Institutional investors can join our live chat on Bloomberg, a groundbreaking venue since 2010 – now with clients in 20+ countries, just email tatiana@thebeartrapsreport.com – Thank you.

Lawrence McDonald is the New York Times Bestselling Author of “A Colossal Failure of Common Sense” – The Lehman Brothers Inside Story – one of the best-selling business books in the world, now published in 12 languages – ranked a top 20 all-time at the CFA Institute.

Massive Retail Capitulation

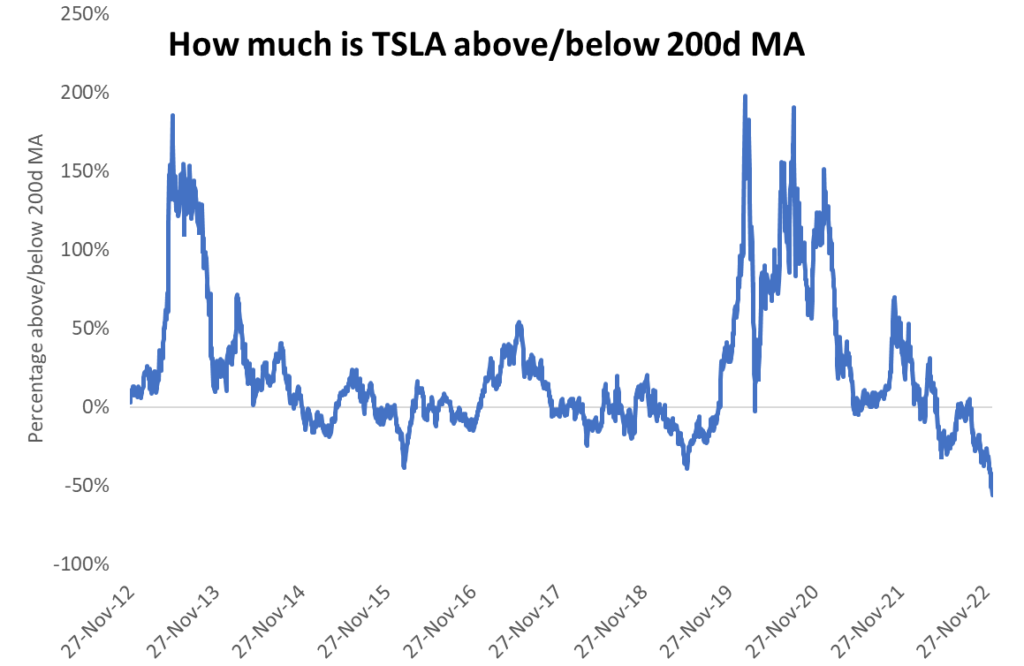

This week, TSLA equity traded 61% below the 200-day moving average, the most in a decade — Tesla reports Q4 unit sales before trading starts Tuesday, January 3rd.

This week, TSLA equity traded 61% below the 200-day moving average, the most in a decade — Tesla reports Q4 unit sales before trading starts Tuesday, January 3rd.

Tesla vs. CAT, the Mad Rush into Industrials

Investors are falling all over themselves to exit tech stocks and increase exposure to industrials. Hard asset plays have dramatically outperformed financial assets – and long-duration “growth” equities. The street is looking for $112B of sales in 2023 vs. a $384B equity market capitalization for TSLA stock. She used to trade at 80x sales, just wow.

Investors are falling all over themselves to exit tech stocks and increase exposure to industrials. Hard asset plays have dramatically outperformed financial assets – and long-duration “growth” equities. The street is looking for $112B of sales in 2023 vs. a $384B equity market capitalization for TSLA stock. She used to trade at 80x sales, just wow.

A $1T Loss?

If TSLA touches $98, the market cap loss is near $1 trillion, she traded at $105 pre-market this week. Close to $25B value of shares traded Tuesday, more than Apple, Amazon, Microsoft, and Google combined. Nearly 700m shares in 3 days this week, that´s 25% of the float. This is an epic retail exit – tax loss selling. Daily RSI was near 17 this week, the lowest of all time for this capitulation measuring stick. Tesla was 5th largest in the S&P, now 18, now less than UNH, Lilly, and Chevron. If you sell TSLA equity in December – the investor can buy the stock in 31 days and still book the loss for tax purposes. In years with LARGE Q4 equity market losses – the “January Effect” can be fairly impressive. Looking back over the last 50 years – when you have a down December, stocks are up 1.2% in January. Since 1991, with stocks off more than -2% in December, they have been up +3.7% on average in January, Bloomberg terminal data.

