“With a cross-asset view (emerging market currencies, eurodollar/Fed funds, gold, and silver); bets on a “one and done” Fed have dramatically outperformed U.S. equities in Q4 and are all pointing to early signs of a softer Fed policy path. Looking down the road ahead, the U.S. equity market will CRASH in 1987 style if the Fed plays tough guy (3/4 more rate hikes?!), it’s that simple. Similar to the March 2016 landscape, the market is about to embarrass the Fed yet again. As we have stressed over the last month, they will capitulate in our view. Stay long emerging markets EEM, gold GLD and the gold miners GDX.”

Bear Traps Report, November 15, 2018

Join our Larry McDonald on Real Vision here, a video blog with value.

Pick up our latest report here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Breaking: *AUSTRALIA’S 10-YEAR BOND YIELD DROPS TO ALL-TIME LOW – Bloomberg at 5:39ET, March 24, 2019

Using Equities to Confirm Signals coming from Fixed Income Markets

At the Bear Traps Report, we take a cross-asset view from 20,000 feet looking for important signals which can validate an investment thesis. Today, fixed income and equity markets are telling us something, and it’s time to listen.

March 2019: Ex-Fed Chair Yellen, Global Central Banks Do Not Have Adequate Crisis Tools

June 2017: Fed’s Yellen expects no new financial crisis in ‘our lifetimes’

Recent yield curve inversion has central bankers a bit uncomfortable.

Equities, Consumer Discretionary are Crushing Staples

In recent years, U.S. equities in the economically sensitive consumer discretionary XLY sector have substantially outperformed consumer staples XLP (82.6% vs. 47.9% over the last five years total return). Since June 2018, the world has changed – staples XLP have had their day in the sun (red channel above). During Friday’s 500 point swoon in the Dow Jones Industrial Average, the XLY was 2% lower – while defensive equities in the XLP were unchanged – a sign of things to come. What’s the connection here between what bonds and equities are telling us?

In recent years, U.S. equities in the economically sensitive consumer discretionary XLY sector have substantially outperformed consumer staples XLP (82.6% vs. 47.9% over the last five years total return). Since June 2018, the world has changed – staples XLP have had their day in the sun (red channel above). During Friday’s 500 point swoon in the Dow Jones Industrial Average, the XLY was 2% lower – while defensive equities in the XLP were unchanged – a sign of things to come. What’s the connection here between what bonds and equities are telling us?

From the Recent Highs

Regional Banks $BKX -10.6%

Financials $XLF -6.9%

Russell $IWM -4.4%

Dow Transports -3.8%

Semiconductors $SMH -3.5%

Energy $XLE -2.9%

Dow -2.8% FANGs -2.6%

Cons Disc $XLY -2.0%

Oil -1.8%

Utilities $XLU +0.40%

Staples $XLP +1.1%

It’s far too early to draw major conclusions, but one thing is clear – economically sensitive sectors (banks, small caps) are leading the way lower for now.

Floating Rate Loans Take a Beating

When Fixed Income markets start to price in a cap on near term / intermediate term bond yields, floating rate securities begin to dramatically under-perform (bank loans BKLN).

When Fixed Income markets start to price in a cap on near term / intermediate term bond yields, floating rate securities begin to dramatically under-perform (bank loans BKLN).

Economic Risk Indicators

In October, Wall St.’s economists were looking for 3-4 more rate hikes. Here we are in March and they’ve thrown in the towel. Clearly, there are so many cross-currents to watch. Most are obsessed with the U.S. Treasury curve. Late this week she inverted for the first time since the start of the financial crisis, it’s the talk of the town. Economists call this the first reliable market signal of an approaching recession and a rate-cutting cycle coming at us.

Financials Leading Stocks Lower

Since October, the 2-10s US Treasury curve has flattened from 34 to 11bps. Since March 18, the XLF Financials ETF has plunged nearly 7%, the KBW Nasdaq Bank Index of large lenders posting its biggest one-week slide since 2016, off 10.6% since Tuesday – all with the staples XLP up 1%. Sure, we all know banks’ earnings power struggles with a flat curve and the follow on pressure on net interest margins. But, is this downdraft in the financials simply a product of a flattening yield curve? Or is something more ominous afoot?

