Updated August 14, 2000 Breaking News: Buffett moves into Gold – per 13F Sec Filing: Berkshire Hathaway new position Barrick Gold $GOLD, Raises Kroger $KR, Maintains Apple $AAPL

Why is Buffett buying Barrick $Gold with the stock up 176% from the 2018 lows? He is NOT, “being greedy when others are fearful” – Berkshire is chasing, but why? They clearly see a secular shift in monetary policy with far MORE political influence. A post WW2 like Fed. We are looking at a social justice focused central bank, trying to rid themselves of the inequality label, let us explore.

*BERKSHIRE HATHAWAY EXITED GOLDMAN SACHS STAKE IN 2Q: 13F

*BERKSHIRE HATHAWAY REDUCED WELLS FARGO, PNC FINL STAKES IN 2Q

*BERKSHIRE HATHAWAY REDUCED JPMORGAN STAKE IN 2Q: 13F

Buffett enters gold (first time?) cut JP Morgan $JPM by 62% and exited Goldman $GS, NOT exactly an endorsement of the US economy. A Very defensive portfolio shift. Buffett just told you he believes the Fed will enter YCC Yield Curve Control and NOT allow meaningful steepening in US Treasuries. Thus, his hard exit from the financials, and gold miner entry – he is positioned for financial repression and stagflation. On gold, in a letter to investors he once wrote;

“Those who regularly preach doom because of government budget deficits (as I regularly did myself for many years) might note that our country’s national debt has increased roughly 400-fold during the last of my 77-year periods. That’s 40,000%! Suppose you had foreseen this increase and panicked at the prospect of runaway deficits and a worthless currency. To ‘protect’ yourself, you might have eschewed stocks and opted instead to buy [3.25] ounces of gold with your $114.75 (Buffett’s first investment 80 years ago). And what would that supposed protection have delivered? You would now have an asset worth about $4,200, less than 1% of what would have been realized from a simple unmanaged investment in American business. The magical metal was no match for the American mettle. [$114.75 would have grown to $606,811 if invested in a no-fee index fund tracking the S&P 500.”

*Our institutional client flatform includes; financial advisors, family offices, RIAs, CTAs, hedge funds, mutual funds, and pension funds.

Email tatiana@thebeartrapsreport.com to get on our live Bloomberg chat over the terminal, institutional investors only please, it’s a real value add.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

WARNING: A Look at the FOMC’s New Policy Path – By the time we get to Jackson Hole the trade may be 75-80% played out…

Central Banks and Commodity Prices

August 14 Breaking: Buffett moves into Gold – per 13F Sec Filing: Berkshire Hathaway new position Barrick Gold $GOLD, Raises Kroger $KR, Maintains Apple $AAPL

This summer, many professional sports are on a shortened schedule, but front-running the Fed is in full swing.

Month over Month

Silver +51.9%

Mosaic MOS +50% (Ags, Agriculture plays as of August 10)

Natural Gas +27%*

Cobalt: +16.4%

Platinum: +15.2%

Gold: +13.9%

Palladium: +11.4%

Lead: +9.4%

Aluminum: +8.8%

Copper: +5.8%

Nickel: +1.9%

*Commodity prices have surged since the Fed’s aggressive messaging campaign, let’s explore. As inflation expectations have risen, stocks valued off long term, future cash flows have struggled. The former piping hot – cloud SaaS sector equities are off -10-35% in recent weeks. At the same time, “value plays” like Berkshire Hathaway have surged +20% since late June. In our view, the Fed is triggering a colossal sector rotation. Just look at natural gas, ripping higher. Warren Buffett is smiling. In July, he plowed $10B into Dominion’s natural gas assets – this is an indication that Berkshire is NOT expecting a demand shift away from fossil fuels anytime soon. Berkshire loaded up on pipes and storage assets – Buffett clearly expects high demand in this commodity play. Keep in mind, Dominion’s position in the “midstream” does really well when prices are higher – it’s clear to us Berkshire is BULLISH on the natural gas commodity. Buffett backed up the truck on very cheap assets which are a cash flow machine. He gets the inflation hedge with the cash flow growth upside, brilliant. Buffett is CLEARLY listening to the Fed’s Brainard.

Navigating Monetary Policy through the Fog of COVID (there are TOO MANY technical analysts throwing around charts and NOT enough people digging through the most important Fed speeches)

Governor Lael Brainard

At the Perspectives on the Pandemic Webinar Series, hosted by the National Association for Business Economics, Washington, D.C.

“As the Fed expanded its balance sheet to unprecedented levels from December 2008 to December 2011, precious metals and precious metal miners widely outperformed equity markets. Historically, in the most extreme precious metal bull markets, silver widely outperforms gold. Today, silver trades at multi-decade cheap levels relative to gold. We remain bullish on both, but as we alerted clients last week, silver remains our highest conviction buy over the next 12 – 18 months. We’re long a full 3/3 position in the portfolio.”