**The January Effect is a tendency for increases in stock prices during the beginning of the year, particularly in the month of January. The cause behind the January Effect is attributed to tax-loss harvesting, consumer sentiment, year-end bonuses, raising year-end report performances, and more. – CFI.

“Historic forced by margin calls for Tesla – it´s all retail Larry, ALL retail – rather than sentiment shift, see large scale TRF (Schwab, Ameritrade, etc) volume. The SIZE TSLA margin calls are forcing (triggering) ALOT of cross-selling through the entire long duration – speculative equity campgrounds.” — Equity Portfolio Manager on the West Coast, in our Bear Traps Portfolio

TSLA normally reports quarterly unit sales in the first weekend after the end of each quarter. Consensus is looking for a total of ~420K cars sold (down from 450K est. a few weeks ago). Given that New Year falls on the weekend, there is some uncertainty as to when exactly TSLA reports Q4 unit sales. We believe either Monday or Tuesday, January 3rd around the market open is most likely.

Previous January Report Date / Time

Sunday 1/2/2022 11am Stock +13.5% the next day

Friday 1/2/2021 9:55am Stock +3.4% the next Monday

Friday 1/3/2020 8:17am Stock +3% that day

Wednesday 1/2/2019 8:34am Stock -1.5% that day

Is Team Biden coming to Tesla’s Rescue?

At the start of the new year, buyers will once again enjoy a tax credit when they purchase a Tesla vehicle. The original 2010 EV tax credit had a quota of 400K units. For Tesla, the tax credits fully disappeared in early 2020 when Tesla reached that unit sales quota. But thanks to the Inflation Reduction Act (IRA) that Congress passed earlier this year and Biden signed yesterday, the tax credits are back in 2023. In the IRA there is a $7,500 tax credit for buyers of EVs, including TSLA and GM, who lost their previous tax credits. However, there are other strict limits on which brands would be eligible for the full credit, based on the selling price and where the cars and components are made. Unless the car is made in North America (NAFTA), the buyer is not eligible for the full tax credit. In addition, at least 50% of the battery parts will need to be made in North America. Lastly, a minimum of 40% of minerals used in the batteries must be sourced from the US or countries with free trade agreements with the US. So even buyers of GM and Tesla cars might only be eligible for half ($3,750) of the tax credit because their batteries and minerals come from a “foreign entity of concern” (China/Russia).

However, the Treasury Department recently said that the final decision on the critical minerals’ requirement won’t be available until March. As a result, all the requirements in the IRA governing EV cars, minerals, and parts will be waived. This means that, until Treasury issues its final set of rules, it will allow the full $7,500 tax incentive on all qualifying models.**

“We don’t expect them to reach 400K (unit sales) in Q4, data comes next week – early January. But, we also don’t think they always tell the truth. So, who knows? The IRA (Inflation Reduction Act) is about the only thing here between TSLA and a complete collapse in demand from what we can see. Also, many other countries have subsidies that are ending on December 31st. So, TSLA is benefitting from demand pull forward in those other countries. That will reverse in the March quarter, and may offset some of the benefits stated by the bulls.” CIO, Large Fund.

So, prospective EV buyers in the US will be extremely motivated to buy their EV before the Treasury issues their final list of requirements in March, as it could potentially save them thousands. We could therefore see demand for Tesla cars and other EVs (2 out of every three EVs sold in the US are Tesla’s) being pulled forward into Q1.

Musk is keenly aware that all this might have led EV car buyers to postpone purchases until Q1 and he increased year-end rebates to $7,500 and 10K miles of free charging in early December. Whether this was enough to meet Tesla’s estimates for 420K unit sales for Q4 remains to be seen. We will know this before trading starts on January 3. But the IRA waiver could still cause a burst in US sales in early 2023.

