had been cut in half, or more, compared to the early stage of inflation. Who were most at risk? Those with no capital and few skills: the underclass. Landlords fared much better, so too those with capital. Rates of interest increased in keeping or exceeding the rate of inflation. The Hapsburgs ended up paying interest rates as high as 52%, exceptionally high, but indicative. Feudal lords raised rents. There were times when rents rose faster than energy and food prices.

Wages, Gasoline LEAD CPI

Wages and gasoline are FAR above where the Fed wants them to be. No one seems to care, for now.

Wages and gasoline are FAR above where the Fed wants them to be. No one seems to care, for now.

Overall, rents in England, for instance, rose nine-fold from 1510 to 1640 during a period in which grain prices went up four-fold and wages merely two-fold. Increases in rent caused ferment in the countryside. Kett’s Rebellion of 1549 in England wanted rents to be rolled back to where they had been 65 years prior. Real wages, wages adjusted for inflation, declined from the late 15th century into the early 17th century. Since the upper classes were relatively better off than the lower classes, one could even argue that inflation strengthened feudalism.

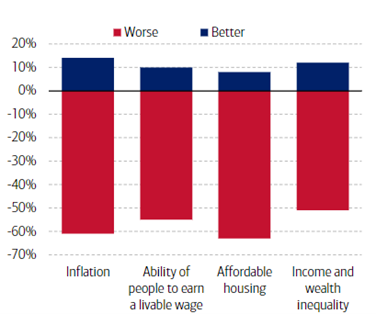

Here is our seventh lesson: Long-term inflation increases social inequality, reinforces the power of the rich, and increases the hatred of them by the lower classes. This is not irrelevant to the social and political tensions we see in our own time. Dominant elites gain strength. And they don’t give it up willingly. During the period under consideration, returns to capital were much greater than returns to labor, resulting in labor’s widespread discontent with the status quo. One consequence of increased inequality was squalor: in England, the number of vagabonds and homeless increased dramatically. We see this in our own time as well. The homelessness that so many of us decry is a direct consequence of inflation. Such is the lesson of history.

Another familiar consequence to prolonged inflation came in the form of monetary imbalances. The response to inflation was the creation of more money. Silver in circulation vaulted by 10,000 tons mid-sixteenth century to north of 34,000 tons in 1660, by some estimates. Where did this lucre come from? Silver and gold from America flooded Europe. It is key to understand that inflation was well underway for quite sometime before precious metals from the New World hit European markets. Prices in England and Germany had already doubled by the time Mexican silver reached them. Another argument against precious metals causing, as opposed to aggravating, inflation, is that their effects were not evenly distributed with the distribution of the metals. More silver and gold reached Spain than anywhere else in Europe, but its inflation was less intense than in the rest of Europe. Insofar as one looks only at inflation in Spain, it was worse in the half-century before its money increased than once the treasures began unloading at the port. Much of the silver in Europe came from the Potosi mine in Mexico, which opened in 1545. This mine was responsible for almost half the silver that arrived in Europe from the Americas. It was mined by indigenous slaves. It is quite something to go through museums and look at silver plate from 1550 to 1650 and realize that all that silver passed through Indian slaves’ hands.

Gold Silver Cross

Silver has been outperforming gold for months. As the Fed arrives to the end of the hiking cycle, look for silver (SLV) to outshine gold (GLD).

Silver has been outperforming gold for months. As the Fed arrives to the end of the hiking cycle, look for silver (SLV) to outshine gold (GLD).

Silver and gold from the New World didn’t cause inflation but exacerbated it. The desire to increase the money supply existed in the Middle Ages as well during its inflationary period. Once people see inflation rise, they want more money. It is noteworthy that there were fluctuations in coinage that made this trend zigzag.

Hence our eighth lesson is: that inflation causes an increase in the money supply and in the volatility thereof. We saw a huge surge in the money supply recently and now that surge is over. It will reappear. The fluctuations in coinage during the sixteenth and early 17th centuries track quite neatly to the fluctuations in the price of wheat, for example. One might think that New World lucre was sufficient to satisfy money demand, but that assumption would be false. Every old and closed mine in Europe was eventually reopened, and new mines were found. Obviously, in our own time, we are not there yet, but that will change. All this was not lost upon thoughtful observers of the age. This is the period in which the monetary theory of inflation was invented. The first monetarist was, unsurprisingly, Spanish. Martin de Azpilcueta wrote: “Money is worth more when and where it is scarce than when it is abundant.” A decade later, the Frenchman Jean Bodin said much the same. Nicolaus Copernicus did as well. It became commonplace across Europe soon enough. Hence, while the primary cause for inflation was population growth, one aggravating cause was the supply of money.

Naturally, and familiarly enough, fiscal imbalances ran rife. In response to ongoing inflation, from the mid-sixteenth century on, fiscal imbalances ballooned as a primary governmental response. In response to increased fiscal deficits, taxes were increased. These taxes fell disproportionately on the lower classes. Some of the nobility remained exempt from taxation, and certainly from the most onerous taxes. Since government revenues still fell behind, government borrowing increased to make up for the difference. Once we reach the early 1540s, we find that a significant portion of the government of Spain’s revenue went to pay interest on debt, and this is from the primary beneficiary of Mexican silver mining. The fiscal imbalances interacted with the rest of the reactions to inflation, of course. The various inflationary responses to inflation that only increased inflation form a complex matrix in which sometimes one, sometimes inflationary force gained temporary dominance. Falling real wages and higher rents increased inequality as the rich gained yet more power which in turn caused the powerful to raise taxes on the weak only to see government coffers still unable to keep pace with inflation, causing those governments to debase their currencies. However, there were many other cross-currents besides that example.

Thus our ninth lesson is: that inflation causes fiscal imbalances which cause more inflation.

Naturally, all this led to social conflict. It is not pure accident that the Protestant Reformation, and the Catholic Counter-Reformation, moreover, occurred in the second half of the 16th century. The Diet of Worms in 1521 may mark the start of the Protestant Reformation, but it took increasing hold by the mid-16th century.

