Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Institutional investors can join our live chat on Bloomberg, a groundbreaking venue, just email tatiana@thebeartrapsreport.com – Thank you. LGM

As a former convertible bond trader, I have always found this unique corner of Wall St. extremely telling. Over the years we have witnessed countless clues and signals that come out of the interesting players on the field.

Robert M. Bakish is now a hall-of-fame stock seller, he’s also best known as the President and Chief Executive Officer of ViacomCBS. One of the world’s leading producers of media and entertainment content, driven by a global portfolio of powerful consumer brands, including CBS, Showtime, Nickelodeon, MTV, BET, Comedy Central, and Paramount Pictures. But, could Bob’s stock selling prowess help bring a Wall St. Bank to its knees?

This month Bakish noticed an unusual move higher in his stock price, at one point in 2021 the VIAC was 73% higher. Last week, Uncle Bob wisely approached Goldman Sachs and Morgan Stanley about selling some stock. In order to get the best price, Bob wanted to keep the sale quiet and do it quickly. He wisely stressed, “keep it, discreet boys.” On March 23, they priced close to $3B of equity and mandatory convertible securities, but the size and breadth of the sale caught some market participants off guard, some more than others indeed.

“Goldman dumps billions of dollars of stock causing losses at Nomura, then Goldman analysts downgrade Nomura because of the losses and poor risk management.”

Tom Braithwaite

By now, everyone knows Archegos’ Bill Hwang was a protégé and one of the so-called tiger cubs of legendary hedge fund manager Julian Robertson. What people don’t fully understand is how just one firm can abuse and leverage the TRS (total return swap infrastructure) across the prime brokerage underbelly of Wall St.

Typically associated with the fixed income market (in bonds), a total return swap is a swap agreement in which one party makes payments based on a set rate, either fixed or variable, while the other party makes payments based on the return of an underlying asset, which includes both the income it generates and any capital gains. The plus side for Archegos is they could hide the size of their positions and very quickly turn the buying power of $1 into $5 or even $10. “Estimates of Archegos total positions are climbing–billions, then $50 billion, now some traders estimate $100 billion. ” Fox Biz, Charlie Gasparino notes. The thing about these guys (like Archegos) is, (and there are a lot of them out there), the only way to accumulate that kind of extreme wealth in a short period of time is through the most extreme, reckless hubris lens. Ultimately, it’s the same perspective that forges the insane riches, that will also be the catalyst behind colossal losses taking place in the blink of an eye.

Who’s Left Holding the Bag?

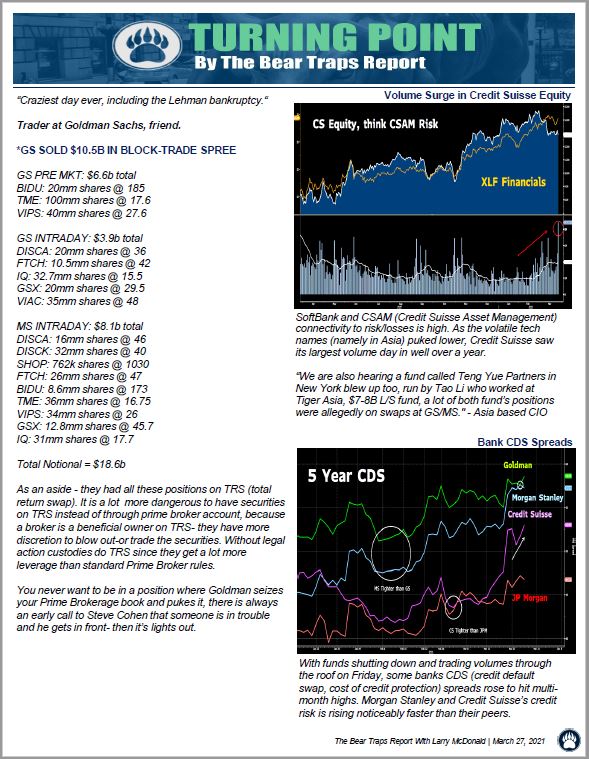

Credit Suisse CS CASH BOND MARKETS +15/+20 from Fri close now (Bond – Credit Risk on the Rise)

CS 4.194 4/31 146/136 5×5 +7

CS 3.869 1/29 105/95 5×5 +7

CS 4.282 1/28 155/145 5×5 +7

CS 1.305 2/27 117/107 5×5 +8

Some parts of the fixed income market remain calm, but credit risk associated with Credit Suisse is on the rise.

Credit Leads Equities

Our index of 21 Lehman Systemic Risk indicators always has a section focused on credit risk.

