Join our Larry McDonald on CNBC’s Halftime Report Friday at 12:30pm

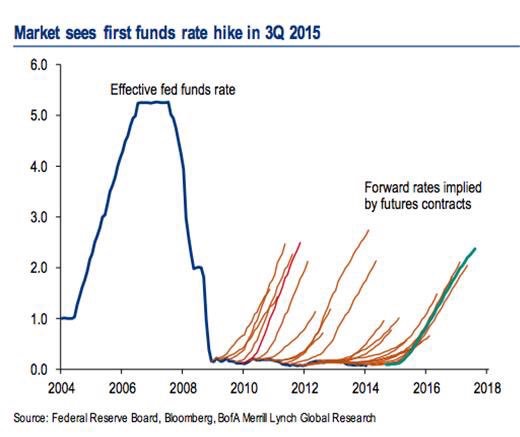

“Central banks around the world are having more and more influence on the markets. Many people are trading off of anticipated policy moves and the crowded trades are even more profound. However, the sentiment of investors making bets on the “great divergence” has reached a fever pitch. Fed funds futures are expecting at 78% of a 25bps rate hike, far too many people are on one side of the boat. We believe credit risk will veto the Fed policy path next year. We do not see rate hikes coming in 2016. We implore you to buy the gold miners GDX and long U.S. Treasury bonds.”

The Bear Traps Report, December 9, 2015

Get on the Bear Traps Report Today, click hereThe clowns, otherwise know as “stock market cheerleaders” are quick to remind us every time equities near record highs. Over the last 2 years, we’ve heard countless times how “we’re breaking out into record territory.”

Its so disingenuous. We must all deal with the reality of what were up against. Since the Federal Reserve started to taper their monetary goodie bag, stocks have gone no where, while a few names FANG (Facebook, Amazon, Netflix and Google) have hogged all the returns.

S&P 500

Facebook is up 51% since November 7, 2014 while the S&P 500 is unched.

Get on the Bear Traps Report Today, click hereRussell 2000

Amazon is up 98% since October 29, 2013 while the Russell 2000 is unched.

Get on the Bear Traps Report Today, click hereDow Jones Industrial Average

Google is up 23% since October 30, 2014 while the Dow Jones Industrial Average is unched.

Get on the Bear Traps Report Today, click here

Central Bankers have been bamboozling Wall St. for far too long.

Central Bankers have been bamboozling Wall St. for far too long.