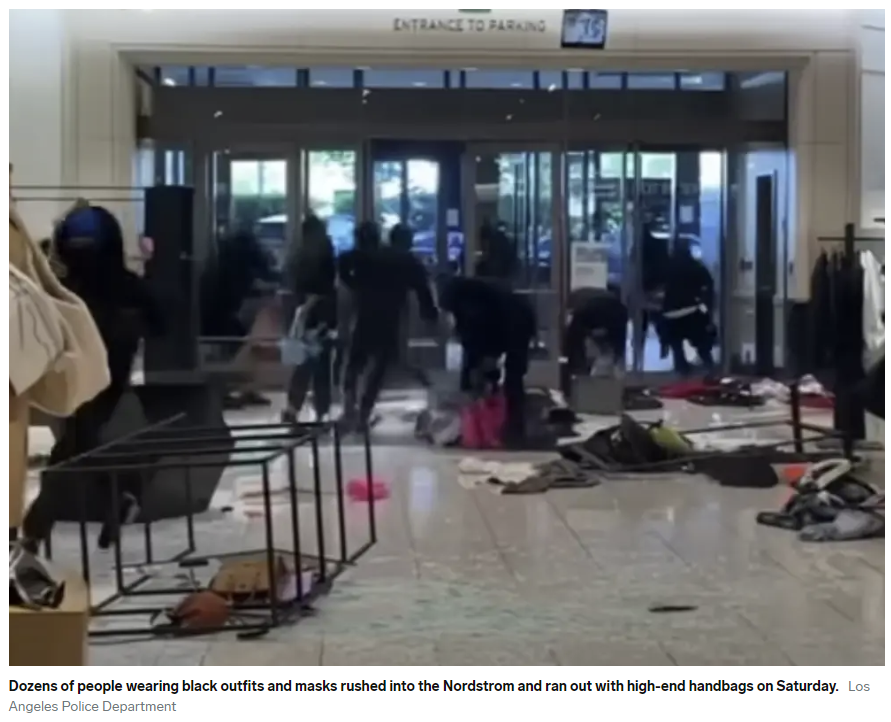

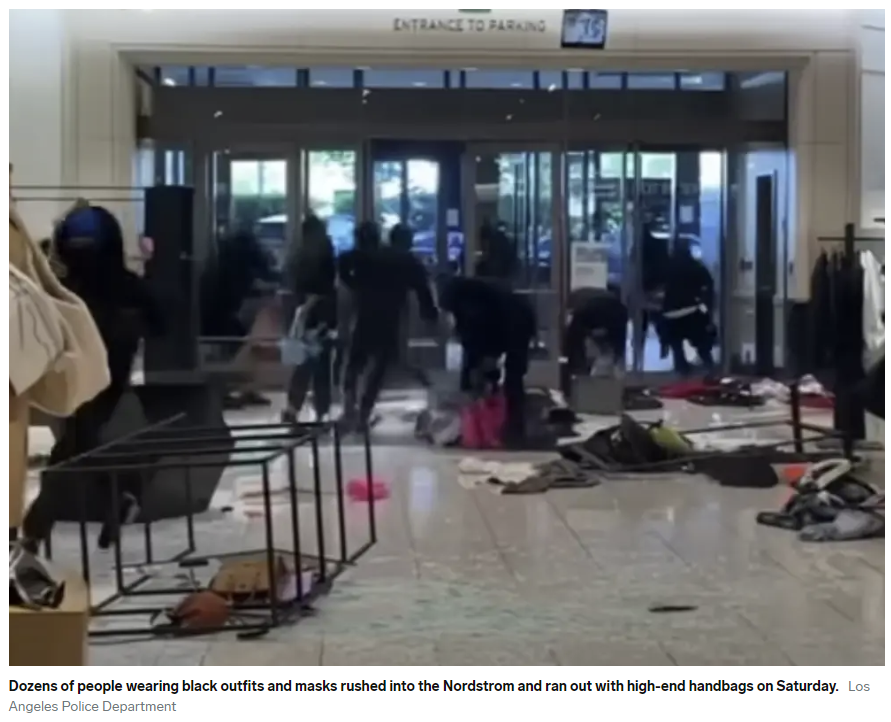

Social Conflict on the Rise

Ultimately, much like today – social unrest became violent. As inflation increased in the latter 16th century, so too did the volatility of prices. Prices catapulted and collapsed only to catapult again. Overall the trend was higher, but the year-to-year price swings were extreme. When four consecutive harvests failed, from 1594 to 1597 inclusive, famine and sickness increased. Medicine of course was not particularly advanced. Thus there were waves of population decline during this period. Epidemics reduced England’s population by 20% during a five-year period in the 1550s and prices softened commensurately. However, once the population grew again, inflation came back with a vengeance.

Ultimately, much like today – social unrest became violent. As inflation increased in the latter 16th century, so too did the volatility of prices. Prices catapulted and collapsed only to catapult again. Overall the trend was higher, but the year-to-year price swings were extreme. When four consecutive harvests failed, from 1594 to 1597 inclusive, famine and sickness increased. Medicine of course was not particularly advanced. Thus there were waves of population decline during this period. Epidemics reduced England’s population by 20% during a five-year period in the 1550s and prices softened commensurately. However, once the population grew again, inflation came back with a vengeance.

As high prices put the government in debt, that debt forces the debasement of currency which puts governments under greater fiscal pressure yet again. As this cycle repeated, social instability increased. Social instability was manifested and increased by war. The steepest increases in inflation were in the 1540s and 1550s, a period of increased war expenditure. Thus our tenth lesson is that inflation exacerbates social tension, the most strident manifestation of which is war, and this social tension in turn increases inflation still more. In our own time, it is obvious governments are spending more on the Ukraine conflict and it is easy enough to imagine other conflicts around the world that would lead to still more increased military expenditure. Yet even without that, who can deny the social conflicts within our own society today?

Matters eventually came to a head. The 1590s evolved into a prolonged crisis. The last quarter of the century was a period of stagflation: rising prices and less opportunity. In the last year of Queen Elizabeth’s reign, prices rose although the economy was in depression. Indeed, across Europe, real wages for laborers and artisans fell while capital continued its advance. As the inflationary cycle reached a climax, prices became more volatile with wild swings every few years in the price for wheat, barley, and oats. Starting in 1591, the weather was wet and cold for seven years running. It was a little ice age, with Alpine glaciers growing into inhabited valleys. Starvation increased. Again, the lack of economic material resources only served to increase economic inequality. A crime wave was the result. As the price of food increased, the incidence of crime increased as well. Given the year-over-year volatility in pricing, there were years when the price of food declined and then so too crime declined only to return once food prices increased again. We note that many retailers have been complaining about inventory shrinkage – theft. This is our eleventh lesson: as food prices increase, theft increases.

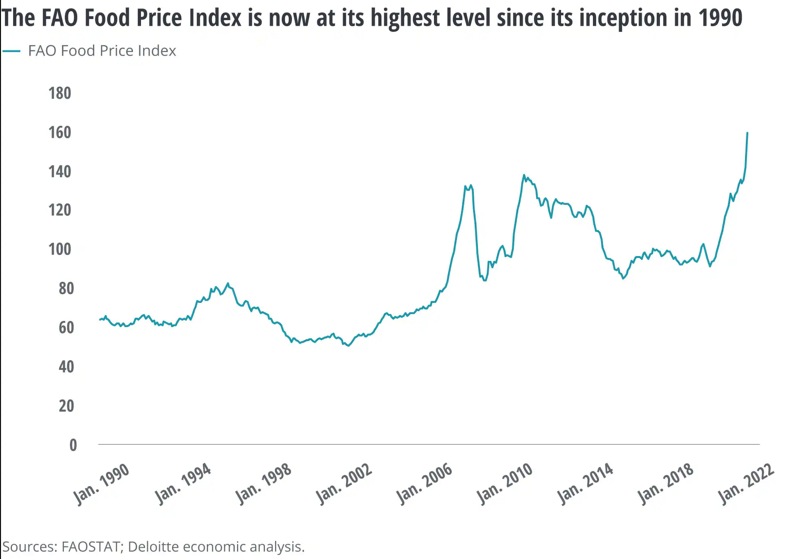

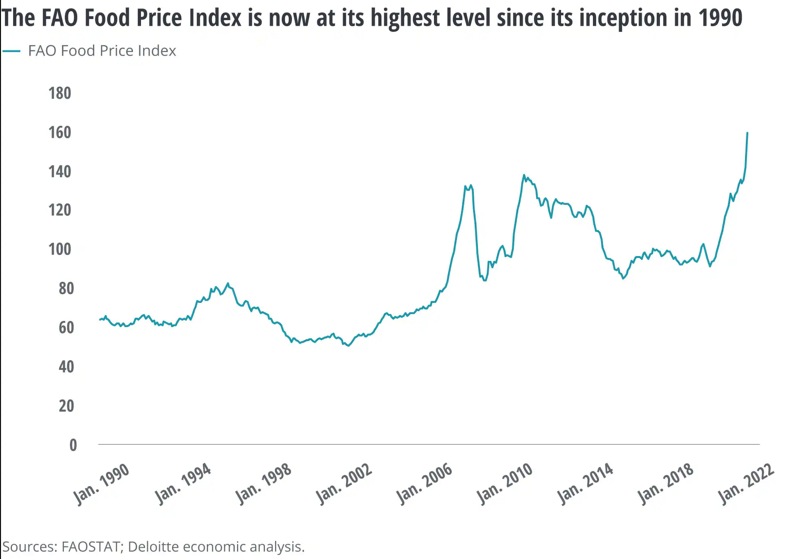

Food Inflation Trends are Sticky

Transitory inflation died 24 months ago.

