Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

US Dollar Carrying Outsized Macro Risk Factors

In our view, just 30 counties will determine the next President of the U.S., memories of 2016 indeed. If you look closely, the U.S. dollar’s labor market sensitivity in these key regions is the most compelling development of all. This unique data offers a “looking glass” into the 2020 election outcome. With our partners at ACG Analytics in Washington, we’re spending a lot of time focused on the most revealing inputs and locations across the United States. Four years ago we made some important discoveries for clients pointing to a Trump upset win. Today, we’re looking to add alpha down a path less traveled. Let’s explore.

What’s the True Price of a Strong Dollar?

Like a loud vacuum, a strong dollar sucks important U.S. manufacturing jobs overseas. Votes in all-important States with the most significant election-outcome influence are on the line. This is a major problem for the White House and it’s receiving substantial attention around the halls of the West Wing we’re told. The higher greenback raises the price tag of U.S. manufactured goods around the world. In response, President Trump desperately wants a softer USD, and he will do just about anything to get it.

Wrecking Ball Policy Divergence

In an attempt to support the Eurozone economy, since 2014 the European Central Bank has expanded its balance sheet by $2.7T and kept its deposit facility rate between -0.20% and -0.50%, suppressing the Euro currency. If there was a score for cheating on the global trade playing field, ECB chair Mario Draghi has a perfect “10”. Over the same time period, the Fed hiked interest rates 9x and reduced its balance sheet by $600B, per Bloomberg (since this clear policy error, the Fed has recently expanded its balance sheet by $200B and cut the Fed funds rate upper bound from 2.50% to 2.00%). This bizarre policy divergence between the Fed and ECB has empowered the global wrecking ball that has become the U.S. dollar. Trump’s bid to stay in the White House hangs in the balance.

In an attempt to support the Eurozone economy, since 2014 the European Central Bank has expanded its balance sheet by $2.7T and kept its deposit facility rate between -0.20% and -0.50%, suppressing the Euro currency. If there was a score for cheating on the global trade playing field, ECB chair Mario Draghi has a perfect “10”. Over the same time period, the Fed hiked interest rates 9x and reduced its balance sheet by $600B, per Bloomberg (since this clear policy error, the Fed has recently expanded its balance sheet by $200B and cut the Fed funds rate upper bound from 2.50% to 2.00%). This bizarre policy divergence between the Fed and ECB has empowered the global wrecking ball that has become the U.S. dollar. Trump’s bid to stay in the White House hangs in the balance.

U.S. Election Risk and the Dollar

As we look down the road ahead, this factor is forging significant macro-risk. A sharp blade hangs over markets. Day after day, asset managers are asking us more and more questions. “It’s like Argentina on roids. The candidates are just as far apart, but the possible wealth destruction in the United States with an incoming left-wing government – after Trump fueled bull-market is unimaginable”, our Larry McDonald told an audience at a conference in Latin-America last week. Enormous tails indeed. Unlike previous U.S. elections, the risk-dynamics for investors are LARGE given the colossal spread between market-friendly and un-friendly candidates in 2020. We must keep a trained eye on these developments. In our view, U.S. stocks could fall more than 40% if the probability of a – Warren, Sanders, Harris – election win starts to rise meaningfully. Watch the U.S. Dollar, here’s why.

President Trump pulled off a historic 2016 Electoral College upset with a 304 to 227 margin of victory. There are a total of 538 votes in the Electoral College and a candidate must win a simple majority (270) of those votes to win the election.

*Trump garnered 304 electoral votes and Clinton 227, as seven faithless electors, two pledged to Trump and five pledged to Clinton, voted for other persons. – Wiki

The Key States and Key Counties, Electoral Votes

20 PA Pennsylvania*

18 OH Ohio

16 MI Michigan*

10 WI Wisconsin*

*That’s 64 total electoral votes in these all-important States, Trump pulled off an inside straight, winning MI, WI, and PA by just 77,744 votes (per NYT, Wiki data).

