Join our Larry McDonald on CNBC’s Trading Nation, Wednesday at 3:05pm ET

Pick up our latest report on Tesla here:

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click hereLackluster demand and overseas Model 3 delivery problems will weigh on Tesla’s first-quarter earnings results when the company reports in April, RBC Capital Markets warned clients Monday. – CNBC noted.

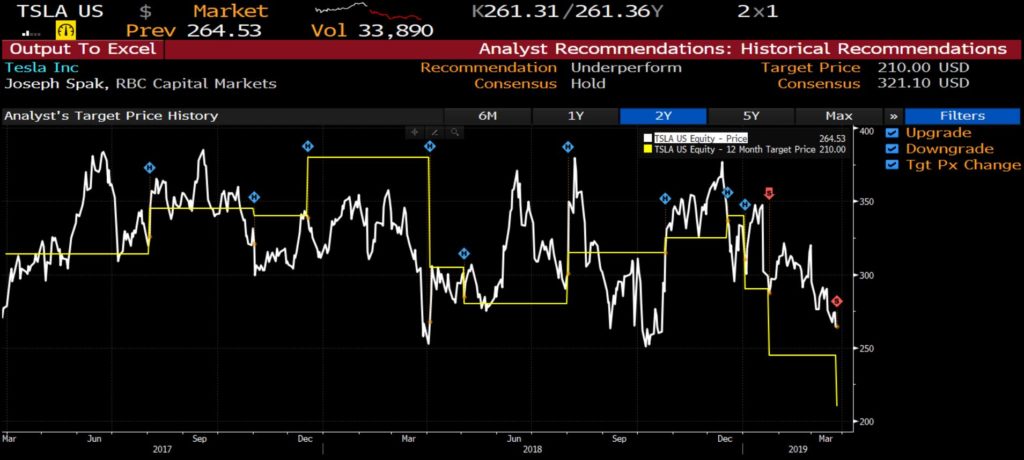

The brokerage cut its first-quarter Model 3 delivery forecast to 52,500 from 57,000 and slashed its price target to $210 from $245, a 14 percent reduction that implies more than 20 percent downside over the next year.

“We see both 2019 and 2020 revenue as down vs. the 4Q18 run-rate and, given Tesla is priced for growth, believe the valuation will come in,” analyst Joseph Spak wrote in a note to clients. “Overall, for 2019 we now forecast about 261,000 Model 3 [deliveries], down from 268,000 prior. Our 2020 forecast of 347,500 remains unchanged.”

RBC in Full Tesla Capitulation

RBC Capital Markets lowers its 12-month price target on shares of Tesla amid softer demand expectations and a delivery snag in China – new target is a 14 percent reduction to his prior forecast and implies more than 20 percent downside over the next year from Friday’s close. “We see both 2019 and 2020 revenue as down vs. the 4Q18 run-rate and, given Tesla is priced for growth, believe the valuation will come in” – CNBC Reported.

RBC Capital Markets lowers its 12-month price target on shares of Tesla amid softer demand expectations and a delivery snag in China – new target is a 14 percent reduction to his prior forecast and implies more than 20 percent downside over the next year from Friday’s close. “We see both 2019 and 2020 revenue as down vs. the 4Q18 run-rate and, given Tesla is priced for growth, believe the valuation will come in” – CNBC Reported.

RBC’s price target on Dec 20 was $340 raised that week – up from $325. So they hiked the target 2x in Q4, now in full capitulation with 3 reductions.

MUST READ: We have a full report on electric vehicles, lithium, and Tesla here.

Don’t miss our next trade idea. Get on the Bear Traps Report Today, click here