Join our Larry McDonald on CNBC’s Fast Money, Wednesday May 18, at 5pm.

Check out our packages here

Street economists have blindly been focused on economic data in their effort to figure out what the Fed is going to do. We’ve made the point, you’re far better off keeping a close eye on credit markets.

2s -10s

Over the last 70 years, the spread between the 2 year Treasury and the ten year has been a reliable economic forecaster. If the economy is truly growing, creating sustainable wage pressure inflation, the spread between 2s – 10s will widen. In other words, investors will demand a higher yield on long term bonds relative to what they’re receiving on short term paper.

The spread between 2-10s hit a fresh 8 year low last week (see below).

One of the Biggest Victims?

Years ago, banks made upwards of 30% of their bottom line profits “playing the NIM.” Net Interest Margins are vital to a banks long term sustainable profitability. Simply put, banks borrow short and lend long term. A flat yield curve is no friend of the banks, not to mention rising risks of recession.

Back in February, near the market lows on CNBC we recommended clients get long the banks to take advantage of fear and capitulation (the banks surged 21% from our buy call ). Today we are sellers.

As you can see below, Mr. Market has been pricing in NIM pain in the US financials.

Last 52 Weeks

S&P 500: +0.30%

Financials XLF: -4.90%

Check out our packages here

A Warning from Retail

Retail stocks are now in a correction, off 11.7% from their April highs vs only -3.1% for the S&P 500. The real warning sign is that in retail we’re seeing leadership in defensive names (recession proof stocks), while at the same time strong US Treasury demand.

Last year on CNBC, I was lectured by other guests that lower oil prices would be good for the U.S. consumer. The problem, they ignored the multiplier effect of all those high paying jobs lost in the oil and mining space. Association of American Railroads weekly rail traffic report for week ending May 7th: 492.9K carloads and intermodal units, -10.6% y/y.

How about that rock solid US consumer that was going to spend frivolously all these windfall dollars from lower gasoline prices. At least they don’t spend it at Disney, Aropostale, Fossil or Macy’s and JC Penney.

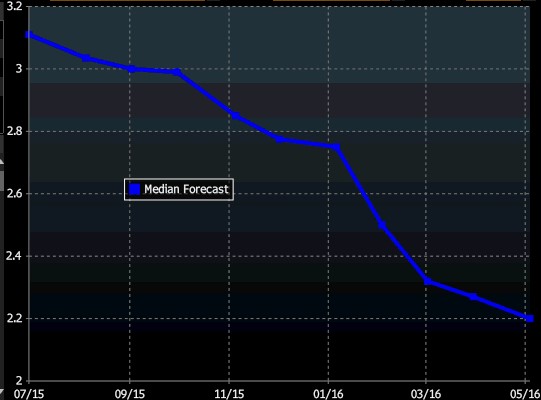

Wall St. and the U.S. 10 Year, Pure Comedy

Meanwhile, the gang that cant shoot straight has had another tough year trying to forecast the U.S. 10 year Treasury yield. They’ve gone from 3.15% to 2.20%,. The only problem is the ten year closed Friday at 1.70%.

We are sticking to our long held 1.40% target.