Into 2020, the Greenback is Wearing Outsized Risk Factors

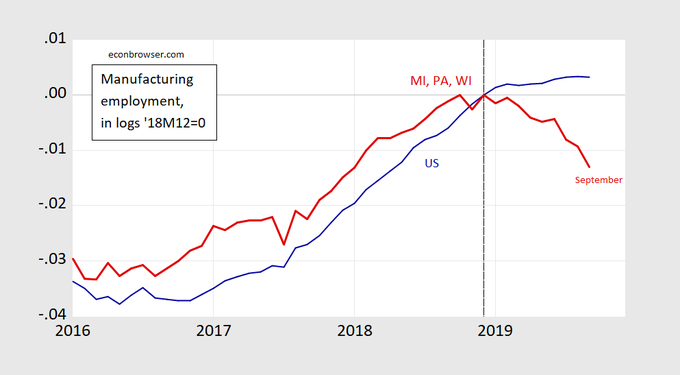

In Q3, the U.S. Dollar’s surge to its October 1st peak of 99.67 (97.28 today) did some serious damage to manufacturing jobs in MI, WI, and PA (see the image below). This places TRUMP in a meaningful risk position, far more than U.S. equities are currently pricing-in. If you do the math, Trump CANNOT win these states in 2020 with a strong dollar. U.S. equities are at grave risk unless the White House / Fed can get the greenback down, and down fast.

In Q3, the U.S. Dollar’s surge to its October 1st peak of 99.67 (97.28 today) did some serious damage to manufacturing jobs in MI, WI, and PA (see the image below). This places TRUMP in a meaningful risk position, far more than U.S. equities are currently pricing-in. If you do the math, Trump CANNOT win these states in 2020 with a strong dollar. U.S. equities are at grave risk unless the White House / Fed can get the greenback down, and down fast.

The 2019 Dollar Surge Higher Comes with a HIGH Price for Trump Similar to 2015-2016, this year as the dollar soared, U.S. export products to other countries became far more expensive and manufacturing jobs in Michigan, Wisconsin, and Pennsylvania plunged.

Similar to 2015-2016, this year as the dollar soared, U.S. export products to other countries became far more expensive and manufacturing jobs in Michigan, Wisconsin, and Pennsylvania plunged.

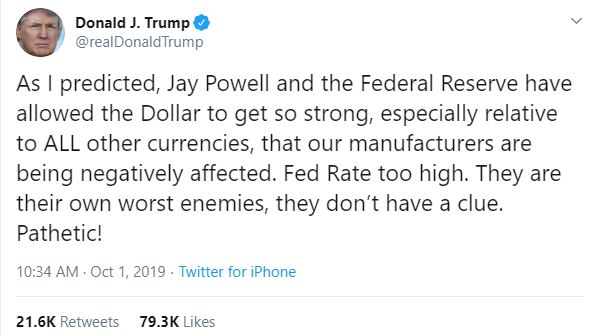

Trump Tweets and the Dollar

In August, Trump tweeted yet another message of worry focused at Federal Reserve Chair Jerome Powell. That included yet another mention of how strong the dollar is, with Trump saying “highest Dollar in US History.” It was the latest entry in Trump’s crusade for a weaker dollar, which he says will give the US a leg up in the ongoing global trade war. He’s continuously lashed out at the Fed and Powell (see October 1, 2019, above) as the reasons for the greenback’s strength.

Important Lessons from 2016

After the 2015-2016 US Dollar surge, manufacturing jobs in the U.S. came under serious pressure. We believe this factor, among others, cost Hillary Clinton the election. Heading into 2020, there are few things Treasury Secretary Steven Mnuchin and of President Donald Trump want more than a weaker Dollar. It’s probably not too much of a stretch to say that the Dollar’s 2014-2016 surge delivered Michigan, Wisconsin, and Pennsylvania to Trump on the back of undermined manufacturing and exports (see the above image, Dead Zone). The President clearly knows this and it’s part of the reason for his regular tweets and comments lamenting Powell’s interest rate 2018 rate hikes and the strong USD. Stay tuned.