Bear Traps Report, April 3, 2020

The COVID-19 contraction is unprecedented in modern times for its severity and speed. Following the deepest plunge since the Great Depression, employment and activity rebounded faster and more sharply than anticipated. But the recent resurgence in COVID cases is a sober reminder that the pandemic remains the key driver of the economy’s course. A thick fog of uncertainty still surrounds us, and downside risks predominate. The recovery is likely to face headwinds even if the downside risks do not materialize, and a second wave would magnify that challenge. Fiscal support will remain vital. Looking ahead, it likely will be appropriate to shift the focus of monetary policy from stabilization to accommodation by supporting a full recovery in employment and a sustained return of inflation to its 2 percent objective.1

Fed Speak Drives Metals, More than ALL other Factors Combined

Every year or so there’s a game-changer in Fedspeak messaging, where new clues to the future policy path are floated. As we head toward some very key events in the coming weeks, namely, the Jackson Hole conference and the Fed meeting in September, the Fed HAS BEEN lurching towards making a very important transition. In a speech delivered on July 14, Gov Lael Brainard cemented the path forward for all to see. She called it, “stabilization to accommodation,” and it’s NO coincidence that Silver surged nearly 60% in the days after her signal calling. After the fireworks, what’s the key question for the Fed now? After answering so many questions in March in regard to their power to stabilize markets, how does policy maintain its impact and grow with the pace of the recovery? A key answer to that will be in the Fed’s new forward guidance on interest rates. As even the Fed would say, this guidance is insufficient relative to the current risks and especially considering the fact that they are already at the zero lower bound. The question now, what will forward guidance look like in the future as that’s the crucial element of this Brainard transition of stabilization to accommodation. Going back nearly 2 months now, we have been of the view for some time that the Fed will adopt outcome-based forward guidance at the September meeting. What this means is, the Fed will attach its reaction function to realized economic outcomes. An example of this would look like, the Fed will not hike rates until employment and inflation are at X level. What this would do is, it would show the market that the Fed has no plans in getting in the way of recovery. Bottom line, in English – we’re looking at a new “social justice” Fed, trying to rid themselves of the “inequality” label, this is what’s driving the metals.

Every year or so there’s a game-changer in Fedspeak messaging, where new clues to the future policy path are floated. As we head toward some very key events in the coming weeks, namely, the Jackson Hole conference and the Fed meeting in September, the Fed HAS BEEN lurching towards making a very important transition. In a speech delivered on July 14, Gov Lael Brainard cemented the path forward for all to see. She called it, “stabilization to accommodation,” and it’s NO coincidence that Silver surged nearly 60% in the days after her signal calling. After the fireworks, what’s the key question for the Fed now? After answering so many questions in March in regard to their power to stabilize markets, how does policy maintain its impact and grow with the pace of the recovery? A key answer to that will be in the Fed’s new forward guidance on interest rates. As even the Fed would say, this guidance is insufficient relative to the current risks and especially considering the fact that they are already at the zero lower bound. The question now, what will forward guidance look like in the future as that’s the crucial element of this Brainard transition of stabilization to accommodation. Going back nearly 2 months now, we have been of the view for some time that the Fed will adopt outcome-based forward guidance at the September meeting. What this means is, the Fed will attach its reaction function to realized economic outcomes. An example of this would look like, the Fed will not hike rates until employment and inflation are at X level. What this would do is, it would show the market that the Fed has no plans in getting in the way of recovery. Bottom line, in English – we’re looking at a new “social justice” Fed, trying to rid themselves of the “inequality” label, this is what’s driving the metals.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

A variety of data suggest the economy bottomed out in April and rebounded in May and June. Payroll employment rebounded strongly in May and June. Retail sales jumped 18 percent in May, exceeding market expectations, and real personal consumption expenditures (PCE) are estimated to have increased 8 percent. Consumer sentiment improved in May and June.2 And both the manufacturing and nonmanufacturing Institute for Supply Management indexes jumped into expansionary territory last month. Financing conditions remain broadly accommodative on balance: They continued to ease over recent weeks for nonfinancial corporations and municipalities, although they remained stable or tightened slightly for small businesses and households.3

The earlier-than-anticipated resumption in activity has been accompanied by a sharp increase in the virus spread in many areas. Uncertainty will remain elevated as long as the pandemic hangs over the economy. Even if the virus spread flattens, the recovery is likely to face headwinds from diminished activity and costly adjustments in some sectors, along with impaired incomes among many consumers and businesses. On top of that, rolling flare-ups or a broad second wave of the virus may lead to widespread social distancing—whether mandatory or voluntary—which could weigh on the pace of the recovery and could even presage a second dip in activity. A broad second wave could re-ignite financial market volatility and market disruptions at a time of greater vulnerability. Nonbank financial institutions could again come under pressure, as they did in March, and some banks might pull back on lending if they face rising losses or weaker capital positions.

A closer look at the labor market data hints at the complexity. The improvement in the labor market started earlier, and has been stronger, than had been anticipated. Over May and June, payroll employment increased by 7.5 million, the unemployment rate fell 3.6 percentage points, and the labor force participation rate rose 1.3 percentage points.4 The large bounceback is a sharp contrast to the Global Financial Crisis, when the initial employment decline was shallower and it took much longer before a similar share of the initial job losses was recouped.

The job gains in the past two months were concentrated among workers who were on temporary layoff. They likely were driven by an earlier-than-expected rollback of COVID-related restrictions as businesses ramped up hiring and consumers exhibited more comfort engaging in commercial activities, as well as by a boost to employment from the Paycheck Protection Program. While nearly all industries experienced increases, the improvement was especially notable in the leisure and hospitality sector, which had been particularly hard hit by COVID-related closures in April.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

It is unclear whether the rapid pace of labor market recovery will be sustained going forward, and risks are to the downside. The pace of improvement may slow if a large portion of the easiest gains from the lifting of mandated closures and easing of capacity constraints has already occurred. Moreover, weekly COVID case counts have been rising, and some states are ramping up restrictions. These developments mostly occurred after the reference period for the June employment report. After declining at a fast clip through early June, initial claims for unemployment insurance have moved roughly sideways in recent weeks and remained at a still elevated level of 1.3 million in the week ending July 4.5 Some high-frequency indicators tracked by Federal Reserve Board staff (including mobility data and employment in small businesses) suggest that the strong pace of improvement in May and the first half of June may not be sustained.