This is not the only boon for Tesla starting next year. The EPA is proposing to increase the cellulosic ethanol component in the renewable fuel standard will climb to 2.13 billion gallons from 630 million. Refiners will be allowed and by necessity required to comply with these mandates by buying “eRINs” credits from EV manufacturers. Since Tesla has by far the most EV cars on the road, refiners will have to buy most eRINs from Tesla.

In years past Tesla always boosted gross margins from “Zero Emission Credits” that other car makers bought from Tesla to offset carbon emissions. Now the administration is giving Tesla another back door subsidy, although it is yet unclear when these rules go into effect.

** EV and plug-in models were manufactured in North America in the 2022 and 2023 model years that DOE says are eligible: Audi, BMW, Chevrolet, Chrysler, Ford, GMC, Jeep, Lincoln, Lucid, Nissan, Rivian, Tesla, Volvo, Cadillac, Mercedes and Volkswagen. Yet because of price limits or battery-size requirements, not all these vehicle models will qualify for credits. Note that IRS details issued on Dec 29 indicated that only 20% of Model Y would be eligible for full tax credit, unless Tesla lowers their price on certain versions of the Y.

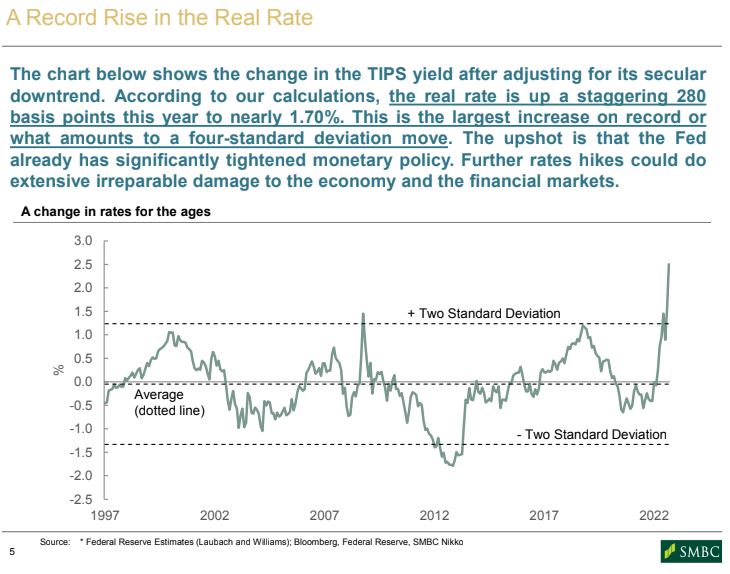

In our view, Joe LaVorgna is the best economist on Wall Street, he shared this important chart with clients this week.

In our view, Joe LaVorgna is the best economist on Wall Street, he shared this important chart with clients this week.  The U.S, ten-year bond yield

The U.S, ten-year bond yield The prospect of a softer Fed policy path juiced gold miners on Friday. The probability (interest rate futures) of another 75bps rate hike in December

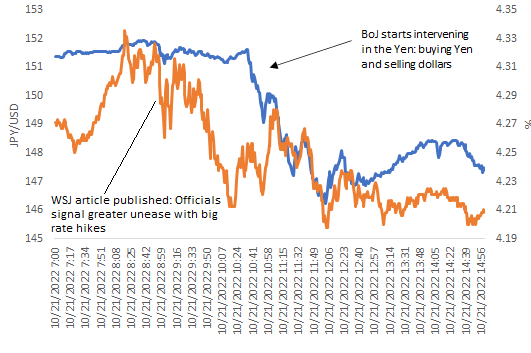

The prospect of a softer Fed policy path juiced gold miners on Friday. The probability (interest rate futures) of another 75bps rate hike in December  Bank of Japan – after their first intervention failed – they brought in the Fed for support in round #2.

Bank of Japan – after their first intervention failed – they brought in the Fed for support in round #2. The Nasdaq is close to 9% off the October lows – Why now?

The Nasdaq is close to 9% off the October lows – Why now?