After the 2015-2016 US Dollar surge, manufacturing jobs in the U.S. came under serious pressure. We believe this factor, among others, cost Hillary Clinton the election. Heading into 2020, there are few things Treasury Secretary Steven Mnuchin and of President Donald Trump want more than a weaker Dollar. It’s probably not too much of a stretch to say that the Dollar’s 2014-2016 surge delivered Michigan, Wisconsin, and Pennsylvania to Trump on the back of undermined manufacturing and exports (see the above image, Dead Zone). The President clearly knows this and it’s part of the reason for his regular tweets and comments lamenting Powell’s interest rate 2018 rate hikes and the strong USD. Stay tuned.

US Labor Force Size, Millions of Americans Employed

October 2019: 164.5m

November 2016: 159.5m

*Seasonally adjusted, US Bureau of Labor Statistics data.

There’s is one very large bright spot for Trump coming out of the labor market. Roughly 5 million more Americans are employed today relative to November 2016.

“Are you better off today than you were four years ago?”

In the final week of the 1980 presidential campaign between Democratic President Jimmy Carter and Republican nominee Ronald Reagan, the two candidates held their only debate. Going into the Oct. 28 event, Carter had managed to turn a dismal summer into a close race for a second term. And then, during the debate, Reagan posed what has become one of the most important campaign questions of all time: “Are you better off today than you were four years ago?” Carter’s answer was a resounding “NO,” and in the final, crucial days of the campaign, his numbers tanked. On Election Day, Reagan won a huge popular vote and electoral victory. The “better off” question has been with us ever since. Its simple common sense makes it a great way to think about elections. And yet the answers are rarely simple.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

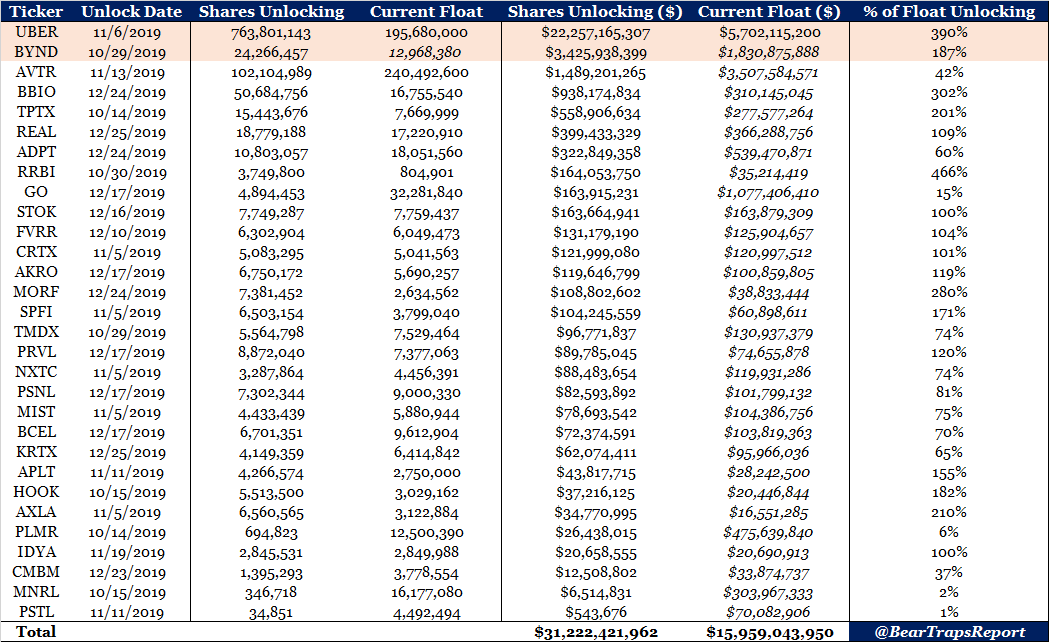

Ridesharing companies LYFT, and UBER don’t have a moat in our view. It’s like “Chinese capitalism” (that funnels lots of profits to consumers, thus poor performance in the company’s stock prices). It’s a subsidy of consumers (Uber riders) at the expense of Uber shareholders and Uber Drivers.

Ridesharing companies LYFT, and UBER don’t have a moat in our view. It’s like “Chinese capitalism” (that funnels lots of profits to consumers, thus poor performance in the company’s stock prices). It’s a subsidy of consumers (Uber riders) at the expense of Uber shareholders and Uber Drivers.