Transitory inflation died 24 months ago.

With shortages in food, pandemics were rife. For example, half a million people died in the Iberian Peninsula between 1597 to 1602. In fact, the late 1500s into the early 1600s was the worst pandemic period since the Black Plague of the Middle Ages. Given the food shortages, fertility rates declined. Between the mid-16th century to 1617 in Toledo, baptisms declined by 50%. In fact, this period was the only time the population of Europe had declined since the Black Death. The European economy collapsed outright between 1610 and 1620. The number of ships counted in the Baltic Sea peaked in 1600 and declined steadily for half a century thereafter. Ship counting in the Baltic Sea continues to this day and we have upped the game with the Baltic Dry Index, a shipping freight-cost index, used by economists as an economic bellwether. Tonnage in Seville harbor peaked in 1610 then crashed and continued to decline thereafter for several decades. Industrial production in Amsterdam and Rotterdam peaked in 1620 and began an inexorable decline. War continued in various guises from 1590 to 1650 with only one year (1610) being a year without war. The armies of Europe had never been larger since the Roman Empire. The German population declined 40% from 1618 to 1648. That is a worse hit than even the Black Death. Deficit spending increased. Coinage was debased. Taxes on the lower classes increased. The result? Revolution. Catalonia and Portugal suffered a revolutionary conflict in 1640. Charles I in England faced a full-scale civil war and was beheaded. In France, rebellions, dubbed the Frondes, continued from 1648 to 1654. Altogether in France, there were 264 rebellions between 1596 to 1660. Naples and Sicily suffered civil unrest in 1647. The Netherlands did the same in 1650. Sweden did the same in 1650. Switzerland in 1654. Denmark in 1660. Scotland and Ireland faced a sequence of sanguinary revolts from 1638 to 1660.

However, leaving Germany to one side, the demographic disaster in Europe overall was less than the Black Plague, in part because the economy itself was more advanced. True, the inflation rate overall was higher, but the volatility, while high, wasn’t as high as experienced in the late Middle Ages. While the average price decline in the 16th and first half of the 17th century was double that of the inflationary period of the late Medieval era, the average volatility was about half as much as in the late Middle Ages. Productivity had obviously improved, and this helped to some degree. Markets were more integrated, and this helped as well. The 14th century saw the civilization of the High Middle Ages crumble away. The period we are now examining suffered no such fate. While the first half of the seventeenth century shocked civilization, it didn’t destroy it. Therein lies our twelfth (and optimistic) lesson: given our era’s advances in integrated markets and productivity, it seems unlikely that however bad the inflationary climax will be, in and of itself it is unlikely to destroy life as we know it, barring, of course, thermonuclear conflict.

Crises do end, and by the second half of the 17th century normalcy finally returned. Grain prices fell then leveled out. Energy prices and manufactured goods traded in a price range. Rents and interest rates fell while wages rose. Inequality lessened. The population grew slowly. Productivity improved some as did production overall. Real wages in England for laborers and builders almost doubled from 1650 to 1740 as the power of labor returned. Labor was more valuable than capital. A hectare of farmland that rented for around 12.8 francs in 1670 rented for only 7.5 francs by 1701. Interest rates in England fell from 10% at the beginning of the 17th century to 6% by its end. Overall prices fluctuated in a sideways pattern from 1650 to 1735. The price stability is remarkable. Meteorological shocks still affected food prices, but these prices soon recovered their former level and stability. All of this was bad news for the wealthy, who saw returns on capital decline, rents decline and labor costs increase while prices overall were flat. During this period, gold and silver still flooded Europe. Money supply increased but not inflation.

For instance, in France, from 1683 to 1730, silver livres in circulation increased from 500 million to 1.2 billion. Yet the cost of living remained constant. Not only that, but French coinage went through a series of debasements during those years. Price stability in France and Europe occurred despite monetary expansion, not because of monetary decline. How could this happen? The answer is that population growth stalled.

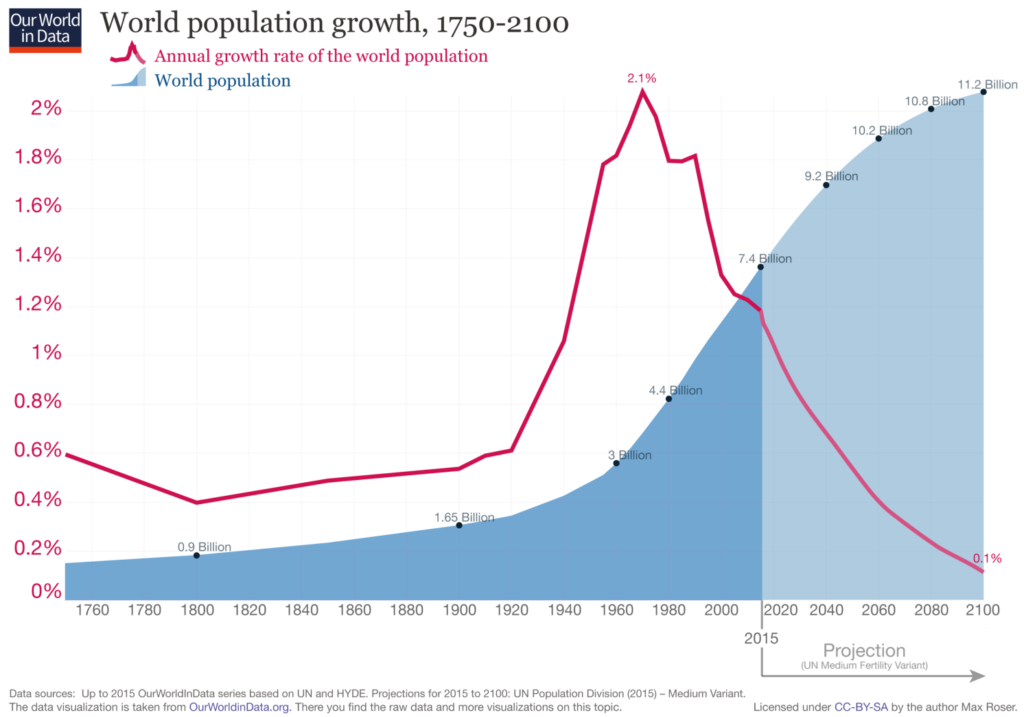

Population Trends

High levels of dependency and the relative scarcity of labor may induce a shift in the methods of production from labor-based R&D back to a reliance on natural resources. The global economy is going to pass through a severe population problem over the coming century, resulting from the simultaneous peak in global population levels with near-zero population growth (Roser et al. 2013, Giovanni and Tena Junguito 2023). This conflation of world firsts is seen above, which shows that global population is projected to reach a peak of approximately 11 billion individuals in the year 2100, at the same time that population growth is forecast to be moving asymptotically to zero. With Pedro Naso and Timothy Swanson.

