Join our Larry McDonald on CNBC’s Trading Nation, Wednesday at 3:05pm ET

What’s Our List of Systemic Risk Indicators Saying now? Pick up our latest note here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click hereThis Note Was Updated May 13, 2017 at 8am

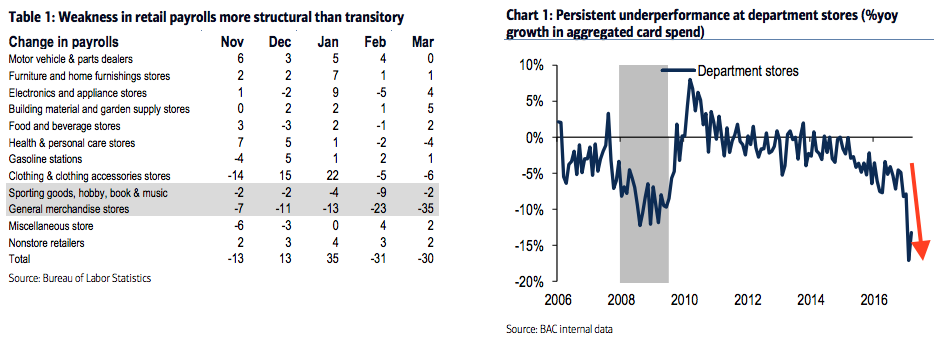

Central banks have done it again, eight years of an easy money gravy train have led to a colossal overbuild in the mall – commercial real estate space. Secular forces like Amazon and changing habits of shoppers are a factor, but this kind of divergence has a lot to do with too much bored capital reaching for yield in the WRONG places.

As America shifts to core urban sectors, there’s a substantial amount of real estate that becomes obsolete. There are a lot of loans that NEVER should have been made – high debt levels exacerbated the overbuild disconnect.

A secular change in retail consumption is taking hold, department store year over year spending is off nearly 20%, BAC data. Mortgage Daily reported this month – the rate of late payments on securitized commercial mortgage backed securities (CMBS) funded loans is surging at an alarming rate. The record number of balloon payments coming do this year means defaults will rise substantially in 2017. The major correction in the retail sector is only making the situation worse.

Some US$6.6bn of property loans packaged into CMBS deals since 2010 could be impaired, Morningstar Credit Ratings estimated in Q4 of last year. We think this number is closer to $40B, ultimately – when the dust settles.

Core CPI, the Credit Contraction Connection

At what point does the credit contraction in commercial real estate, auto loans, credit cards and student loans – leak over to core consumer prices?