The pandemic’s harm to lives and livelihoods is falling disproportionately on black and Hispanic families. After finally seeing welcome progress narrowing the gaps in labor market outcomes by race and ethnicity in the late stage of the previous recovery, the COVID shock is inflicting a disproportionate share of job losses on African American and Hispanic workers. According to the Current Population Survey, the number of employed persons fell by 14.2 percent from February to June among African Americans and by 13.4 percent among Hispanics—significantly worse than the 10.4 percent decline for the population overall.6

Separately, on the other side of our dual mandate, inflation has receded further below its 2 percent objective—reflecting weaker demand along with lower oil prices in recent months. Both core and total PCE price inflation measures have weakened, with the 12-month percent changes through May standing at 1.0 percent and 0.5 percent, respectively.7 Measures of inflation expectations are mixed; while market-based measures have moved below their typical ranges of recent years, survey measures have remained relatively stable within their recent historical ranges.8 Nonetheless, with inflation coming in below its 2 percent objective for many years, the risk that inflation expectations could drift lower complicates the task of monetary policy.

The strong early rebound in activity is due in no small part to rapid and sizable fiscal support. Several daily and weekly retail spending indicators tracked by Federal Reserve Board staff suggest that household spending increased quickly in response to stimulus payments and expanded unemployment insurance benefits. Household spending stepped up in mid-April, coinciding with the first disbursement of stimulus payments to households and a ramp-up in the payout of unemployment benefits, and showed the most pronounced increases in the states that received more benefits.9 With some of the fiscal support measures either provided as one-off payments or slated to come to an end in July, the strength of the recovery will depend importantly on the timing, magnitude, and distribution of additional fiscal support.

At the sectoral level, there is substantial heterogeneity in the effect of COVID. Recent data suggest that the recoveries in sectors such as manufacturing, residential construction, and consumer goods are likely to be relatively more resilient, while consumer services are more likely to remain hostage to social distancing. Manufacturing production jumped nearly 4 percent in May (following a historic drop in April), and forward-looking indicators point to another solid increase in June. Pending home sales and single-family permits rose more than anticipated in May. In the consumer sector, the rebound in spending has been concentrated in goods categories—especially those sold online—whereas most services categories have remained quite depressed. A similar concern may apply to the commercial real estate (CRE) sector and to equipment investment. Some parts of the CRE market—most notably, the lodging and retail segment—are experiencing significant distress and have seen sharp increases in delinquency rates along with tighter bank lending standards. For equipment investment, production and supply chain disruptions and high levels of uncertainty continue to weigh on expenditures.

In addition to the headwinds facing demand, there could be persistent effects on the supply side of the economy. The cross-border distancing associated with the virus raises the possibility of persistent changes to global supply chains. Within the U.S. economy, the virus may cause durable changes to business models in a variety of activities, resulting in greater reliance on remote work, reductions in nonessential travel, and changes to CRE usage and valuations.

In downside scenarios, there could be some persistent damage to the productive capacity of the economy from the loss of valuable employment relationships, depressed investment, and the destruction of intangible business capital. A wave of insolvencies is possible. As the Federal Reserve Board’s May Financial Stability Report highlighted, the nonfinancial business sector started the year with historically elevated levels of debt.10 Already this year, we have seen about $800 billion in downgrades of investment-grade debt and $55 billion in corporate defaults—a faster pace than in the initial months of the Global Financial Crisis. Several measures of default probabilities are somewhat elevated. It remains vitally important to make our emergency credit facilities as broadly accessible as we can in order to avoid the costly insolvencies of otherwise viable employers and the associated hardship from permanent layoffs.

Finally, in keeping with the global nature of the pandemic, foreign developments could impinge on the U.S. recovery. The International Monetary Fund estimates that real global gross domestic product dropped at an annual rate of about 18 percent in the second quarter after falling nearly 13 percent in the first quarter. While the potential for a fiscal response across the euro area is positive and important, there has been some renewal of tensions between the United States and China, and the outlook for many emerging markets remains fragile.

The Federal Reserve moved rapidly and aggressively to restore the normal functioning of markets and the flow of credit to households and businesses. The forceful response was appropriate in light of the extraordinary nature of the crisis and the importance of minimizing harm to the livelihoods of so many Americans. With the restoration of smooth market functioning and credit flows, our emergency facilities are appropriately moving into the background, providing confidence that they remain available as an insurance policy if storm clouds again move in.

While it is welcome news that 7.5 million jobs were added in the past two months, it is critical to stay the course in light of the remaining 14.7 million job losses that have not been restored since the COVID crisis started. The healing in the labor market is likely to take some time. Last month, a majority of Federal Open Market Committee (FOMC) participants indicated they expect economic activity to decline notably this year and recover only gradually over the following two years. A majority of FOMC participants indicated that they expect core inflation to remain below our 2 percent objective and employment to fall short of its maximum level at least through the end of 2022.

Looking ahead, it will be important for monetary policy to pivot from stabilization to accommodation by supporting a full recovery in employment and returning inflation to its 2 percent objective on a sustained basis. As we move to the next phase of monetary policy, we will be guided not only by the exigencies of the COVID crisis, but also by our evolving understanding of the key longer-run features of the economy, so as to avoid the premature withdrawal of necessary support. Because the long-run neutral rate of interest is quite low by historical standards, there is less room to cut the policy rate in order to cushion the economy from COVID and other shocks. The likelihood that the policy rate is at the lower bound more frequently risks eroding expected and actual inflation, which could further compress the room to cut nominal interest rates in a downward spiral. With underlying inflation running below 2 percent for many years and COVID contributing to a further decline, it is important that monetary policy support inflation expectations that are consistent with inflation centered on 2 percent over time. And with inflation exhibiting low sensitivity to labor market tightness, policy should not preemptively withdraw support based on a historically steeper Phillips curve that is not currently in evidence. Instead, policy should seek to achieve employment outcomes with the kind of breadth and depth that were only achieved late in the previous recovery.11

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

With the policy rate constrained by the effective lower bound, forward guidance constitutes a vital way to provide the necessary accommodation. For instance, research suggests that refraining from liftoff until inflation reaches 2 percent could lead to some modest temporary overshooting, which would help offset the previous underperformance.12 Balance sheet policies can help extend accommodation by more directly influencing the interest rates that are relevant for household and business borrowing and investment.

