Hurricane Ida made landfall Sunday evening and hit New Orleans and Baton Rouge on Monday morning. The National Hurricane center currently identifies Ida as a “dangerous Category 4 hurricane” with wind speeds up to 150 mph. To compare, hurricane Katrina in 2005 had a maximum wind speed of 175 mph and hurricane Laura (2020) had a maximum wind speed of 150 mph. The storm could damage as many as 1ml homes (think insurers), with a possible reconstruction cost that exceeds $200bl. For the oil and gas industry already battered from Covid-19 disruptions, the impact could be significant in the short term.

As of right now, 1.65ml bpd of crude production is shut in due to the hurricane, equal to 91% of Gulf crude production, 85% of natural gas production is shut in as well. On top of that, 1.9ml bpd of refining capacity, or about 10% of total US refining capacity is shut down or brought to a reduced rate. Refiners that have shut down or reduced production include Marathon’s Garyville (578K bpd), Exxon’s 520K bpd Baton Rouge refinery (50% shut), Phillips 66 Alliance (255K bpd) and Shell’s Norco (230K bpd) facility.

Where is the Trade?

From 2011-2020, cheap natural gas was a colossal headwind for Nuclear power plays like NorthShore Global Uranium Mining ETF (URNM), with prices up 20% since mid-August and 100% since December – natural gas has become a substantial tailwind for the nuclear power sector.

Refining and Chemicals

The total operating refining capacity in the Gulf Coast (a.k.a. PADD III) is currently about 9.6ml bpd. This means that as much as 20% of PADD III refining capacity is shut down. The Gulf coast oil refining industry is also responsible for about 20% of global ethylene production.

In a worst-case scenario, refining capacity could be offline for multiple weeks. This could put further upward pressure on prices of petrochemicals such as polypropylene and PVC (used for bottles, pipelines etc). Dow (Chemical) DOW equity surged to $65.42 Friday from as low as $58.50 in July. Prices for these chemicals are already near all-time highs as a result of the February freeze that caused supply disruptions in the industry. For gasoline, having refiners offline for multiple weeks could also lead to a surge in gasoline prices, as supply is impaired. We see an additional inflation impact here.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click hereGasoline Supply Picture Heading into Ida

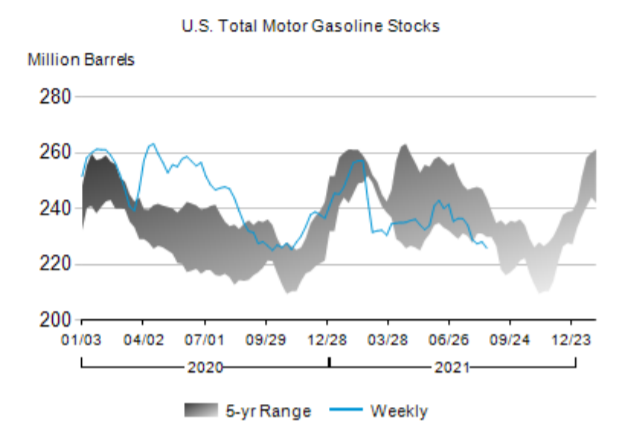

When hurricane Laura hit Louisiana around this time last year, oil and refined product demand was still depressed because of lockdowns and other corona-related demand constraints. U.S. Gasoline demand was then around 8.6ml bpd, which was 12% below normal levels. Today, gasoline demand is back to pre-corona quantities, which is 9.5ml barrels p/d. To add insult to injury, gasoline inventories are currently well below their 5-year average (chart above). This means that any supply disruption that lasts several days or weeks could have a significant impact on gasoline prices. When hurricane Harvey hit the Texas refining industry around Corpus Christi in August 2017, the nationwide refining utilization rate dropped from 96% to 78%. The disruption lasted about one month before refining capacity was fully back online. Gasoline prices spiked 30% in the days after the natural disaster that hit Texas.

Today, refining utilization is at 92%, meaning that any unplanned outages will cut supply even further. Ironically, during these types of disasters, the stocks of refining and petrochemical companies tend to benefit, as the pricing power more than offsets any loss of sales due to local capacity taken offline. For the petrochemical industry, companies like DOW and LYB are the dominant players and could benefit if the chemical industry capacity around New Orleans is taken offline for several weeks.

Valero VLO Seasonals, Outperformance in Q3, Q4

Refiners such as VLO, PSX and MPC benefit if gasoline prices rise more than oil prices. While oil platforms in the Gulf have been shut down ahead of Hurricane Ida, the offshore infrastructure is much more resilient and quicker to come back online than refiners. As a result, oil prices tend to rally less than gasoline prices in the aftermath of these hurricanes.

Refiners such as VLO, PSX and MPC benefit if gasoline prices rise more than oil prices. While oil platforms in the Gulf have been shut down ahead of Hurricane Ida, the offshore infrastructure is much more resilient and quicker to come back online than refiners. As a result, oil prices tend to rally less than gasoline prices in the aftermath of these hurricanes.

Refiners, Crack Spreads – VLO Seasonals Performance

Crack spreads, which are the difference between gasoline and crude oil prices, tend to expand. Rising crack spread means higher profit margins for refiners. In 2017 crack spreads jumped from $18 to 27 following the devastation of Harvey on the refining industry, and in 2005 crack spreads doubled from $14 to $28 after Katrina.

Crack spreads, which are the difference between gasoline and crude oil prices, tend to expand. Rising crack spread means higher profit margins for refiners. In 2017 crack spreads jumped from $18 to 27 following the devastation of Harvey on the refining industry, and in 2005 crack spreads doubled from $14 to $28 after Katrina.