Join our Larry McDonald on CNBC’s Trading Nation, this Wednesday at 2pm.

“When patrons are falling over themselves to buy bonds, it’s important to remember how fast the tide can turn. A BOND SELL OFF in Europe will trigger a SELL OFF in the US. The capitulation panic inducing investors to buy bonds is reaching insanity levels. We believe global bond markets are very close to a substantial near term top as well. Bonds are a screaming sell, we’re adding to our TBT short bond position.”

The Bear Traps Report, July 6, 2016

Political shifts have been the biggest driver of global equity market returns over the last 18 months, U.S. equity investors must keep an eye on Paris in 2017. As we head into the election season in Europe, we believe the French elections (April 23 & May 7) will offer investors a buying opportunity. We fully expect either François Fillon or Marine Le Pen will be the new French president. This means a shift towards more domestic economic growth and lower regulation and taxes. We believe French equities are…..

Impact on U.S. Stocks? Pick up our latest report, click here above:

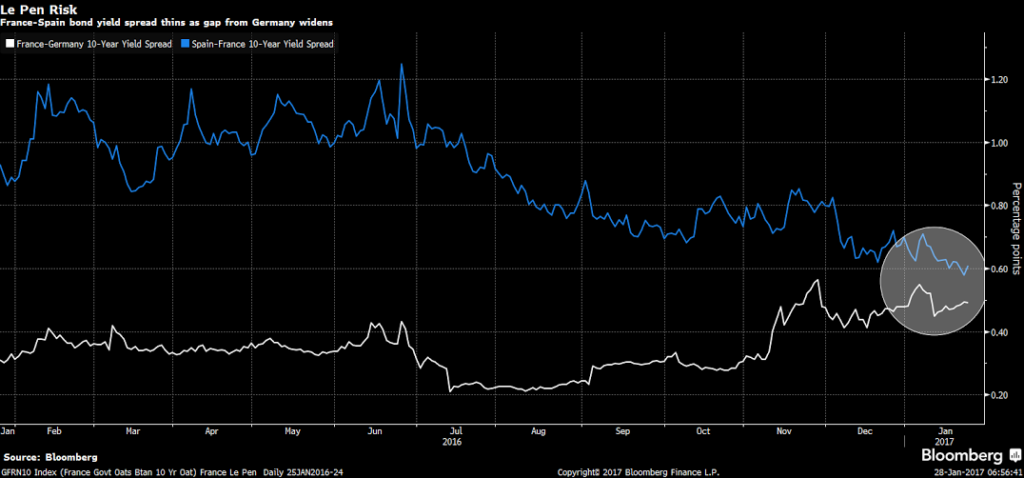

France’s bonds are underperforming peers across the euro area as investors brace for presidential elections, with National Front leader and open euro critic Marine Le Pen leading a major opinion poll for the first round of the vote. The yield on 10-year French securities is the highest relative to Spanish debt since April 2010, while the spread between French and German yields is close to the widest in more than two years. – Bloomberg

France’s bonds are underperforming peers across the euro area as investors brace for presidential elections, with National Front leader and open euro critic Marine Le Pen leading a major opinion poll for the first round of the vote. The yield on 10-year French securities is the highest relative to Spanish debt since April 2010, while the spread between French and German yields is close to the widest in more than two years. – Bloomberg