Forward guidance and asset purchases were road-tested in the previous crisis, so there is a high degree of familiarity with their use. Given the downside risks to the outlook, there may come a time when it is helpful to reinforce the credibility of forward guidance and lessen the burden on the balance sheet with the addition of targets on the short-to-medium end of the yield curve.13 Given the lack of familiarity with front-end yield curve targets in the United States, such an approach would likely come into focus only after additional analysis and discussion.

The Federal Reserve remains actively committed to supporting the flow of credit to households and businesses and providing a backstop if downside risks materialize. With a dense fog of COVID-related uncertainty shrouding the outlook, the recovery likely will face headwinds for some time, calling for a sustained commitment to accommodation, along with additional fiscal support.

1. I am grateful to Ivan Vidangos of the Federal Reserve Board for assistance in preparing this text. These remarks represent my own views, which do not necessarily represent those of the Federal Reserve Board or the Federal Open Market Committee. Return to text

2. This is reflected in the University of Michigan Surveys of Consumers and the Conference Board. Return to text

3. Nearly all of the financial conditions indexes that we track indicate only slightly less accommodative financial conditions currently than just before the onset of the COVID outbreak. Return to text

4. The Bureau of Labor Statistics (BLS) has indicated that the official unemployment rate has understated the extent of joblessness in recent months because many workers who lost their jobs were incorrectly reported as being employed but absent from work, rather than unemployed on temporary layoff. The BLS estimated that this misclassification held down the unemployment rate by about 5 percentage points in April and by about 1 percentage point in June, such that the reduction in the unemployment rate would be about 7-1/2 percentage points if these job losses were classified correctly. Return to text

5. The flattening out seen in recent weeks is even clearer when looking at nonseasonally adjusted claims numbers, which might be a slightly better measure than seasonally adjusted numbers in the current environment. The usual seasonal adjustment procedure, which relies on multiplicative seasonal factors, is not ideally suited to the current extraordinary circumstances. See Jason Bram and Fatih Karahan (2020), “Translating Weekly Jobless Claims into Monthly Net Job Losses,” Federal Reserve Bank of New York, Liberty Street Economics (blog), May 7.

In addition, the Department of Labor stated that 49 states reported about 1 million initial claims for Pandemic Unemployment Assistance (PUA) in the week ending July 4. However, since most PUA applicants must first apply for, and be denied, regular state unemployment insurance (UI) benefits before they apply for PUA, initial PUA claims and initial claims for regular UI benefits will be strongly correlated (likely with some lag) and do not constitute independent measures of the number of unemployed persons seeking unemployment benefits. Return to text

6. The Current Population Survey (or household survey) measures the number of employed persons and includes detailed demographic information, whereas the Current Employment Statistics survey (or establishment survey) measures the number of jobs in the payrolls of nonfarm establishments. Return to text

7. That said, the trimmed mean PCE inflation rate calculated by the Federal Reserve Bank of Dallas over the 12 months ending in May remained stable at 2.0 percent; the data as of May 2020 are available on the Bank’s website at https://www.dallasfed.org/research/pce. And this morning’s Consumer Price Index (CPI) data for June showed some signs of stabilization, with both core and total CPI inflation increasing noticeably last month, driven by a partial rebound in price categories that seemed most affected by social distancing in prior months (such as apparel, accommodation, and transportation services). Return to text

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

8. The median 5-to-10-year measure from the University of Michigan Surveys of Consumers and the median three-year-ahead expected inflation from the Federal Reserve Bank of New York’s Survey of Consumer Expectations both came in at 2.5 percent in June—well within their ranges in recent years. Median long-run expectations from the Survey of Professional Forecasters ticked down 0.1 percentage point to 1.9 percent in the second quarter, which is historically low for this measure. Market-based measures of inflation compensation over the next few years have retraced much of their sharp declines in mid-March but remain below their typical ranges in recent years. The 5-to-10-year measure of longer-term inflation compensation derived from Treasury Inflation-Protected Securities, at around 1.4 percent, remains notably below pre-pandemic levels. Return to text

