“Yesterday, the U.S. 10 year treasury bond hit our long held 1.40% target. A sea of bond bears has become an ocean of bulls. Brexit’s risk to the global economy has created an opportunity for those willing to step in and short bonds in the face of a large group of clowns rushing to the exits (abandoning their long held bearish bond positions).”

Bear Traps Report

July 6, 2016

Government Jobs: June – August 108,000

Three Month Average: 232,000

Employment growth was weaker than consensus estimates at +151k in August, but above Fed estimates of the breakeven rate.

As U.S. bond yields are moving higher, so are those around the world.

U.S. companies kept adding to payrolls in August while measures of slack in the labor market were little changed, signaling steady hiring in the face of lackluster global growth.

“Our economists therefore see this report as just enough for a large majority of officials to support a September rate increase and have raised their subjective odds of a hike this month to 55% from 40%. They have also lowered their subjective odds for December to 25% from 40%, leaving the cumulative odds of at least one hike this year at 80%. ”

Goldman Sachs

Notice the yield price action in US 10s. Sixty days ago every sell off was greeted by a stronger bid for bonds. Today, it’s a 180, every rally in bonds has been over-powered with selling, yields want to move higher.

Bear Traps Report estimates suggest that G4 central bank (ECB, BOE, BOJ) has contributed for nearly 105bp (1.05%) of the reduction in US 10-year yields since the end of 2013.

Jobs and Economic Growth

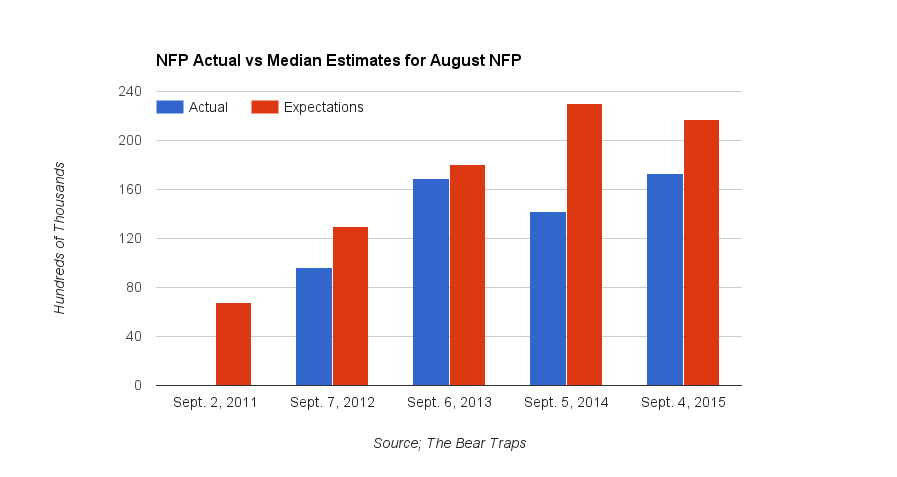

Bloomberg reported payrolls climbed by 151,000 last month following a 275,000 gain in July that was larger than previously estimated, a Labor Department report showed Friday in Washington. The median forecast in a Bloomberg survey called for 180,000. The jobless rate and labor participation rate held steady, while wage gains moderated.

August has been light in recent years, so the market was ready for weakness.

August has been light in recent years, so the market was ready for weakness.

The August figure is consistent with a simmering-down of payrolls growth so far this year as the economy slogs through a period of weak investment and some companies have difficulty finding workers. Federal Reserve officials will have to weigh the jobs data as they decide whether to raise the benchmark interest rate for the first time in 2016.

GDP

Led by a substantial inventory overhang, in recent quarters, U.S. economic growth has suffered, we’ve seen a pull back in business fixed investment. Last Friday, the second release of Q2 GDP reaffirmed the soft signal from the Bureau of Economic Analysis’ preliminary estimate showing modest growth of +1.1% (qoq ar).

On the other hand, Wall St’s economists expect above-trend growth in Q3 (+2.8% to +3.2% qoq ar) and Q4 (+2.1% to 2.5%), as a turn in the inventory cycle, continued strength in consumer spending, and a bounce back in residential investment offset any lingering weakness in capital spending and drag from trade. Beyond this year, they expect growth to slow to an only slightly above-potential pace of 2% over the course of 2017.