Since October, the 2-10s US Treasury curve has flattened from 34 to 11bps. Since March 18, the XLF Financials ETF has plunged nearly 7%, the KBW Nasdaq Bank Index of large lenders posting its biggest one-week slide since 2016, off 10.6% since Tuesday – all with the staples XLP up 1%. Sure, we all know banks’ earnings power struggles with a flat curve and the follow on pressure on net interest margins. But, is this downdraft in the financials simply a product of a flattening yield curve? Or is something more ominous afoot?

US Corporate Bond Binge

Yields on U.S. investment-grade bonds have plunged to the lowest in more than a year.

Yields on U.S. investment-grade bonds have plunged to the lowest in more than a year.

3-Month vs. 10-Year Treasuries

After 9 rate hikes, the Fed has pushed its target rate or “upper bound” to 2.50%, this is holding up the front end of the yield curve. At the same time, global economic pressures have investors buying long-dated bonds, putting downward pressure on yields.

German Bond Yield Back to 2016 Levels

German 10-year bonds were up at 0.57% in October, they touched -0.01% this week – their lowest yield since 2016. The last time bond yields in Europe were this low the ECB was buying $60 to $80B a month of asset purchases vs. just $5 to $10B today.

German 10-year bonds were up at 0.57% in October, they touched -0.01% this week – their lowest yield since 2016. The last time bond yields in Europe were this low the ECB was buying $60 to $80B a month of asset purchases vs. just $5 to $10B today.

Where’s the Trade?

Late this week, the spread between the three-month and 10-year U.S. Treasury yields evaporated, a rush of panic buying pushed 10’s yield to a near 15-month low of 2.40% – the 3-moth TBill yield is 2.40% as well. In Treasuries, a three-month investment or ten years, the yield is the same. Everyone knows inversion is considered a reliable omen of a recession in the U.S., within roughly the next 12-18 months – but where’s the trade?

An Economist Worth Listening To

We have an economist (above – white line) that’s actually worth listening to. As you can see above – going back 30 years – well before U.S. recessions, consumer staples dramatically outperform consumer discretionary stocks. When we take a close look at a recession-proof sector like the staples XLP ETF vs. a sector with a high degree of economic sensitivity, consumer discretionary XLY – we come up with eye-opening data. Notably, this ratio has historically rolled over before yield curve inversions as well. Historically, yield curve inversion only confirms what Stan’s economist is already telling us. For our full report, join us here.

We have an economist (above – white line) that’s actually worth listening to. As you can see above – going back 30 years – well before U.S. recessions, consumer staples dramatically outperform consumer discretionary stocks. When we take a close look at a recession-proof sector like the staples XLP ETF vs. a sector with a high degree of economic sensitivity, consumer discretionary XLY – we come up with eye-opening data. Notably, this ratio has historically rolled over before yield curve inversions as well. Historically, yield curve inversion only confirms what Stan’s economist is already telling us. For our full report, join us here.

Stan Druckenmiller’s Economist

We must introduce you to Druckenmiller’s Economist. Stan will tell you, looking at U.S. Treasury yield curve inversion – in isolation – relative to recession risk is a fool’s errand.

On our Real Vision platform, recently billionaire and legendary investor Stan Druckenmiller talked about clues he takes from the stock market and various economic indicators he uses to make an informed decision about where we are headed. Stan often refers to his “economist” in measuring the performance of different economically sensitive sectors. We agree, but let’s look at fixed income and equity signals together. How do the Staples XLP perform vs. the S&P 500 SPY once the Treasury curve inverts?

Fixed Income Signals in Equity Markets – Consumer Staples vs. the S&P 500

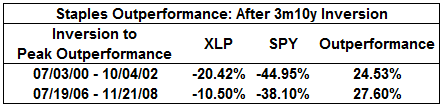

Since 1990, the 3 Month / 10 Year yield Curve has inverted twice. During 2000 to 2002 and from 2006 to 2008. Staples outperformance was substantial in these periods.

Since 1990, the 3 Month / 10 Year yield Curve has inverted twice. During 2000 to 2002 and from 2006 to 2008. Staples outperformance was substantial in these periods.