9. This evidence is also consistent with recent research by Baker and others, who examine a panel of households using a financial planning app and show that these households responded quickly to CARES Act (Coronavirus Aid, Relief, and Economic Security Act) stimulus payments despite stay-at-home orders and social distancing; see Scott R. Baker, R.A. Farrokhnia, Steffen Meyer, Michaela Pagel, and Constantine Yannelis (2020), “Income, Liquidity, and the Consumption Response to the 2020 Economic Stimulus Payments,” NBER Working Paper Series 27097 (Cambridge, Mass.: National Bureau of Economic Research, May). Other recent studies, including Kargar and Rajan as well as Chetty and others, find similar responses to the CARES Act using different data. See Ezra Karger and Aastha Rajan (2020), “Heterogeneity in the Marginal Propensity to Consume: Evidence from Covid-19 Stimulus Payments,” Working Paper Series 2020-15 (Chicago: Federal Reserve Bank of Chicago, May); and Raj Chetty, John N. Friedman, Nathaniel Hendren, Michael Stepner, and the Opportunity Insights Team (2020), “How Did COVID-19 and Stabilization Policies Affect Spending and Employment? A New Real-Time Economic Tracker Based on Private Sector Data (PDF),” Opportunity Insights Working Paper (Cambridge, Mass.: Opportunity Insights, May). Analysis by Bhutta and others uses data from the Survey of Consumer Finances to assess how the cash assistance (expanded unemployment insurance benefits and stimulus payments) under the CARES Act would help families cope with job loss and find that the CARES Act dramatically improves households’ financial security; see Neil Bhutta, Jacqueline Blair, Lisa J. Dettling, and Kevin B. Moore (2020), “COVID-19, the CARES Act, and Families’ Financial Security,” working paper, July. The act’s cash assistance, in addition to families’ liquid savings, would allow an estimated 94 percent of working families to cover their recurring nondiscretionary expenses if they were to lose all of their income for six months from April through September 2020. In contrast, in the absence of the CARES Act, only about half of working families would be able to cover six months of expenses by relying exclusively on their liquid savings and standard unemployment insurance benefits. Return to text

10. See Board of Governors of the Federal Reserve System (2020), Financial Stability Report (PDF) (Washington: Board of Governors, May). Return to text

11. See Lael Brainard (2019), “Federal Reserve Review of Monetary Policy Strategy, Tools, and Communications: Some Preliminary Views,” Remarks at the Presentation of the 2019 William F. Butler Award New York Association for Business Economics, New York, New York. Return to text

12. See Ben S. Bernanke, Michael T. Kiley, and John M. Roberts (2019), “Monetary Policy Strategies for a Low-Rate Environment (PDF),” Finance and Economics Discussion Series 2019-009 (Washington: Board of Governors of the Federal Reserve System, February). Return to text

13. During the recovery from the previous financial crisis, there were several junctures when the expectations implied by market pricing and Committee communications got out of alignment, which proved costly. Return to text

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here

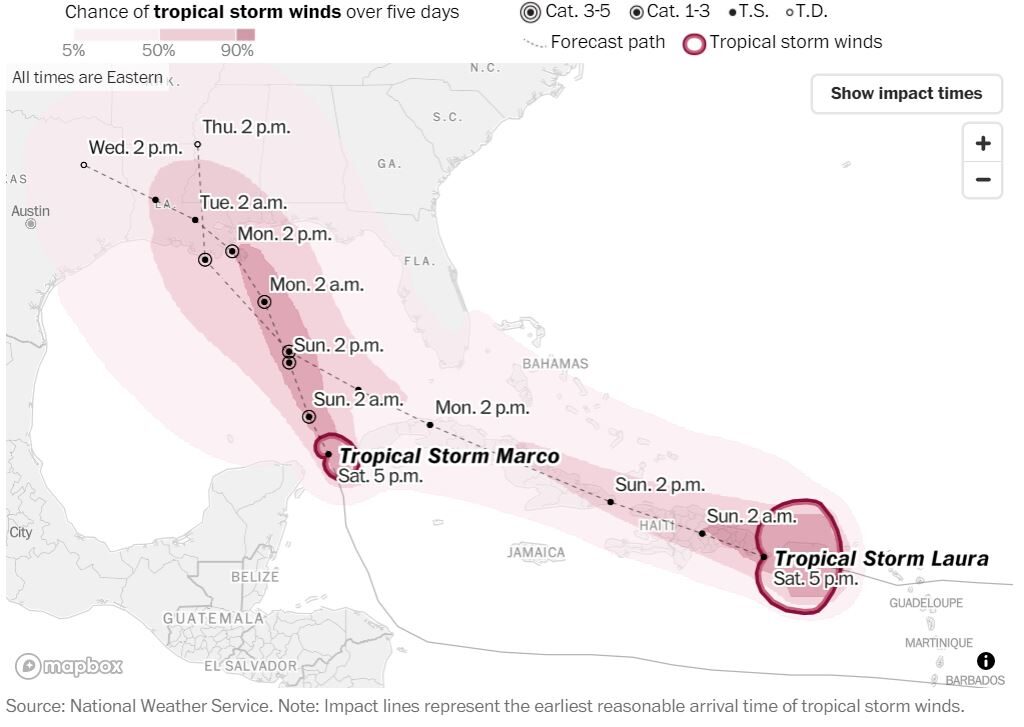

“The models are showing something unprecedented this morning, two storms make landfall within 24 to 36 hours in essentially the same spot.”

“The models are showing something unprecedented this morning, two storms make landfall within 24 to 36 hours in essentially the same spot.”

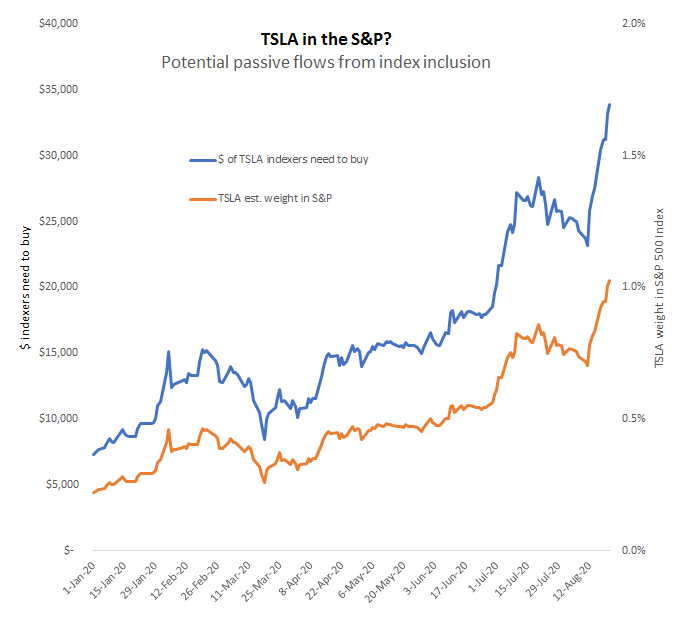

We believe it is likely that the Inclusion Committee at S&P waits until mid-September to announce the inclusion of Tesla in the S&P 500. This would coincide with the quarterly rebalance (Sep 21).