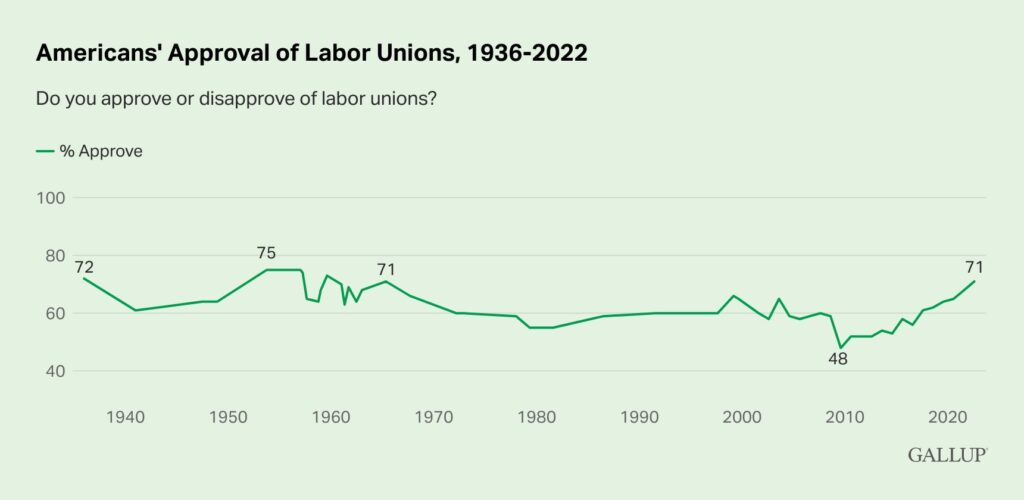

A large bear reversal in the classic economic bellwether, UNP – major technical fail. Some would say labor threatened national strike risk is high, which is true and obvious,

A large bear reversal in the classic economic bellwether, UNP – major technical fail. Some would say labor threatened national strike risk is high, which is true and obvious,  Bernstein notes – “

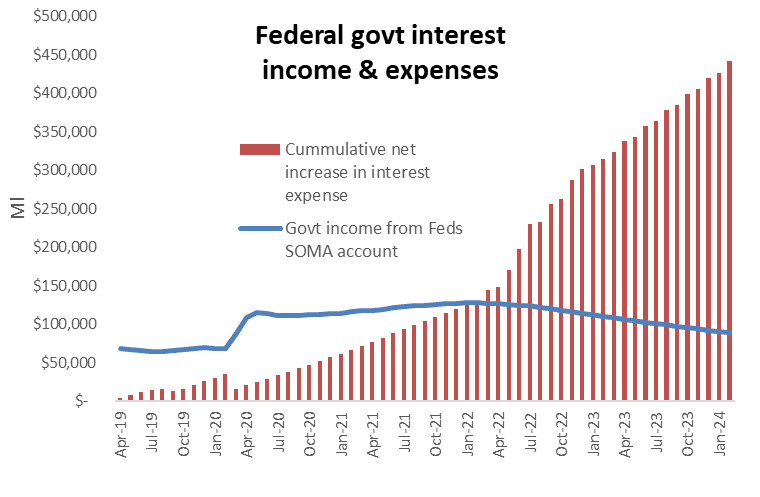

Bernstein notes – “ In the chart, we show how this works. The blue line shows the income from the Fed’s QE portfolio and compares it to the cumulative increase in interest expenses, from both higher interest on the government’s debt and the Fed’s payments of interest on excess reserves (IOER). This shows the $400bl negative swing next year in government income due to the deterioration in net interest income.

In the chart, we show how this works. The blue line shows the income from the Fed’s QE portfolio and compares it to the cumulative increase in interest expenses, from both higher interest on the government’s debt and the Fed’s payments of interest on excess reserves (IOER). This shows the $400bl negative swing next year in government income due to the deterioration in net interest income. We have a Federal Reserve promising to take their overnight rate to 4.5% (in March, just six months ago – the lending rate was 0.25%) and reduce this balance sheet by $1 trillion over 12 months – we were born at night, just NOT last night.

We have a Federal Reserve promising to take their overnight rate to 4.5% (in March, just six months ago – the lending rate was 0.25%) and reduce this balance sheet by $1 trillion over 12 months – we were born at night, just NOT last night.

Credit risk in Europe is near 2020 Covid Panic levels – central banks were cutting rates and handing out checks back then.