High levels of dependency and the relative scarcity of labor may induce a shift in the methods of production from labor-based R&D back to a reliance on natural resources. The global economy is going to pass through a severe population problem over the coming century, resulting from the simultaneous peak in global population levels with near-zero population growth (Roser et al. 2013, Giovanni and Tena Junguito 2023). This conflation of world firsts is seen above, which shows that global population is projected to reach a peak of approximately 11 billion individuals in the year 2100, at the same time that population growth is forecast to be moving asymptotically to zero. With Pedro Naso and Timothy Swanson.

Population growth did not accelerate until after 1730. When we look at Japan in the modern era, it has had low inflation and low to negative population growth. The population of the world overall, however, continues to grow in our age, and inflation has only briefly, if ever, run back to zero, where it should be. From 1650 to 1730, commerce was healthy, violent crime fell, and political structures stabilized. This period of low inflation and economic prosperity corresponds with the Enlightenment. This period developed two contrasting economic theories: mercantilism and laissez-faire. Just as the High Middle Ages went through an inflationary crisis and gave way to the glories of the Renaissance, the inflationary crisis of the late Renaissance gave way to the glories of the Enlightenment.

(The above is in part an encapsulation of work complied by David Fischer. We urge a read of his tome “The Great Wave.” Our twelve lessons inferred from the encapsulation we have done are made by the Bear Traps staff and we do not purport them to be explicitly spelled out in the referenced text as we have done in this paper.)

The heart of “conditioning bias” comes down to one sentence. The longer something works, the more players get drawn into playing the game. We know the junkies are on every street corner these days buying call options when the

The heart of “conditioning bias” comes down to one sentence. The longer something works, the more players get drawn into playing the game. We know the junkies are on every street corner these days buying call options when the  As the market grinded higher – more and more capital came into the hands of algos and quants buying the 20-day moving average.

As the market grinded higher – more and more capital came into the hands of algos and quants buying the 20-day moving average.

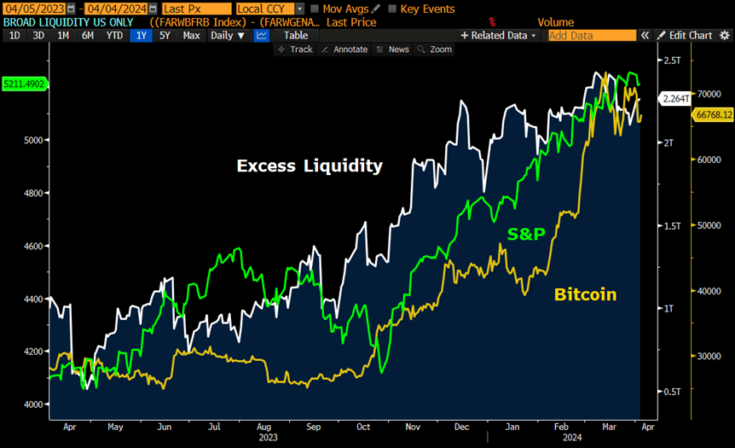

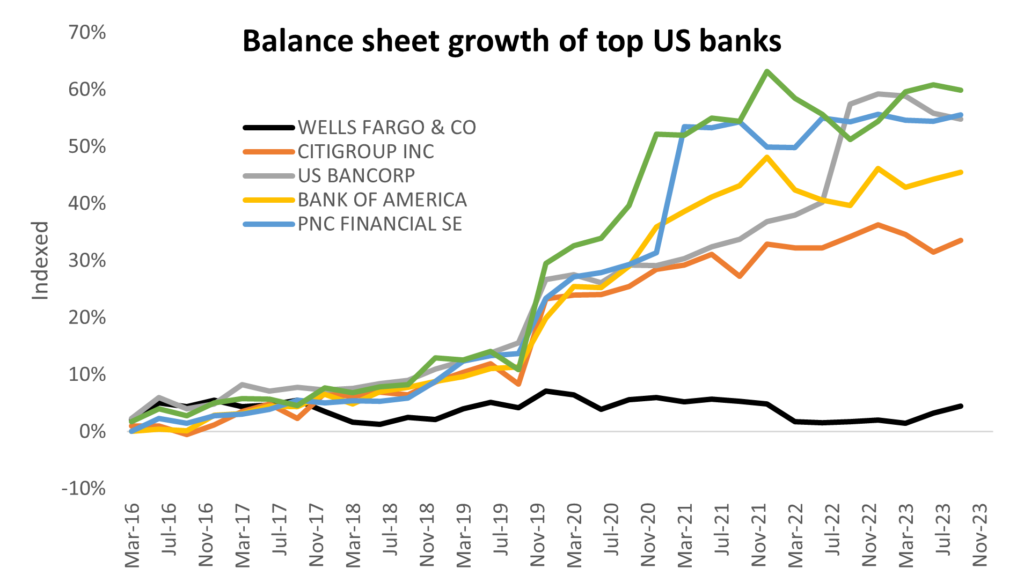

Excess liquidity have surged higher in the last year, which has pushed up risk assets, such as bitcoin and equities.

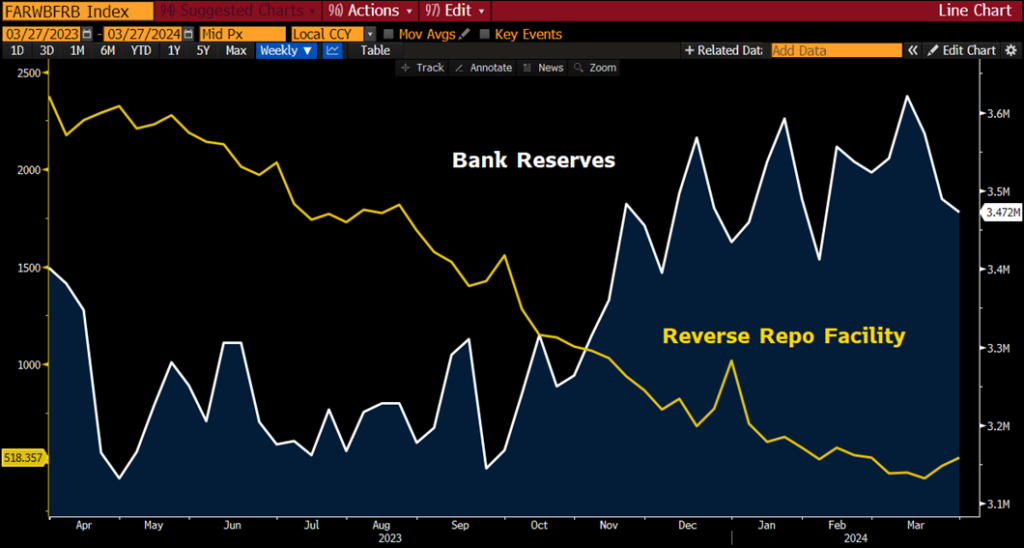

Excess liquidity have surged higher in the last year, which has pushed up risk assets, such as bitcoin and equities. As the Treasury pushed money out of the RRP, bank reserves held at the Fed have gone up simultaneously. This has been one of the biggest driver of stock market gains

As the Treasury pushed money out of the RRP, bank reserves held at the Fed have gone up simultaneously. This has been one of the biggest driver of stock market gains