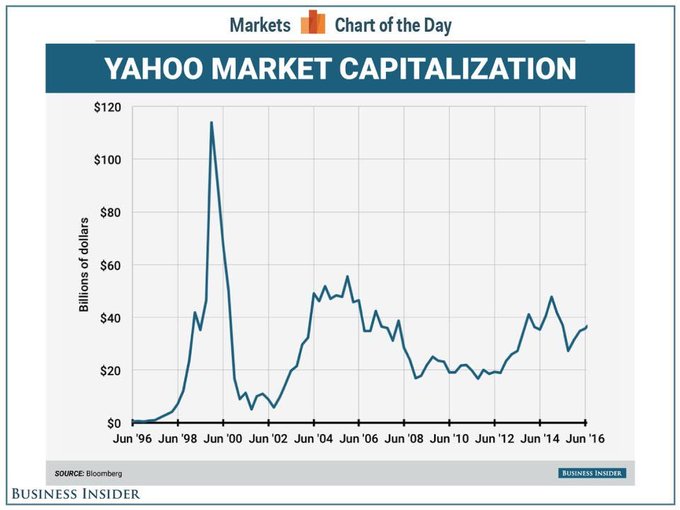

We believe it is likely that the Inclusion Committee at S&P waits until mid-September to announce the inclusion of Tesla in the S&P 500. This would coincide with the quarterly rebalance (Sep 21). Yahoo was added to the S&P 5000 on December 7, 1999. Its market cap was nearly $92B – then it spent the next 15 years between $5B and $50B valuation.

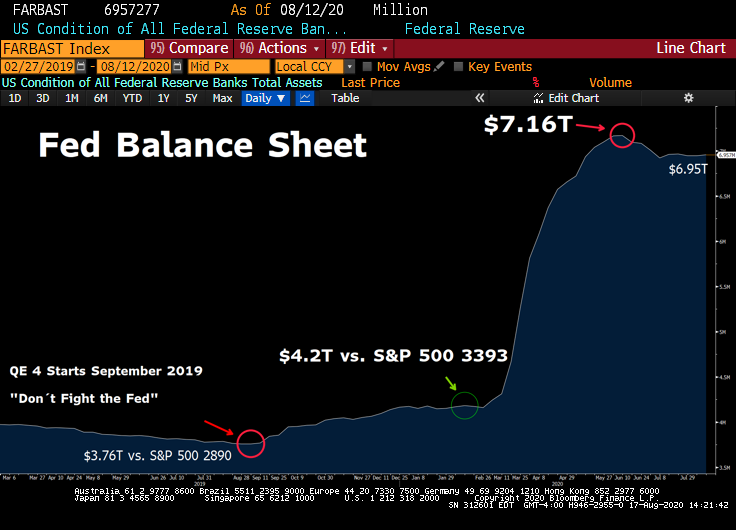

Yahoo was added to the S&P 5000 on December 7, 1999. Its market cap was nearly $92B – then it spent the next 15 years between $5B and $50B valuation.  A: We keep hearing this is in relation to liquidity vs. securities held. So “securities held” are up LARGE (mortgage-backed securities, treasuries, corporate bonds, municipal bonds), but liquidity measures, swap – repo facilities are down a lot. So, the total balance sheet has come down from $7.169T on June 10, to $6.957T today. Above all, roll off of repos and $ swaps from CBs has been a drain on asset side fed balance sheet. These two things have largely happened in tandem as Fed has restored markets to a plethora of liquidity. Fed 84 day swap lines got up to $400b, that number is coming down a lot, and the same is the case for repo. The market can now handle both. As these things come out, Fed balance sheet will start moving higher again as the +$80b a month of UST purchases becomes a marginal driver. For now, PDCF, $ swap lines, repo etc. all the emergency measures that aren’t getting rolled in full and coming off b/s are taking the wind out of the growth of Fed asset side. The bottom line, real liquidity is being pulled from the system.

A: We keep hearing this is in relation to liquidity vs. securities held. So “securities held” are up LARGE (mortgage-backed securities, treasuries, corporate bonds, municipal bonds), but liquidity measures, swap – repo facilities are down a lot. So, the total balance sheet has come down from $7.169T on June 10, to $6.957T today. Above all, roll off of repos and $ swaps from CBs has been a drain on asset side fed balance sheet. These two things have largely happened in tandem as Fed has restored markets to a plethora of liquidity. Fed 84 day swap lines got up to $400b, that number is coming down a lot, and the same is the case for repo. The market can now handle both. As these things come out, Fed balance sheet will start moving higher again as the +$80b a month of UST purchases becomes a marginal driver. For now, PDCF, $ swap lines, repo etc. all the emergency measures that aren’t getting rolled in full and coming off b/s are taking the wind out of the growth of Fed asset side. The bottom line, real liquidity is being pulled from the system.