**Notably, staples outperformance does not start immediately. For example, in the Financial Crisis, it takes over 12 months for the XLP to outperform the SPY after inversion. Though it took over a year, the relative performance accelerated quickly in 2008.

Stapes vs. S&P in a Post-Inversion Regime

Above, is the peak to which staples outperforms the S&P 500 post-inversion. If it was a fight, they’d stop it. In a late cycle, post “yield curve inversion” regime, investors want to be overweight consumer staples – and underweight the S&P 500. Bottom line, the key lessons from previous cycles must be listened to:

Above, is the peak to which staples outperforms the S&P 500 post-inversion. If it was a fight, they’d stop it. In a late cycle, post “yield curve inversion” regime, investors want to be overweight consumer staples – and underweight the S&P 500. Bottom line, the key lessons from previous cycles must be listened to:

1) After “sustained” U.S. Treasury yield curve inversion, equity markets are unlikely to experience a meaningful recovery (price appreciation) from that point forward.

2) Yield curve inversion signals are near meaningless in isolation. We need to see early confirmation from Stan’s economist; defensive sectors’ (staples) outperformance relative to cyclicals (consumer discretionary).

** Beware of fake-outs in yield curve inversion. The 3-Month / 10-Year yield curve inverted in 1998 but only for a FEW DAYS. However, the data seen above begins when the curve consistently inverts in July 2000. In 1998, the S&P 500 rallied viciously after inverted yield curve signal – some call this the Greenspan Put – Wall St. was forced to come together with the Fed to ‘save’ Long Term Capital. This false inversion signal would have caused one to miss out on the next leg of the equity rally.

Pick up our latest report here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

In Q4 2018, China threw a substantial amount of fiscal and monetary weaponry at its weakening $13T economy. Heading into the trade negotiating climax with the USA, we believe tax cuts and PBOC RRR (levels of reserves in their banking system) activity – all together – come to over $500B of stimulus. Three months later, those desperate measures are showing up in the data.

In Q4 2018, China threw a substantial amount of fiscal and monetary weaponry at its weakening $13T economy. Heading into the trade negotiating climax with the USA, we believe tax cuts and PBOC RRR (levels of reserves in their banking system) activity – all together – come to over $500B of stimulus. Three months later, those desperate measures are showing up in the data. We’re seeing a Major trend breakout oil on the heals of the China PMI bounce – bullish wedge.

We’re seeing a Major trend breakout oil on the heals of the China PMI bounce – bullish wedge. In Q1 2019, the global economy’s struggles have powered the tally of negative yielding bond on earth to near $10T. Economic data out of China this weekend will likely turn this ship around.

In Q1 2019, the global economy’s struggles have powered the tally of negative yielding bond on earth to near $10T. Economic data out of China this weekend will likely turn this ship around. China March official composite PMI +1.6pts to 54 driven by manufacturing +1.3pts to 50.5 and non-manufacturing +0.5pts to 54.8. Could partly reflect lunar near year holiday distortions but also likely reflects the impact of China stimulus measures. “A Positive sign for Chinese and global”growth,” says AMP Capital. China delivered good news for global investors this weekend. This year, the country’s struggling demand had weighed on sectors such as auto producers and commodity exporters, worldwide – especially Germany. Likewise, with tariffs and uncertainty about whether a deal with the U.S. will be signed weighing on trade and no sign of a rebound in domestic consumption yet, there is still some work to be done in terms of getting more “buy-in” from the global investment community.

China March official composite PMI +1.6pts to 54 driven by manufacturing +1.3pts to 50.5 and non-manufacturing +0.5pts to 54.8. Could partly reflect lunar near year holiday distortions but also likely reflects the impact of China stimulus measures. “A Positive sign for Chinese and global”growth,” says AMP Capital. China delivered good news for global investors this weekend. This year, the country’s struggling demand had weighed on sectors such as auto producers and commodity exporters, worldwide – especially Germany. Likewise, with tariffs and uncertainty about whether a deal with the U.S. will be signed weighing on trade and no sign of a rebound in domestic consumption yet, there is still some work to be done in terms of getting more “buy-in” from the global investment community. In its largest surge since 2012, China’s manufacturing purchasing managers index rose to 50.5 from 49.2 last month, exceeding all estimates by economists – the consensus was looking for 49.6. In better news, new orders and new export orders – leading indicators which signal future activities, popped up to the highest levels in six months. Keep in mind, Germany’s economy and bond yields have a very high beta to China’s economic fortunes. As you can see above, over the last 5 years lows in German bond yields have been closely tied to periods where China’s Manufacturing PMI struggles. This speaks to HIGHER global bond yields in the days and weeks to come – a bounce is long overdue.