U.S. Core CPI ex Shelter

2017: -0.9%*

2016: 2.2%

2015: 1.4%

2014: 0.8%

2013: 0.2%

2012: 1.9%

2011: 2.4%

2010: 1.1%

2009: -0.3%

2008: 0.4%

2007: 2.1%

*weakest quarter in at least 17 years

Bloomberg, Nordea Markets

IHS Markit CMX BBB- Series 6 Price Index

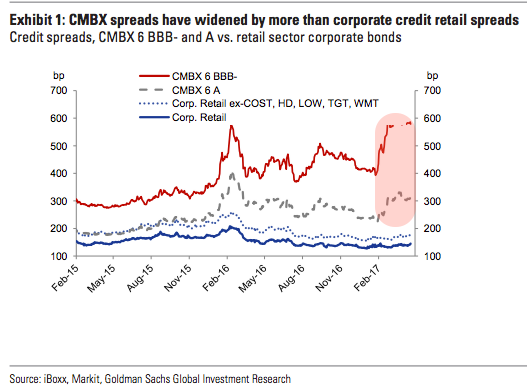

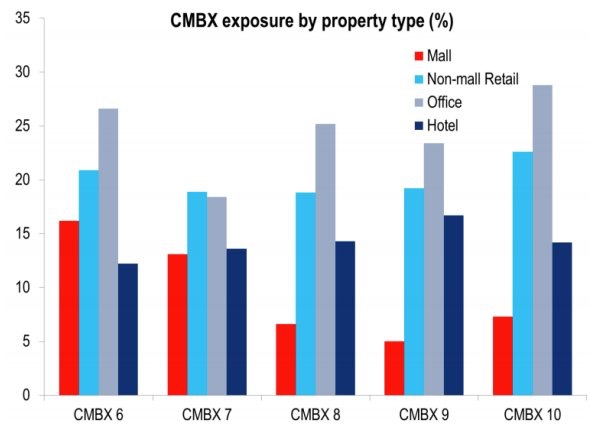

With the U.S. economy at “full employment” and the Federal Reserve hiking interest rates – credit risk is surging. We believe 2017 will be a watershed moment, an acceleration of retail store closures and rent reductions – leading to credit risk contagion. Structured leverage creates asymmetric credit risk as the cycle turns. Retail assets make up over 40% of the debt load inside the CMBX 6 indexes, but only 10% are in the riskiest slices, the regional mall category

With the U.S. economy at “full employment” and the Federal Reserve hiking interest rates – credit risk is surging. We believe 2017 will be a watershed moment, an acceleration of retail store closures and rent reductions – leading to credit risk contagion. Structured leverage creates asymmetric credit risk as the cycle turns. Retail assets make up over 40% of the debt load inside the CMBX 6 indexes, but only 10% are in the riskiest slices, the regional mall category

Traditional – on the ground retailers have announced nearly 3000 location closures through May 1st — including closing involving a number of national chains. The shutdown data for 2017 double those announced across the same period one year ago.

CDS Risk Surge

Credit risk in the retail space is rising at its fastest level since the financial crisis.

Based on the ongoing rate, projections through the end of 2017 are ugly. Retailers are expected to close over 9000 locations by the time 2018 rolls around, substantially higher than the numbers seen following the 2008 financial crisis and recession.

CMBX6 in Some Pain

Off nearly 10% on the year, CMBX6 is the “big short” in the mall space. Hedge funds focused on rising consumer credit risk have been buying default protection on this tranche because of its heavy exposure to U.S. mall REITS.

The Bloomberg Reit Regional Mall Index (BBREMALL) plunged another 4% this week – lowest intraday print since March 2014 – off 33% since August 2016. This week, Macy’s and Kohl’s 1Q comp sales missed estimates.

Shorts have been focused on CMBX6, focused in HIGH mall exposure. In CMBX6 there are sub-indices, each referencing 25 bonds from a portfolio of 25 CMBS offerings issued in 2012. Deals were be selected using rules-based criteria, such as deal size, pricing date, and the applicable rating and credit enhancement of the offered bonds.

Shorts have been focused on CMBX6, focused in HIGH mall exposure. In CMBX6 there are sub-indices, each referencing 25 bonds from a portfolio of 25 CMBS offerings issued in 2012. Deals were be selected using rules-based criteria, such as deal size, pricing date, and the applicable rating and credit enhancement of the offered bonds.

Looking at equities, PEI is the worst performer – down as much as 3% to the lowest intraday print since 2012. These names are not far behind in terms of pain; SPG, MAC, SKT, GGP, TCO, CBL and WPG.

This week, M shares are down as much as 20% to the lowest since 2011, while KSS fell 10%.

Mall Pain

REITs with exposure to M include NYRT, PEI, ESRT, VNO, SPG, and WPG, according to a JPMorgan report from March, while REITs with exposure to KSS include UE, DDR, KIM, RPT, KRG, CDR, ESRT, WPG, BRX, REG.

Office REITs are also moved lower this week; NYRT fell 10% after its liquidation estimate trailed expectations, and CLI dropped 4% after BTIG questioned 1Q results.

What’s Our List of Systemic Risk Indicators Saying now? Pick up our latest note here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

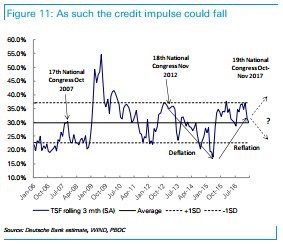

In recent days, markets have witnessed significant weakness in the commodity space, especially focused toward the growth sensitive segment – oil, gas and base metals. On the other hand, global equities are surging while the growth story is faltering.

In recent days, markets have witnessed significant weakness in the commodity space, especially focused toward the growth sensitive segment – oil, gas and base metals. On the other hand, global equities are surging while the growth story is faltering.