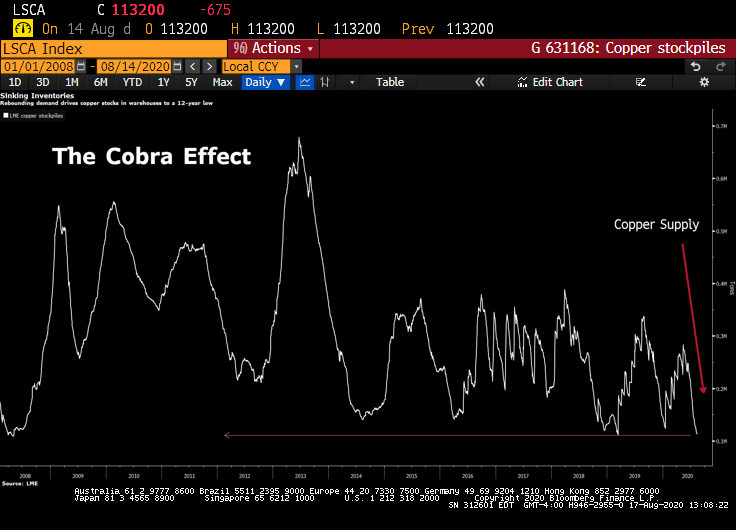

The London Metal Exchange’s global warehouse network is holding the least copper since 2008 in the latest sign of an economic recovery. The decline in inventories over the past few months coincides with record-breaking shipments of copper into China, where demand for the metal in the manufacturing sector has surged since lockdown restrictions were eased. Inventories tracked by the LME now stand at 110,000 tons, down 61% from this year’s peak, per Bloomberg.

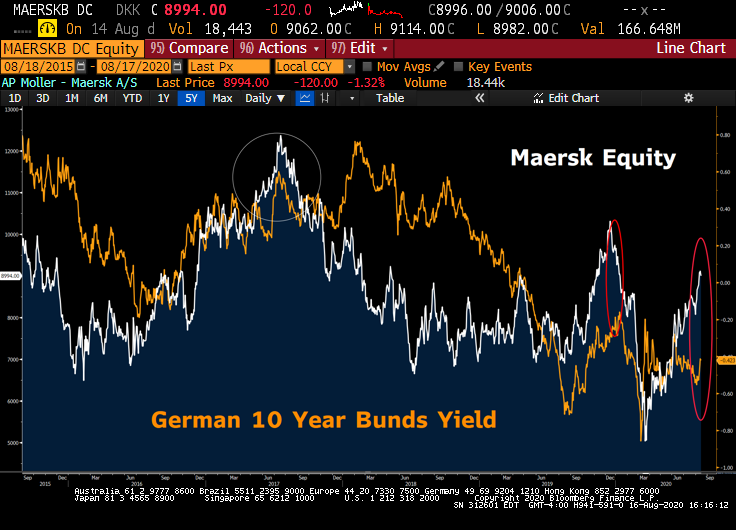

The London Metal Exchange’s global warehouse network is holding the least copper since 2008 in the latest sign of an economic recovery. The decline in inventories over the past few months coincides with record-breaking shipments of copper into China, where demand for the metal in the manufacturing sector has surged since lockdown restrictions were eased. Inventories tracked by the LME now stand at 110,000 tons, down 61% from this year’s peak, per Bloomberg. The last time MAERSK equity was near 9000, German bund yields were 20 to 60bps higher. As one of the world´s top exporters, German bond yields have maintained a strong correlation to shipping costs, until now.

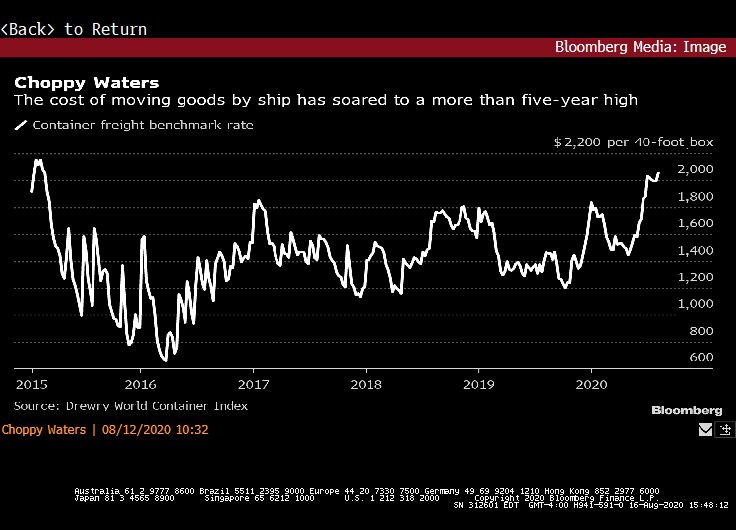

The last time MAERSK equity was near 9000, German bund yields were 20 to 60bps higher. As one of the world´s top exporters, German bond yields have maintained a strong correlation to shipping costs, until now. Capacity constraints have driven up rates for international shipments this year whether by sea, air or land, further complicating matters for supply-chain managers dealing with the effects of Covid-19 on their businesses. The cost of moving goods by ship has climbed 12% in 2020 to the highest since February 2015, according to the Drewry World Container Index. Ocean-liner rates have benefited from the industry being more disciplined with idle capacity, coupled with support from general rate increases and peak-season surcharges, per Bloomberg Intelligence. Must see our

Capacity constraints have driven up rates for international shipments this year whether by sea, air or land, further complicating matters for supply-chain managers dealing with the effects of Covid-19 on their businesses. The cost of moving goods by ship has climbed 12% in 2020 to the highest since February 2015, according to the Drewry World Container Index. Ocean-liner rates have benefited from the industry being more disciplined with idle capacity, coupled with support from general rate increases and peak-season surcharges, per Bloomberg Intelligence. Must see our  When CPI food makes a 2-3 standard deviation move, it´is hard to ignore. For weeks there was meaningful divergence. Commodities were screaming higher while bond yields were looking the other way, no cares. That all changed this week.