In its largest surge since 2012, China’s manufacturing purchasing managers index rose to 50.5 from 49.2 last month, exceeding all estimates by economists – the consensus was looking for 49.6. In better news, new orders and new export orders – leading indicators which signal future activities, popped up to the highest levels in six months. Keep in mind, Germany’s economy and bond yields have a very high beta to China’s economic fortunes. As you can see above, over the last 5 years lows in German bond yields have been closely tied to periods where China’s Manufacturing PMI struggles. This speaks to HIGHER global bond yields in the days and weeks to come – a bounce is long overdue.

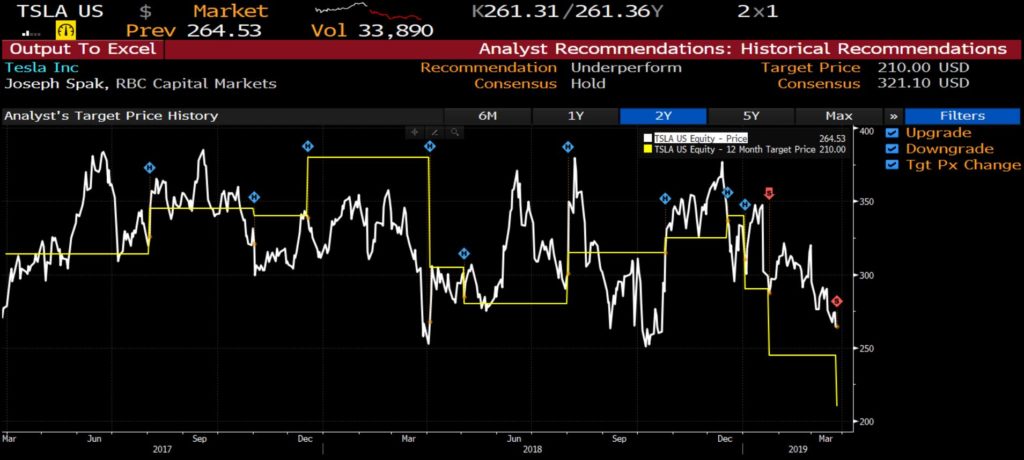

RBC Capital Markets lowers its 12-month price target on shares of Tesla amid softer demand expectations and a delivery snag in China – new target is a 14 percent reduction to his prior forecast and implies more than 20 percent downside over the next year from Friday’s close. “We see both 2019 and 2020 revenue as down vs. the 4Q18 run-rate and, given Tesla is priced for growth, believe the valuation will come in” –

RBC Capital Markets lowers its 12-month price target on shares of Tesla amid softer demand expectations and a delivery snag in China – new target is a 14 percent reduction to his prior forecast and implies more than 20 percent downside over the next year from Friday’s close. “We see both 2019 and 2020 revenue as down vs. the 4Q18 run-rate and, given Tesla is priced for growth, believe the valuation will come in” –  Japan led off this week where US equities closed out last, in the red. The 3% plunge is equivalent to 765 dow points.

Japan led off this week where US equities closed out last, in the red. The 3% plunge is equivalent to 765 dow points. In recent years, U.S. equities in the economically sensitive consumer discretionary XLY sector have substantially outperformed consumer staples XLP (82.6% vs. 47.9% over the last five years total return). Since June 2018, the world has changed – staples XLP have had their day in the sun (red channel above). During Friday’s 500 point swoon in the Dow Jones Industrial Average, the XLY was 2% lower – while defensive equities in the XLP were unchanged – a sign of things to come. What’s the connection here between what bonds and equities are telling us?