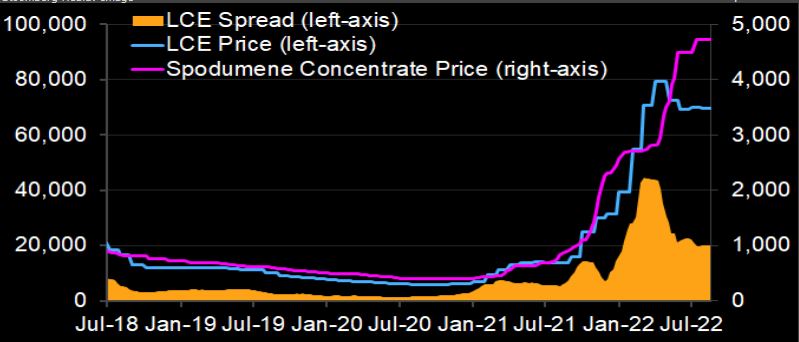

Credit risk in Europe is near 2020 Covid Panic levels – central banks were cutting rates and handing out checks back then. The lithium-refining spread — the price of lithium carbonate (LCE) or hydroxide minus that of spodumene concentrate — may surge through end-August. Bloomberg Intelligence notes the volume loss in lithium carbonate/hydroxide due to Sichuan’s drought-induced power crunch could amount to 12% of China’s monthly output, that´s after factoring in electricity rationing until Aug. 25. This would further tighten the market, already in severe shortage. Downstream demand among iron-phosphate and nickel-cobalt-manganese cathode makers has also been hit by power cuts, but the impact is smaller than for lithium refining. Sichuan’s lithium-hydroxide and lithium-carbonate production capacities are about 40% and 15% of China’s total. This winter, brine-based producers in West China may have to halt output as lakes freeze, adding to upward pressure on prices.

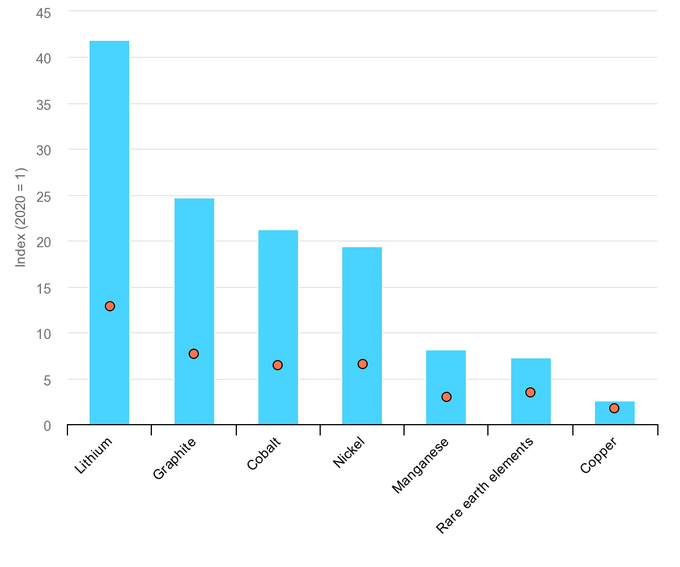

The lithium-refining spread — the price of lithium carbonate (LCE) or hydroxide minus that of spodumene concentrate — may surge through end-August. Bloomberg Intelligence notes the volume loss in lithium carbonate/hydroxide due to Sichuan’s drought-induced power crunch could amount to 12% of China’s monthly output, that´s after factoring in electricity rationing until Aug. 25. This would further tighten the market, already in severe shortage. Downstream demand among iron-phosphate and nickel-cobalt-manganese cathode makers has also been hit by power cuts, but the impact is smaller than for lithium refining. Sichuan’s lithium-hydroxide and lithium-carbonate production capacities are about 40% and 15% of China’s total. This winter, brine-based producers in West China may have to halt output as lakes freeze, adding to upward pressure on prices. We are lectured weekly – Electric vehicle sales could reach 33% globally by 2028 and 54% by 2035. Really? Mining needs to grow 30X by 2040 to meet CO2 reduction goals using solar, wind, & batteries. Lithium production needs to increase by 40X. – Oklo data.

We are lectured weekly – Electric vehicle sales could reach 33% globally by 2028 and 54% by 2035. Really? Mining needs to grow 30X by 2040 to meet CO2 reduction goals using solar, wind, & batteries. Lithium production needs to increase by 40X. – Oklo data.