*Our institutional client flatform includes; financial advisors, family offices, RIAs, CTAs, hedge funds, mutual funds, and pension funds.

Email tatiana@thebeartrapsreport.com to get on our live Bloomberg chat over the terminal, institutional investors only please, it’s a real value add.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

August 19: New York’s MTA Becomes Second to Tap Fed as Banks Demand Higher Yields

Now that the trains are half full, the Federal Reserve took down nearly $500m of the troubled rail´s bonds. Interest costs were 1.92%, nearly 1% LESS than their cost in the private market. This is one COLOSSAL bailout in the works, billions $$$ more bond buys to come in the near future.

How does the Fed decide 1.92%? When the cost of capital is decided by unelected committees (and NOT the free market), who picks the winners and losers?

In our institutional client chat, live on Bloomberg we received this question today:

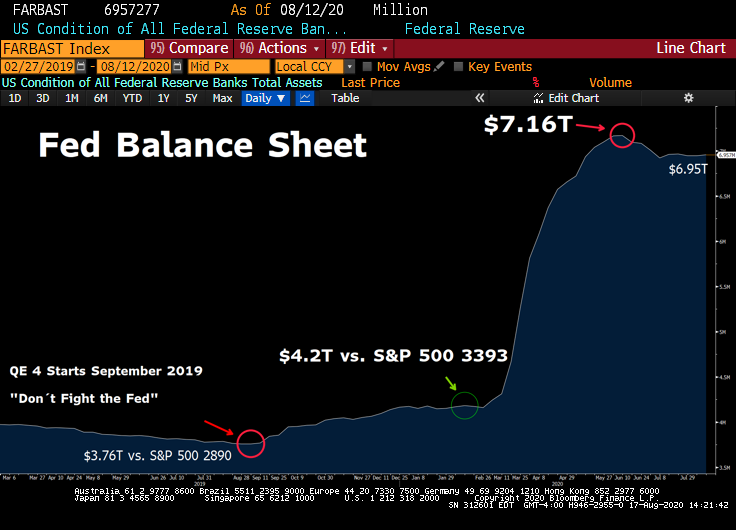

Q: “Why has the Feds balance sheet shrunk over the last 6 weeks if they supposed to be doing over $100B a week of QE? I don’t get why there´s almost no one is talking about this?”

Keep an Eye on the S&P 500 and the Fed Balance Sheet

A: We keep hearing this is in relation to liquidity vs. securities held. So “securities held” are up LARGE (mortgage-backed securities, treasuries, corporate bonds, municipal bonds), but liquidity measures, swap – repo facilities are down a lot. So, the total balance sheet has come down from $7.169T on June 10, to $6.957T today. Above all, roll off of repos and $ swaps from CBs has been a drain on asset side fed balance sheet. These two things have largely happened in tandem as Fed has restored markets to a plethora of liquidity. Fed 84 day swap lines got up to $400b, that number is coming down a lot, and the same is the case for repo. The market can now handle both. As these things come out, Fed balance sheet will start moving higher again as the +$80b a month of UST purchases becomes a marginal driver. For now, PDCF, $ swap lines, repo etc. all the emergency measures that aren’t getting rolled in full and coming off b/s are taking the wind out of the growth of Fed asset side. The bottom line, real liquidity is being pulled from the system. Keep in mind, as the Fed expanded their balance sheet from September to February, we were lectured by Wall St., “don´t fight the Fed.” And then stocks dropped nearly 40%.

A: We keep hearing this is in relation to liquidity vs. securities held. So “securities held” are up LARGE (mortgage-backed securities, treasuries, corporate bonds, municipal bonds), but liquidity measures, swap – repo facilities are down a lot. So, the total balance sheet has come down from $7.169T on June 10, to $6.957T today. Above all, roll off of repos and $ swaps from CBs has been a drain on asset side fed balance sheet. These two things have largely happened in tandem as Fed has restored markets to a plethora of liquidity. Fed 84 day swap lines got up to $400b, that number is coming down a lot, and the same is the case for repo. The market can now handle both. As these things come out, Fed balance sheet will start moving higher again as the +$80b a month of UST purchases becomes a marginal driver. For now, PDCF, $ swap lines, repo etc. all the emergency measures that aren’t getting rolled in full and coming off b/s are taking the wind out of the growth of Fed asset side. The bottom line, real liquidity is being pulled from the system. Keep in mind, as the Fed expanded their balance sheet from September to February, we were lectured by Wall St., “don´t fight the Fed.” And then stocks dropped nearly 40%.