When CPI food makes a 2-3 standard deviation move, it´is hard to ignore. For weeks there was meaningful divergence. Commodities were screaming higher while bond yields were looking the other way, no cares. That all changed this week.  What is interesting is – in Q2 2020, hard commodities led this move higher, and “softs” (agriculture plays) really started to play catch up in recent weeks –

What is interesting is – in Q2 2020, hard commodities led this move higher, and “softs” (agriculture plays) really started to play catch up in recent weeks –  There are reports of up to 30% of China´s agricultural output could be at risk. China facing food shortage after months of flooding, infestations. Xi’s description of food waste as ‘shocking and distressing’ could portend looming food shortage. Per Asian news outlets, this is the second time that Xi has given instructions on China’s grains within a month, raising eyebrows among China watchers as a sign of a possible food crisis.

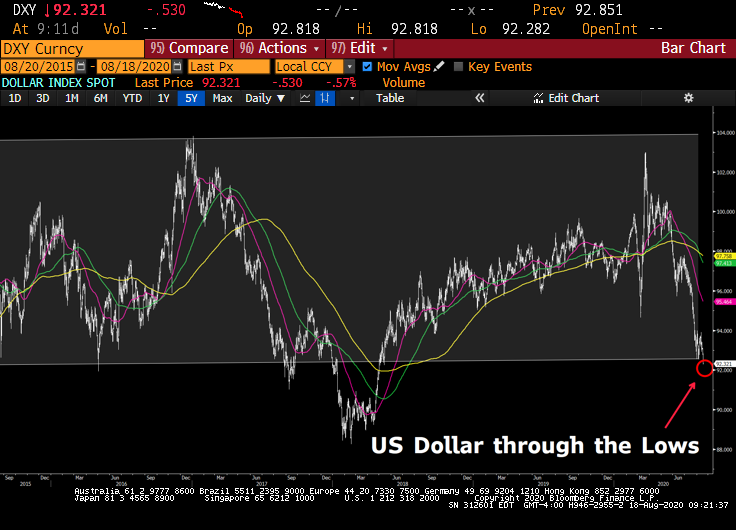

There are reports of up to 30% of China´s agricultural output could be at risk. China facing food shortage after months of flooding, infestations. Xi’s description of food waste as ‘shocking and distressing’ could portend looming food shortage. Per Asian news outlets, this is the second time that Xi has given instructions on China’s grains within a month, raising eyebrows among China watchers as a sign of a possible food crisis.  Cloud and SaaS (software as a service) equities widely underperformed value equities such as Berkshire Hathaway this week. In our view, investors continue to realize they are not positioned correctly being overweight technology with rising inflation expectations. From the Tea “Austerity” Party in 2010 to an MMT fueled, junkie-juiced fiscal spending overdose in 2020? We’ve come a long way baby. Hard to process a $4 to $5 trillion Federal deficit under a Republican Administration without concluding that either inflation is around the corner or the dollar is going to substantially weaken or most likely both. The current inflation picture (August 2020) is meaningless. Markets are starting to price in the 5-10 year forward path.

Cloud and SaaS (software as a service) equities widely underperformed value equities such as Berkshire Hathaway this week. In our view, investors continue to realize they are not positioned correctly being overweight technology with rising inflation expectations. From the Tea “Austerity” Party in 2010 to an MMT fueled, junkie-juiced fiscal spending overdose in 2020? We’ve come a long way baby. Hard to process a $4 to $5 trillion Federal deficit under a Republican Administration without concluding that either inflation is around the corner or the dollar is going to substantially weaken or most likely both. The current inflation picture (August 2020) is meaningless. Markets are starting to price in the 5-10 year forward path.  The GM vs. Netflix debate is the ULTIMATE “Stay at Home” vs. “Re-Open” conversation. Think of Netflix, no free cash flow, or real earnings. The company simply takes all incoming cash and builds a Capex funded content war chest. It’s a cash-burning inferno. Terminal Value (TV) is the present value of all future cash flows, with the assumption of perpetual stable growth in some cases. Terminal value is used in various financial tools such as the Gordon Growth Model, the discounted cash flow, and residual earnings computation. However, it is mostly used in discounted cash flow analyses. Any hint of inflation can DRAMATICALLY alter the company’s valuation built on a high terminal value element. If all the company’s value is found in the projected, long-term (5-10 year) future cash flows, and the probability of inflation rises 3-5 years out, those FUTURE cash flows are WORTH far LESS! To us, this is what’s shaking tech at its core, large tremors (

The GM vs. Netflix debate is the ULTIMATE “Stay at Home” vs. “Re-Open” conversation. Think of Netflix, no free cash flow, or real earnings. The company simply takes all incoming cash and builds a Capex funded content war chest. It’s a cash-burning inferno. Terminal Value (TV) is the present value of all future cash flows, with the assumption of perpetual stable growth in some cases. Terminal value is used in various financial tools such as the Gordon Growth Model, the discounted cash flow, and residual earnings computation. However, it is mostly used in discounted cash flow analyses. Any hint of inflation can DRAMATICALLY alter the company’s valuation built on a high terminal value element. If all the company’s value is found in the projected, long-term (5-10 year) future cash flows, and the probability of inflation rises 3-5 years out, those FUTURE cash flows are WORTH far LESS! To us, this is what’s shaking tech at its core, large tremors ( Every year or so there’s a game-changer in Fedspeak messaging, where new clues to the future policy path are floated.

Every year or so there’s a game-changer in Fedspeak messaging, where new clues to the future policy path are floated.