In recent years, U.S. equities in the economically sensitive consumer discretionary XLY sector have substantially outperformed consumer staples XLP (82.6% vs. 47.9% over the last five years total return). Since June 2018, the world has changed – staples XLP have had their day in the sun (red channel above). During Friday’s 500 point swoon in the Dow Jones Industrial Average, the XLY was 2% lower – while defensive equities in the XLP were unchanged – a sign of things to come. What’s the connection here between what bonds and equities are telling us? When Fixed Income markets start to price in a cap on near term / intermediate term bond yields, floating rate securities begin to dramatically under-perform (bank loans BKLN).

When Fixed Income markets start to price in a cap on near term / intermediate term bond yields, floating rate securities begin to dramatically under-perform (bank loans BKLN). Since October, the 2-10s US Treasury curve has flattened from 34 to 11bps. Since March 18, the XLF Financials ETF has plunged nearly 7%, the KBW Nasdaq Bank Index of large lenders posting its biggest one-week slide since 2016, off 10.6% since Tuesday – all with the staples XLP up 1%. Sure, we all know banks’ earnings power struggles with a flat curve and the follow on pressure on net interest margins. But, is this downdraft in the financials simply a product of a flattening yield curve? Or is something more ominous afoot?

Since October, the 2-10s US Treasury curve has flattened from 34 to 11bps. Since March 18, the XLF Financials ETF has plunged nearly 7%, the KBW Nasdaq Bank Index of large lenders posting its biggest one-week slide since 2016, off 10.6% since Tuesday – all with the staples XLP up 1%. Sure, we all know banks’ earnings power struggles with a flat curve and the follow on pressure on net interest margins. But, is this downdraft in the financials simply a product of a flattening yield curve? Or is something more ominous afoot? Yields on U.S. investment-grade bonds have plunged to the lowest in more than a year.

Yields on U.S. investment-grade bonds have plunged to the lowest in more than a year. German 10-year bonds were up at 0.57% in October, they touched -0.01% this week – their lowest yield since 2016. The last time bond yields in Europe were this low the ECB was buying $60 to $80B a month of asset purchases vs. just $5 to $10B today.

German 10-year bonds were up at 0.57% in October, they touched -0.01% this week – their lowest yield since 2016. The last time bond yields in Europe were this low the ECB was buying $60 to $80B a month of asset purchases vs. just $5 to $10B today. We have an economist (above – white line) that’s actually worth listening to. As you can see above – going back 30 years – well before U.S. recessions, consumer staples dramatically outperform consumer discretionary stocks. When we take a close look at a recession-proof sector like the staples XLP ETF vs. a sector with a high degree of economic sensitivity, consumer discretionary XLY – we come up with eye-opening data. Notably, this ratio has historically rolled over before yield curve inversions as well. Historically, yield curve inversion only confirms what Stan’s economist is already telling us. For our full report, join

We have an economist (above – white line) that’s actually worth listening to. As you can see above – going back 30 years – well before U.S. recessions, consumer staples dramatically outperform consumer discretionary stocks. When we take a close look at a recession-proof sector like the staples XLP ETF vs. a sector with a high degree of economic sensitivity, consumer discretionary XLY – we come up with eye-opening data. Notably, this ratio has historically rolled over before yield curve inversions as well. Historically, yield curve inversion only confirms what Stan’s economist is already telling us. For our full report, join  Since 1990, the 3 Month / 10 Year yield Curve has inverted twice. During 2000 to 2002 and from 2006 to 2008. Staples outperformance was substantial in these periods.

Since 1990, the 3 Month / 10 Year yield Curve has inverted twice. During 2000 to 2002 and from 2006 to 2008. Staples outperformance was substantial in these periods. Above, is the peak to which staples outperforms the S&P 500 post-inversion. If it was a fight, they’d stop it. In a late cycle, post “yield curve inversion” regime, investors want to be overweight consumer staples – and underweight the S&P 500. Bottom line, the key lessons from previous cycles must be listened to:

Above, is the peak to which staples outperforms the S&P 500 post-inversion. If it was a fight, they’d stop it. In a late cycle, post “yield curve inversion” regime, investors want to be overweight consumer staples – and underweight the S&P 500. Bottom line, the key lessons from previous cycles must be listened to:

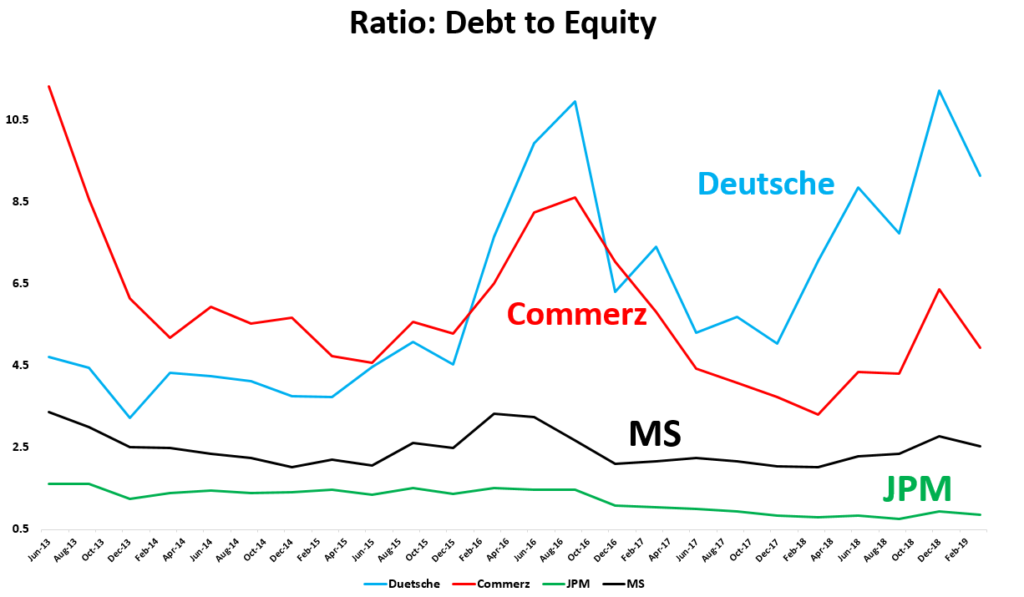

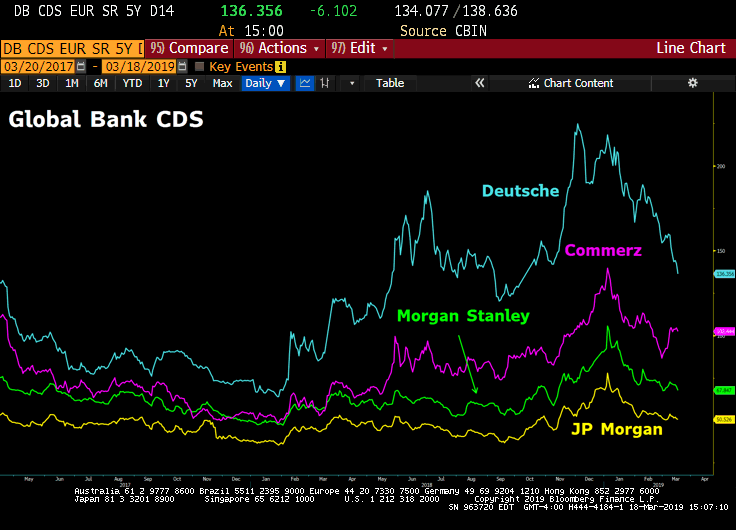

Credit risk in Europe has tightened substantially since the beginning of the year. However, the CDS in Deutsche and Commerzbank remains well above the banks in the US.

Credit risk in Europe has tightened substantially since the beginning of the year. However, the CDS in Deutsche and Commerzbank remains well above the banks in the US.  Our Larry McDonald with hall of fame historian Niall Ferguson in Manhattan Friday. The Debt Jubilee, see our latest sit down on Real Vision

Our Larry McDonald with hall of fame historian Niall Ferguson in Manhattan Friday. The Debt Jubilee, see our latest sit down on Real Vision  We often tell clients, “credit leads equities.” Even more important, tightening financial conditions (FCIs) drive Federal Reserve policy movements, NOT lagging economic data. Nearly every economist in the U.S. was calling for 2-3 rate hikes back in October / November – even as financial conditions were tightening at the fastest pace since 2015. By focusing on FCIs, in late Q3 2018, we were able to position clients in a basket of “Fed Pause” trades (emerging markets, energy, gold) – this thesis has played out beautifully.