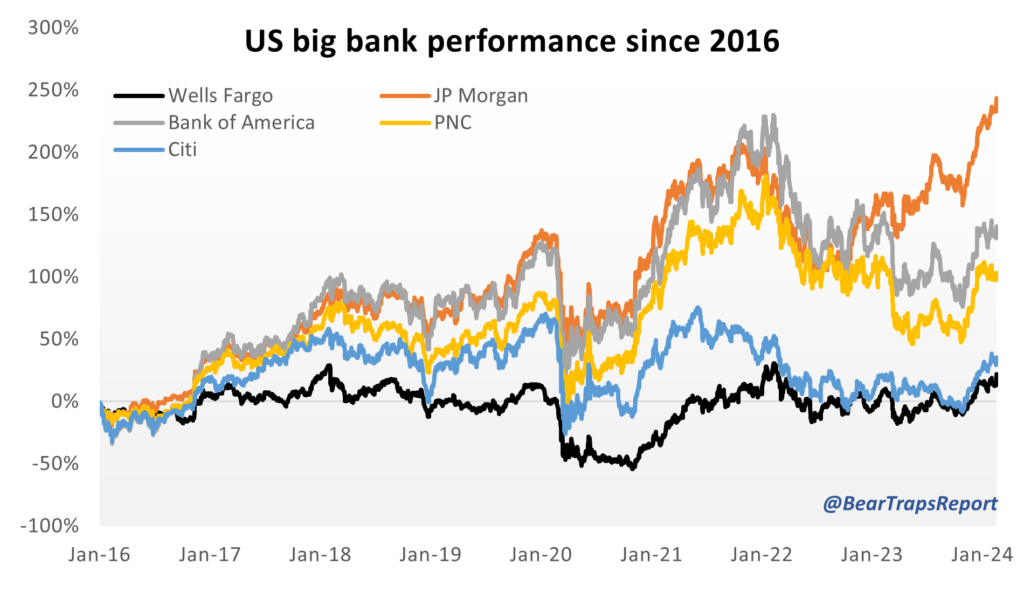

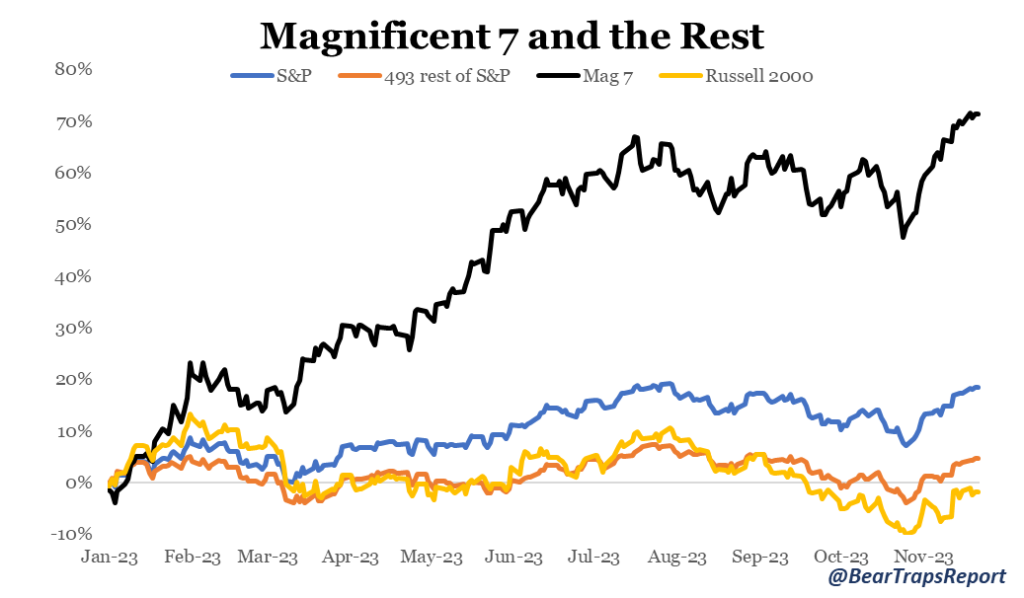

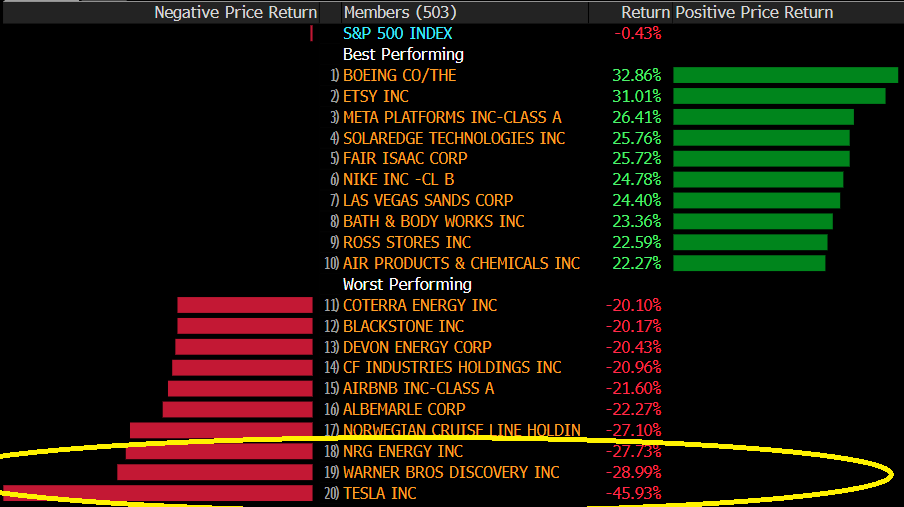

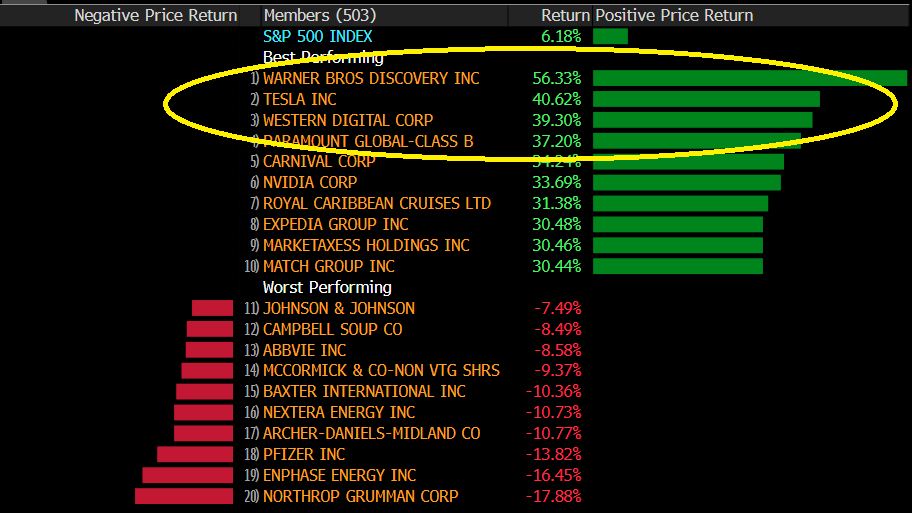

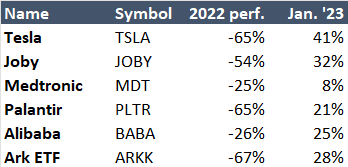

Many of the Q4 2022 losers became winners in early 2023.

Many of the Q4 2022 losers became winners in early 2023. Q4 losers into Q1 winners.