Institutional Client in our Live Chat on Bloomberg: “These are your ‘for cause’ reasons to rip-up an ISDA and (Goldman, Morgan Stanley) start the liquidation process of the Archegos portfolio of levered-bets. How could I start a fund of that size and just tell every other major prime broker my collateral only has eyes for them – especially after AIG?!”

There is meaningful speculation that the DOJ reached out to Goldman Sachs and Morgan Stanley on Archegos’ business practices. Rehypothecation is the age-old practice whereby banks and brokers use, for their own purposes, assets that have been posted as collateral by their clients. The lack of transparency in the formerly highly profitable total return swap arena, left banks dancing in the darkness, oblivious. There is intoxicating greed on both ends here, greed squared. First, you have the banks who have been reaching for profits in an era of flat yield curves. “Oh, why not roll-out total return swaps to prime broker equity clients, juicy margins, lets do it.” For years, total return swaps have been used on far less volatile bond instruments, BUT putting Archegos style leverage on highly volatile equities is insane. Then there is the greed on the client-side. Many clients we respect think, firms like Archegos embraced total return swaps on high-risk equities so they could attempt to manipulate stock prices to the moon (short squeeze weaponry), wipe out short-sellers in TOTAL secrecy (no disclosures). The whole debacle is just a nasty cocktail of extreme, reckless greed.

Some Street research estimates put the stated leverage (OTC/swap) in Archegos´ reputed use of equity TRS accounted for around half of the universe of OTC equity derivatives globally. Nuts!

Unfortunately for Bill Hwang and his pile of leverage, he’s never met an overnight, size seller like Bob Bakish. Last week’s colossal VIAC offering of shares pushed deal insiders into action. The legendary “Chinese Wall” across Wall St. banks has always been made with only the finest swiss cheese. We hear the bankers involved in the stock sale leaked the details to sales covering clients and very quickly Archegos was looking at a 15% loss when it surreptitiously controlled 10-20% of all the outstanding VIAC shares. At one point last week VIAC equity was worth $60B, this week she was lurking back near $25B. On March 23, Morgan Stanley priced the stock sale at $85 (it traded as high as $100 hours later), Bakish should announce a stock buyback tonight at $45 and burn the Street’s britches into the history books. The stuff legends are made of.

An Epic Unwind – Bear Traps Report from March 27, 2021

The epic sale of stock in the Archegos unwind (see above) will leave a dark stain on Wall St. for years to come. The Credit Suisse mess is larger than what’s priced into the market. It’s NOT a Lehman size failure but they will be forced into asset sales (CSAM), and or a size rights offering. It’s beyond sinful in financial terms that PB (Prime Broker) risk across the street has such a disgusting lack of transparency. All of this will force a “come to Jesus” for the Street’s compliance departments and force a meaningful de-leveraging. Then come the regulators and House / Senate hearings. Keep in mind, this same problem went down in January with Robinhood, they could NOT properly and efficiently quantify counterparty risk during the trading-day and were forced into a capital raise. So, Q1 2021 will be forever marked by a period of reckless risk-taking breaking the system.

The epic sale of stock in the Archegos unwind (see above) will leave a dark stain on Wall St. for years to come. The Credit Suisse mess is larger than what’s priced into the market. It’s NOT a Lehman size failure but they will be forced into asset sales (CSAM), and or a size rights offering. It’s beyond sinful in financial terms that PB (Prime Broker) risk across the street has such a disgusting lack of transparency. All of this will force a “come to Jesus” for the Street’s compliance departments and force a meaningful de-leveraging. Then come the regulators and House / Senate hearings. Keep in mind, this same problem went down in January with Robinhood, they could NOT properly and efficiently quantify counterparty risk during the trading-day and were forced into a capital raise. So, Q1 2021 will be forever marked by a period of reckless risk-taking breaking the system.

Last Week’s Events will Trigger Secular Change

Wall St. has always been an industry with thousands of silos sitting in the meadow. There are times when the investment bankers are sitting on a piece of information that can nearly destroy another part of the bank (Prime Brokerage TRS Total Return Swap business) – or for sure another bank’s business. It is the ultimate game of trading on inside information, some had it first, others just a few hours later, and that can make all the difference in the world.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

Our Larry McDonald, author of a “Colossal Failure of Common Sense”, and Andrew Ross Sorkin of “Too Big to Fail” fame –

Our Larry McDonald, author of a “Colossal Failure of Common Sense”, and Andrew Ross Sorkin of “Too Big to Fail” fame –  All the signs were there Friday. Banks with credit risk tied closest to hedge fund blow-ups dramatically underperformed.