We often tell clients, “credit leads equities.” Even more important, tightening financial conditions (FCIs) drive Federal Reserve policy movements, NOT lagging economic data. Nearly every economist in the U.S. was calling for 2-3 rate hikes back in October / November – even as financial conditions were tightening at the fastest pace since 2015. By focusing on FCIs, in late Q3 2018, we were able to position clients in a basket of “Fed Pause” trades (emerging markets, energy, gold) – this thesis has played out beautifully. The very latest reading of the core PCE index, rose 0.19%, its largest monthly gain since May. Prices for services, more sensitive than goods to domestic labor supply / wages, surged 0.29% – the largest jump in nearly 15 months. It’s also interesting to note how much bonds have rallied with sharply lower yields in U.S. Treasuries, while core PCE inflation is still up meaningfully over the last 18 months and NOT giving up any ground (see the white circle above).

The very latest reading of the core PCE index, rose 0.19%, its largest monthly gain since May. Prices for services, more sensitive than goods to domestic labor supply / wages, surged 0.29% – the largest jump in nearly 15 months. It’s also interesting to note how much bonds have rallied with sharply lower yields in U.S. Treasuries, while core PCE inflation is still up meaningfully over the last 18 months and NOT giving up any ground (see the white circle above). Just when the Street gave up on reflation and the rate cut camp started to overflow – bonds put in the most significant sell-off since Q2 2018 in recent days. It’s looking more and more like China hit the panic button heading into the trade negotiations. They were dealing from a position of weakness with an economy reeling from the sharpest global slowdown in decades. The mountain of fiscal and monetary policy actions they’ve taken is nothing short of remarkable. RRR cuts, tax cuts, infrastructure spending splurge. Looks like an $800B boost to the German economy 🙂 – maybe global synchronized growth will appear on stage after all?

Just when the Street gave up on reflation and the rate cut camp started to overflow – bonds put in the most significant sell-off since Q2 2018 in recent days. It’s looking more and more like China hit the panic button heading into the trade negotiations. They were dealing from a position of weakness with an economy reeling from the sharpest global slowdown in decades. The mountain of fiscal and monetary policy actions they’ve taken is nothing short of remarkable. RRR cuts, tax cuts, infrastructure spending splurge. Looks like an $800B boost to the German economy 🙂 – maybe global synchronized growth will appear on stage after all? Economic boost: This will help Xi’s team sitting across the table from Uncle Bob (U.S. trade hawk) Lighthizer.