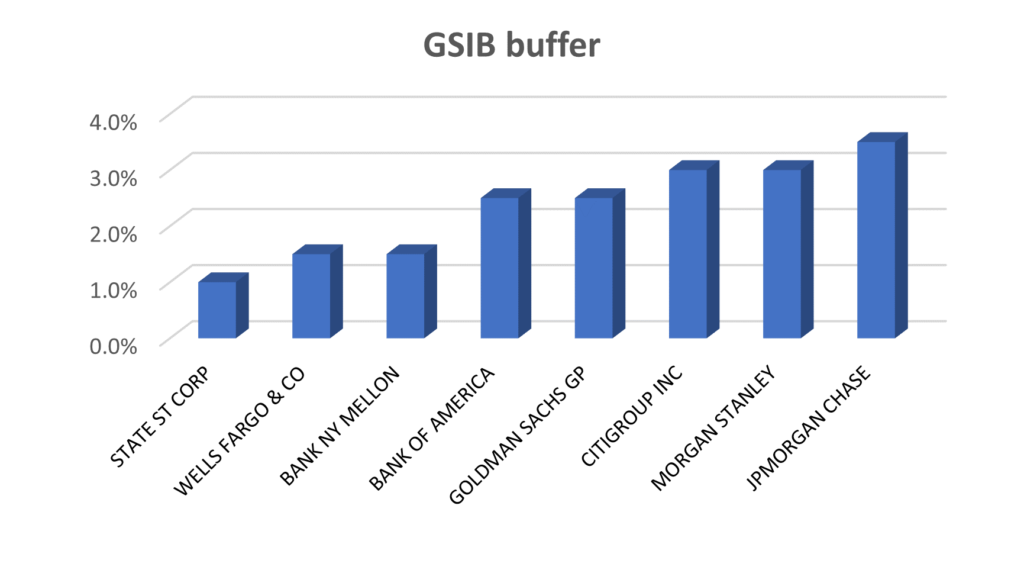

Q4 losers into Q1 winners. The year 2023 will go down as an epic haves vs. have nots.

The year 2023 will go down as an epic haves vs. have nots.

In 16 trade alerts, we positioned clients in beaten-down names in Q4 2022. NOT listed above was our CRM Salesforce position, CRM equity was up 70% in 1H 2023, see below.

In 16 trade alerts, we positioned clients in beaten-down names in Q4 2022. NOT listed above was our CRM Salesforce position, CRM equity was up 70% in 1H 2023, see below. Our 7-Factor Capitulation model delivered a strong buy. We were aggressive buyers of CRM equity in Q4 2022.

Our 7-Factor Capitulation model delivered a strong buy. We were aggressive buyers of CRM equity in Q4 2022. The TAN solar ETF is the cheapest to the QQQs all time.

The TAN solar ETF is the cheapest to the QQQs all time. FMC Corp (FMC) and Mosaic (MOS) have been among the worst-performing stocks this year, with FMC down 90% from the March ’22 highs. Fertilizer and crop protection stocks have been selling off all year together with crop commodities. We think FMC and MOS have now also become a victim of tax loss selling/window dressing and these stocks should improve once the tax loss selling has subsided.

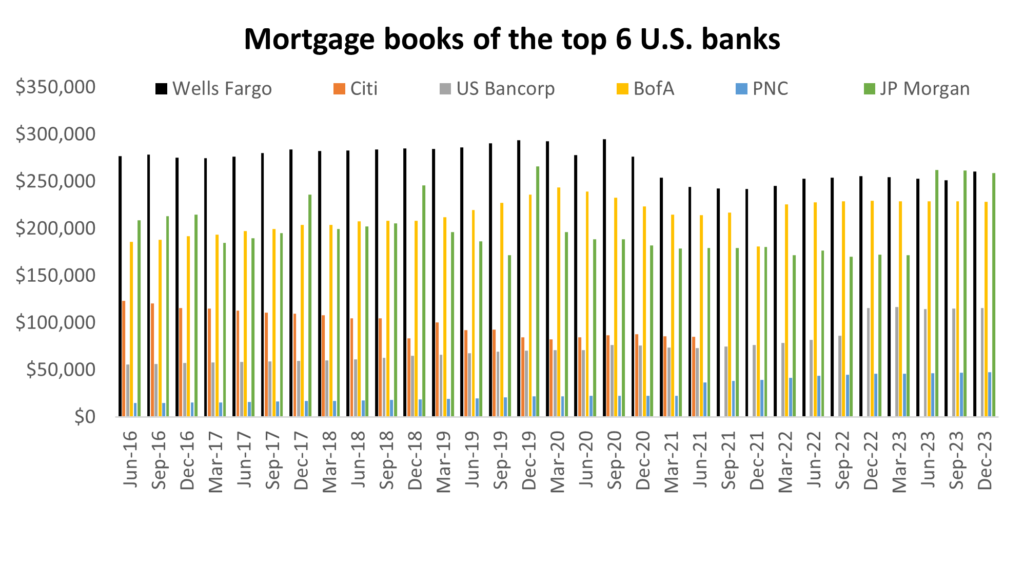

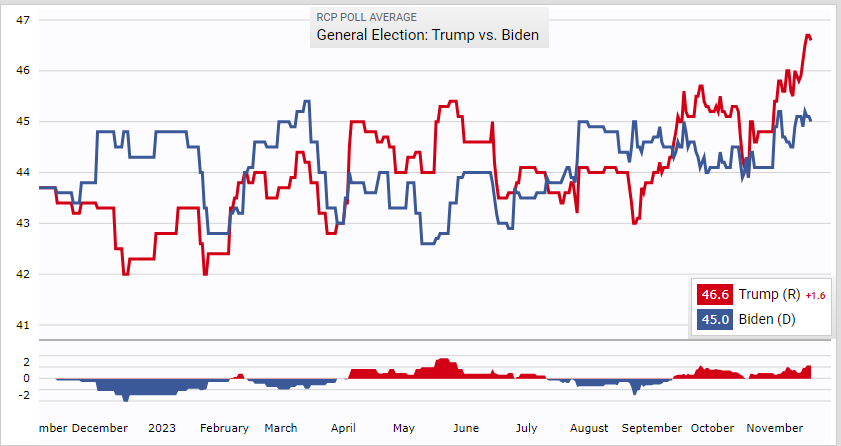

FMC Corp (FMC) and Mosaic (MOS) have been among the worst-performing stocks this year, with FMC down 90% from the March ’22 highs. Fertilizer and crop protection stocks have been selling off all year together with crop commodities. We think FMC and MOS have now also become a victim of tax loss selling/window dressing and these stocks should improve once the tax loss selling has subsided. One of our favorite tax loss trades is Fannie Mae (FNMA) and Freddy Mac (FMCC) . These stocks were decimated in 2021 after the court rejected claims that the Federal Housing Finance Agency exceeded its authority in collecting more than $100 billion in profits from the Government Sponsored Enterprises (GSE). Hedge funds had crowded into this trade and sued the FHFA for this sweep, hoping the courts would decide in their favor. When they didn’t, hedge funds fled the stock and it collapsed. Surely there are still plenty of people who hold the stock at a loss, and we could see some selling pressure on the stock (and the preferreds) into New Year. However, the presidential elections are in November of 2024. While it is extremely hard to forecast who will win these elections, the polls currently favor Trump slightly, while the betting sites attach even odds to Biden and Trump (~40%). After the 2016 election, FNMA and FMCC common stock soared to $4.5 and $4.3 per share respectively on the hopes that the GSEs would be privatized. If we believe that a Trump victory could once again trigger speculation over a privatization, then the fair value of FNMA and FMCC is worth $1.8 and 1.72 per share and not 70 cents (40% odds of a $4.5 stock price after the election).