All the signs were there Friday. Banks with credit risk tied closest to hedge fund blow-ups dramatically underperformed. Friday’s volume was pointing to some real issues. In recent weeks as the Lex Greensill debacle sucked more oxygen out of the air, CS equity has been dramatically underperforming. Institutional clients in our live chat were asking this week if Nomura’s pain is $2-4B, doesn’t that put CS in the $6-8B range? Any capital issues for the bank? Do they have to start de-risking or seek to raise more capital? All at quarter-end? With $275B of risk-weighted assets by the end of 2020 and a 12.5 CET1 ratio, this equals $34.375B capital. Clients we trust see a high risk of impairments.

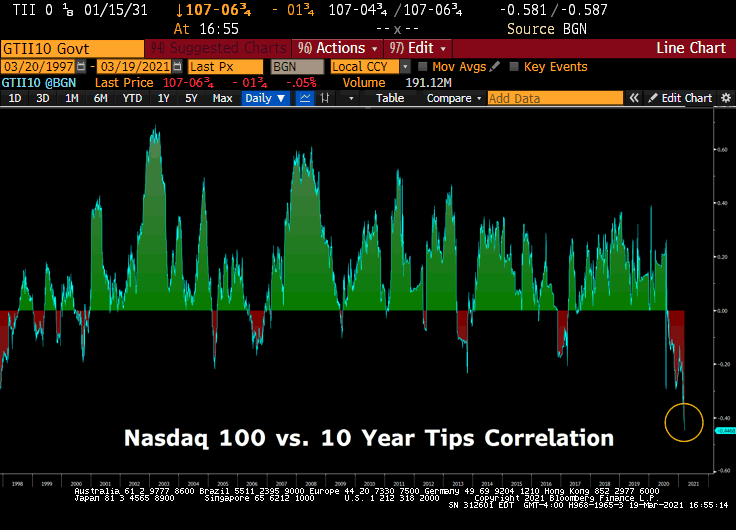

Friday’s volume was pointing to some real issues. In recent weeks as the Lex Greensill debacle sucked more oxygen out of the air, CS equity has been dramatically underperforming. Institutional clients in our live chat were asking this week if Nomura’s pain is $2-4B, doesn’t that put CS in the $6-8B range? Any capital issues for the bank? Do they have to start de-risking or seek to raise more capital? All at quarter-end? With $275B of risk-weighted assets by the end of 2020 and a 12.5 CET1 ratio, this equals $34.375B capital. Clients we trust see a high risk of impairments. A colossal portion of “growth” stocks have their true worth embedded in the “net present value” of FUTURE cash flows. Thus, as bond yields and inflation expectations rise – tech stocks are worth a lot less.

A colossal portion of “growth” stocks have their true worth embedded in the “net present value” of FUTURE cash flows. Thus, as bond yields and inflation expectations rise – tech stocks are worth a lot less. The Street is up at 6-7% 2021 GDP growth expectations. BUT, including the inflation outlook – nominal GDP growth could be nearly 10% in 2021, but comparisons get tough in 2022 with growth estimates falling below 3%.

The Street is up at 6-7% 2021 GDP growth expectations. BUT, including the inflation outlook – nominal GDP growth could be nearly 10% in 2021, but comparisons get tough in 2022 with growth estimates falling below 3%. Gasoline is testing its five year highs and Core CPI is down. Say what? How can that be? Is the government manipulating inflation measures so it can keep its money printing presses running hot? Of course! But there’s more to the story than that. As to highly questionable lower inflation readings, it’s true. The components have changed over the decades such that if one were to calculate CPI using the 1980 formula, it would be more than twice as high as the current reading! But there is another less nefarious (or blindingly stupid) reason. An increase in gasoline prices is a tax on consumer demand. A person making $45k a year only has so much money to spend. And every dollar made is spent. So if an extra dollar goes to gas, that is one less dollar to a component of Core CPI. So higher gasoline prices take demand away from other goods and services. Higher gasoline prices exert deflationary pressure on other goods and services.

Gasoline is testing its five year highs and Core CPI is down. Say what? How can that be? Is the government manipulating inflation measures so it can keep its money printing presses running hot? Of course! But there’s more to the story than that. As to highly questionable lower inflation readings, it’s true. The components have changed over the decades such that if one were to calculate CPI using the 1980 formula, it would be more than twice as high as the current reading! But there is another less nefarious (or blindingly stupid) reason. An increase in gasoline prices is a tax on consumer demand. A person making $45k a year only has so much money to spend. And every dollar made is spent. So if an extra dollar goes to gas, that is one less dollar to a component of Core CPI. So higher gasoline prices take demand away from other goods and services. Higher gasoline prices exert deflationary pressure on other goods and services.