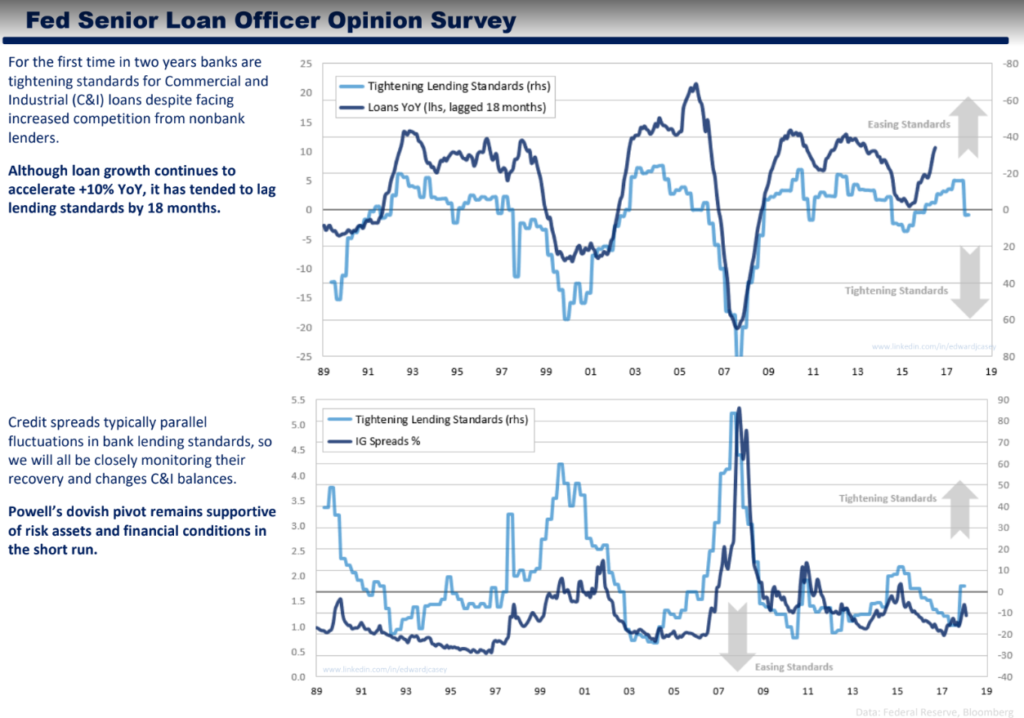

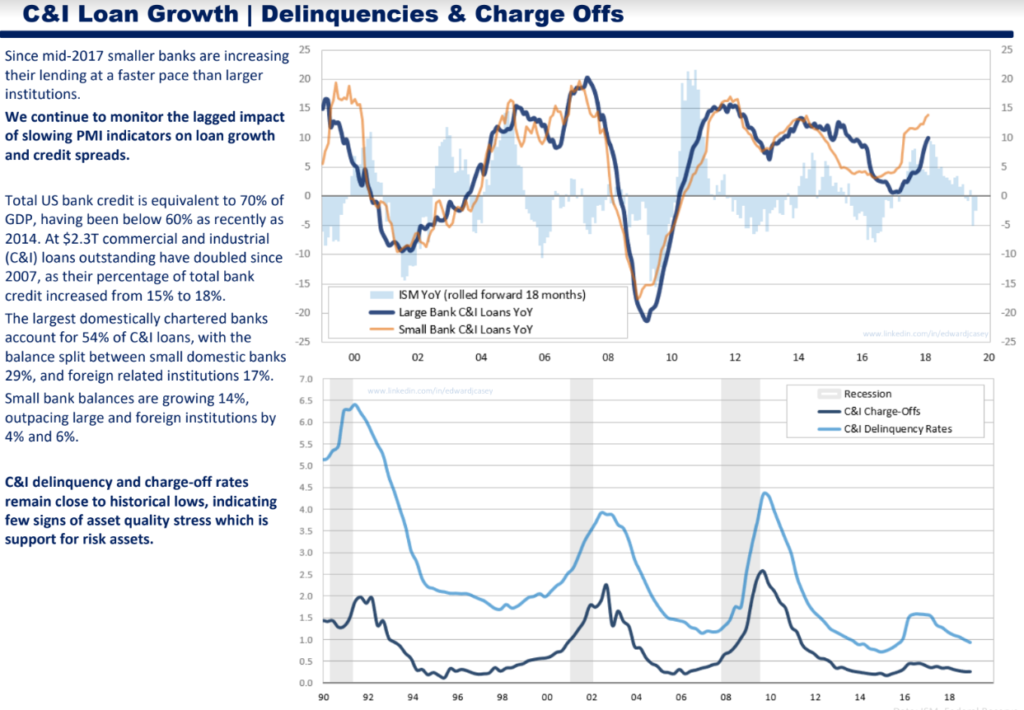

Economic boost: This will help Xi’s team sitting across the table from Uncle Bob (U.S. trade hawk) Lighthizer. The CDX IG is the most followed measure of corporate credit conditions in the U.S., we’re looking at the credit spreads on large investment grade companies above. As you can see, credit conditions tightened dramatically, and then the senior loan officer survey caught up with what the CDX IG was telling us weeks earlier. The Fed pays close attention to the loan survey data above, unfortunately, it takes forever to compile the STALE data. The survey above is the most recently available, as of January 31, 2019, but the actual engagement with loans officers was compiled in Q4. The white line above is telling you current credit conditions are easing, and easing fast relative to the now “out of date” C&I loan survey data.

The CDX IG is the most followed measure of corporate credit conditions in the U.S., we’re looking at the credit spreads on large investment grade companies above. As you can see, credit conditions tightened dramatically, and then the senior loan officer survey caught up with what the CDX IG was telling us weeks earlier. The Fed pays close attention to the loan survey data above, unfortunately, it takes forever to compile the STALE data. The survey above is the most recently available, as of January 31, 2019, but the actual engagement with loans officers was compiled in Q4. The white line above is telling you current credit conditions are easing, and easing fast relative to the now “out of date” C&I loan survey data.