One of our favorite tax loss trades is Fannie Mae (FNMA) and Freddy Mac (FMCC) . These stocks were decimated in 2021 after the court rejected claims that the Federal Housing Finance Agency exceeded its authority in collecting more than $100 billion in profits from the Government Sponsored Enterprises (GSE). Hedge funds had crowded into this trade and sued the FHFA for this sweep, hoping the courts would decide in their favor. When they didn’t, hedge funds fled the stock and it collapsed. Surely there are still plenty of people who hold the stock at a loss, and we could see some selling pressure on the stock (and the preferreds) into New Year. However, the presidential elections are in November of 2024. While it is extremely hard to forecast who will win these elections, the polls currently favor Trump slightly, while the betting sites attach even odds to Biden and Trump (~40%). After the 2016 election, FNMA and FMCC common stock soared to $4.5 and $4.3 per share respectively on the hopes that the GSEs would be privatized. If we believe that a Trump victory could once again trigger speculation over a privatization, then the fair value of FNMA and FMCC is worth $1.8 and 1.72 per share and not 70 cents (40% odds of a $4.5 stock price after the election).

There are a number of upcoming catalysts for the stock, including the Comcast/Hulu deal, NBA renewal, ESPN partnership announcement and potential asset sales. DIS in now in the process of controlling costs, and its booking progress. The next step for DIS will be to return to revenue growth. ESPN+ streaming and repositioning Disney + /Hulu are part of this growth strategy. A recent deal with Charter allows for Ad supported Disney + to be available to all 10ml Charter subscribers. For ESPN there is a catalyst to tie it to its newly forged $2bl sports betting alliance with PENN. The challenges for DIS are to halt or at least slow down the decline in linear media. Also, DIS will continue to have to invest in things like Disney + and NBA etc to return to growth. These FCF headwinds will continue to weigh on the stock in 2024. We like DIS especially because we believe it is a tax loss selling candidate and it is likely to enjoy a rebound in January as the tax loss selling subsides. The stock is no longer expensive, at 12x fwd EV/EBITDA.

There are a number of upcoming catalysts for the stock, including the Comcast/Hulu deal, NBA renewal, ESPN partnership announcement and potential asset sales. DIS in now in the process of controlling costs, and its booking progress. The next step for DIS will be to return to revenue growth. ESPN+ streaming and repositioning Disney + /Hulu are part of this growth strategy. A recent deal with Charter allows for Ad supported Disney + to be available to all 10ml Charter subscribers. For ESPN there is a catalyst to tie it to its newly forged $2bl sports betting alliance with PENN. The challenges for DIS are to halt or at least slow down the decline in linear media. Also, DIS will continue to have to invest in things like Disney + and NBA etc to return to growth. These FCF headwinds will continue to weigh on the stock in 2024. We like DIS especially because we believe it is a tax loss selling candidate and it is likely to enjoy a rebound in January as the tax loss selling subsides. The stock is no longer expensive, at 12x fwd EV/EBITDA. Many retailers and apparel companies have sold off hard throughout 2022 and 2023. One notable apparel bellwether that has fallen on hard times has been NKE. TGT is another retailer that has suffered from declining purchasing power among its customers and bloated inventories. VSCO spun off Bed & Bodyworks several years ago and has been challenged by consumer trends away from their core product (intimates) as well as a negative sentiment. We believe that these stocks should rebound in January, on more favorable comps (NKE, TGT) and an end to tax loss selling. Note that Dicks (DKS) reported robust Q3 results, which suggests athletic sales are improving.

Many retailers and apparel companies have sold off hard throughout 2022 and 2023. One notable apparel bellwether that has fallen on hard times has been NKE. TGT is another retailer that has suffered from declining purchasing power among its customers and bloated inventories. VSCO spun off Bed & Bodyworks several years ago and has been challenged by consumer trends away from their core product (intimates) as well as a negative sentiment. We believe that these stocks should rebound in January, on more favorable comps (NKE, TGT) and an end to tax loss selling. Note that Dicks (DKS) reported robust Q3 results, which suggests athletic sales are improving. ALB and SQM have been among the worst performing stocks this year, with FMC down 90% from the March ’22 highs and SQM 56% from the September ’22 high. We think FMC ad SQM have also become a victim of tax loss selling/window dressing. There is an excess inventory of lithium in the channel, and as a result lithium prices have weakened a lot, which explained their plunge this year. But China EV sales for October, the largest market in the world, were extremely strong. Rising EV sales will eventually translate into more lithium demand or inventory depletion. We think the selling in these stocks has been overdone and we should see a rebound in January.

ALB and SQM have been among the worst performing stocks this year, with FMC down 90% from the March ’22 highs and SQM 56% from the September ’22 high. We think FMC ad SQM have also become a victim of tax loss selling/window dressing. There is an excess inventory of lithium in the channel, and as a result lithium prices have weakened a lot, which explained their plunge this year. But China EV sales for October, the largest market in the world, were extremely strong. Rising EV sales will eventually translate into more lithium demand or inventory depletion. We think the selling in these stocks has been overdone and we should see a rebound in January. Our seven factor capitulation model is picking up on a few attractive developments. a) The MSOS ETF made a new low in Q3 2023, WITHOUT a confirmation from the weekly RSI. In other words, there is a positive divergence, the RSI has improved over the last 6-months. This is a sign of seller exhaustion, something you want to see in Q4, heading into the new year. b) Meaningful up volume arrived in recent months. Most of the weak hands that owned the shares much higher have been taken out, while a new class of MSOS share ownership, now owns the shares at a MUCH lower price. This is just what you want to see heading into the new year and speaks to potentially attractive returns in 1H 2024.

Our seven factor capitulation model is picking up on a few attractive developments. a) The MSOS ETF made a new low in Q3 2023, WITHOUT a confirmation from the weekly RSI. In other words, there is a positive divergence, the RSI has improved over the last 6-months. This is a sign of seller exhaustion, something you want to see in Q4, heading into the new year. b) Meaningful up volume arrived in recent months. Most of the weak hands that owned the shares much higher have been taken out, while a new class of MSOS share ownership, now owns the shares at a MUCH lower price. This is just what you want to see heading into the new year and speaks to potentially attractive returns in 1H 2024. In recent weeks, the XBI biotech ETF reached 10-year extremes vs. the Nasdaq 100. A weekly RSI of 18.75 is extremely rare vs. the QQQs. The year 2023, has been another challenging one for biotech stocks. The XBI is 14% off multi-year lows. The ETF has a historically high percentage of companies trading at or below their cash value, making the sector ripe for M&A support. The biotech industry is well-positioned for AI upside, attractive growth potential, and well known rapid advancements in drug developments. Growing demand to treat chronic diseases is always an upside catalyst, but AI innovations should give the sector a meaningful boost in the coming years.

In recent weeks, the XBI biotech ETF reached 10-year extremes vs. the Nasdaq 100. A weekly RSI of 18.75 is extremely rare vs. the QQQs. The year 2023, has been another challenging one for biotech stocks. The XBI is 14% off multi-year lows. The ETF has a historically high percentage of companies trading at or below their cash value, making the sector ripe for M&A support. The biotech industry is well-positioned for AI upside, attractive growth potential, and well known rapid advancements in drug developments. Growing demand to treat chronic diseases is always an upside catalyst, but AI innovations should give the sector a meaningful boost in the coming years. Look carefully, oil is very often a CPI leader. An oil reversal higher points to higher – follow on – CPI.

Look carefully, oil is very often a CPI leader. An oil reversal higher points to higher – follow on – CPI.  Wages and gasoline are FAR above where the Fed wants them to be. No one seems to care, for now.

Wages and gasoline are FAR above where the Fed wants them to be. No one seems to care, for now. Silver has been outperforming gold for months. As the Fed arrives to the end of the hiking cycle, look for silver (SLV) to outshine gold (GLD).

Silver has been outperforming gold for months. As the Fed arrives to the end of the hiking cycle, look for silver (SLV) to outshine gold (GLD). Ultimately, much like today – social unrest became violent. As inflation increased in the latter 16th century, so too did the volatility of prices. Prices catapulted and collapsed only to catapult again. Overall the trend was higher, but the year-to-year price swings were extreme. When four consecutive harvests failed, from 1594 to 1597 inclusive, famine and sickness increased. Medicine of course was not particularly advanced. Thus there were waves of population decline during this period. Epidemics reduced England’s population by 20% during a five-year period in the 1550s and prices softened commensurately. However, once the population grew again, inflation came back with a vengeance.

Ultimately, much like today – social unrest became violent. As inflation increased in the latter 16th century, so too did the volatility of prices. Prices catapulted and collapsed only to catapult again. Overall the trend was higher, but the year-to-year price swings were extreme. When four consecutive harvests failed, from 1594 to 1597 inclusive, famine and sickness increased. Medicine of course was not particularly advanced. Thus there were waves of population decline during this period. Epidemics reduced England’s population by 20% during a five-year period in the 1550s and prices softened commensurately. However, once the population grew again, inflation came back with a vengeance. Transitory inflation died 24 months ago.

Transitory inflation died 24 months ago. High levels of dependency and the relative scarcity of labor may induce a shift in the methods of production from labor-based R&D back to a reliance on natural resources. The global economy is going to pass through a severe population problem over the coming century, resulting from the simultaneous peak in global population levels with near-zero population growth (Roser et al. 2013, Giovanni and Tena Junguito 2023). This conflation of world firsts is seen above, which shows that global population is projected to reach a peak of approximately 11 billion individuals in the year 2100, at the same time that population growth is forecast to be moving asymptotically to zero. With Pedro Naso and Timothy Swanson.

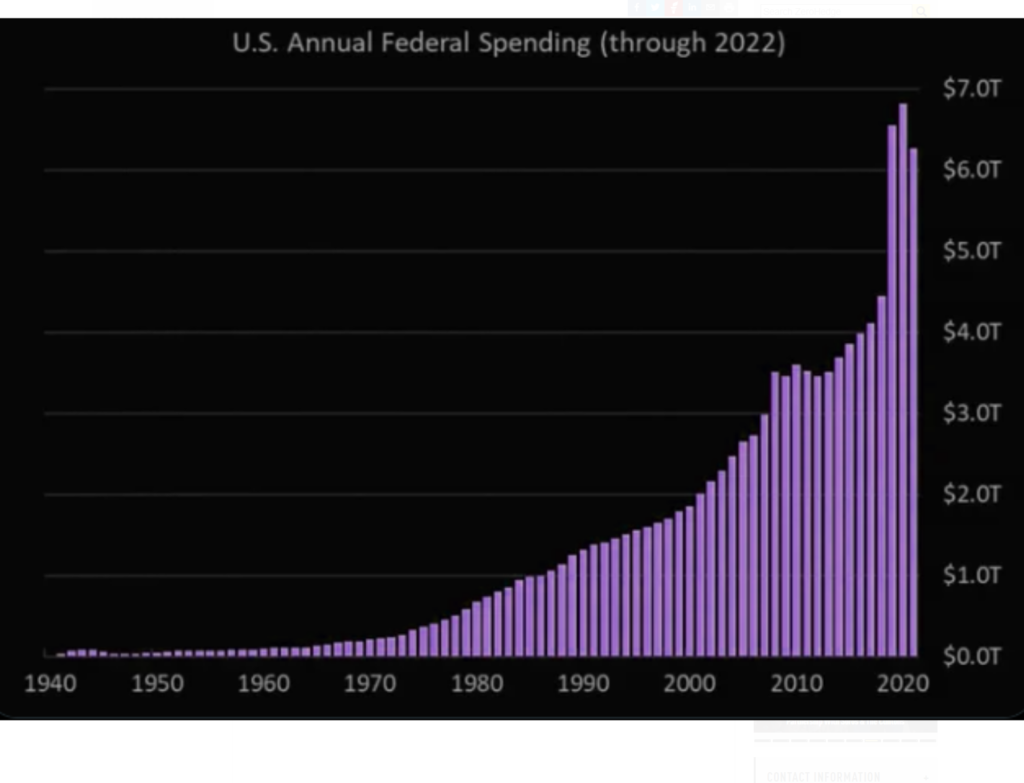

High levels of dependency and the relative scarcity of labor may induce a shift in the methods of production from labor-based R&D back to a reliance on natural resources. The global economy is going to pass through a severe population problem over the coming century, resulting from the simultaneous peak in global population levels with near-zero population growth (Roser et al. 2013, Giovanni and Tena Junguito 2023). This conflation of world firsts is seen above, which shows that global population is projected to reach a peak of approximately 11 billion individuals in the year 2100, at the same time that population growth is forecast to be moving asymptotically to zero. With Pedro Naso and Timothy Swanson. “The US government has already spent $5.3 TRILLION this year. We are on track for the 4th consecutive year with $6 trillion or more in government spending. Since 2020, the US government has spent a jaw-dropping $25 TRILLION. To put this in perspective, the market cap of the S&P 500 is $37 trillion. Spending since 2020 is equivalent to 68% of the entire S&P 500 market cap.”

“The US government has already spent $5.3 TRILLION this year. We are on track for the 4th consecutive year with $6 trillion or more in government spending. Since 2020, the US government has spent a jaw-dropping $25 TRILLION. To put this in perspective, the market cap of the S&P 500 is $37 trillion. Spending since 2020 is equivalent to 68% of the entire S&P 500 market cap.”

U.S. government spending is UP 10% year over year. We are looking at a near $2T deficit. There are 70,000,000 Americans receiving an 8% COLA (cost of living adjustment). What many people fail to understand, are the colossal social and political drivers of inflation. Once inflation gets above 6%, the follow-on effects linger on for years. It´s like spilling a can of Coca-Cola in the backseat of the car. It gets under the seat cushions, it´s in the seams and is extremely hard to kill. Especially with government spending ripping higher which after all was a reaction to higher inflation in the first place!

U.S. government spending is UP 10% year over year. We are looking at a near $2T deficit. There are 70,000,000 Americans receiving an 8% COLA (cost of living adjustment). What many people fail to understand, are the colossal social and political drivers of inflation. Once inflation gets above 6%, the follow-on effects linger on for years. It´s like spilling a can of Coca-Cola in the backseat of the car. It gets under the seat cushions, it´s in the seams and is extremely hard to kill. Especially with government spending ripping higher which after all was a reaction to higher inflation in the first place! The “power of labor” and rents are keeping core inflation high – more than double the Fed´s target.

The “power of labor” and rents are keeping core inflation high – more than double the Fed´s target.